Business Costs

The Philippines measures poorly in most competitive comparisons with the ASEAN-6 economies (see Part 2 Becoming More Competitive), and business costs are an important factor underlying these rankings. The following discusses areas where the country has relatively high business costs, as well as some cost factors where the country is more competitive.

Business operating costs are an important part of Philippine national competitiveness and are constantly being evaluated by investors in deciding where to locate, expand, or close business operations. Cost factors affect the calculations of both domestic and foreign investors, although foreign investors usually scan a broader international horizon when making investment decisions.

Export firms may find it difficult to maintain overseas markets vis-à-vis competitors in other countries if their production and logistic costs rise too much. Peso appreciation can make all costs (except imported inputs) more expensive to foreign customers, while the converse occurs with peso depreciation. Foreign investors may choose to invest or disinvest in a country based on relative business costs, including international transportation.

Business location decisions also includeconsiderations other than operating costs, such as local market size, regulatory, and political risk. In the late 1980s, new investors bypassed the Philippines because of perceived political instability. However, in mid-2010 the Philippines was perceived as more stable politically than Thailand, following violent demonstrations by government opponents in Bangkok. Currently, a “China Plus One” strategy is being followed by multinationals manufacturing in China seeking a second investment location in Asia. Rising labor activism in China is pushing multinationals to look increasingly outside China

“…manufacturing in China is about to get far ore expensive. Soaring labor costs caused by worker shortages and unrest, a strengthening Chinese currency that makes exports more expensive and inflation and rising housing costs are all threatening to increase sharply the cost of making devices linke notebook computers, digital cameras, and smartphones. Desperate factory owners are already shifting production away from the dominant Chinese electronics manufacturing center in Shenzen toward lower-cost regions far to the west, even deep in China’s mountainous interior.”

—David Barboza, In iPhone’s Path, a Map of China Labor Patterns, International Herald Tribune, July 7, 2010

Another example of non-cost considerations is the impetus for BPO outsourcing firms to locate in both India and the Philippines, created when large US firms began to require bidders for their outsourcing contracts to have operations in at least two separate countries.

Business costs vary considerably by industry. For example, in semiconductor assembly, the cost of machinery, materials, and power make up most of the price of the final product while labor cost is less important. By contrast, call centers have low capital costs, but labor and telecommunication costs are critical country selection criteria. The low-margin garment industry shifts quickly to locate factories in economies with low-cost labor.

This Roadmap does not provide a comprehensive comparison of business costs in the Philippines and its regional competitors.182 Instead, we discuss several major costs which harm national competitiveness and advocate that (a) the highest level of government be conscious of competitive business costs and (b) maintaining and improving cost competitiveness be an important public sector priority because of its close relationship to employment creation.

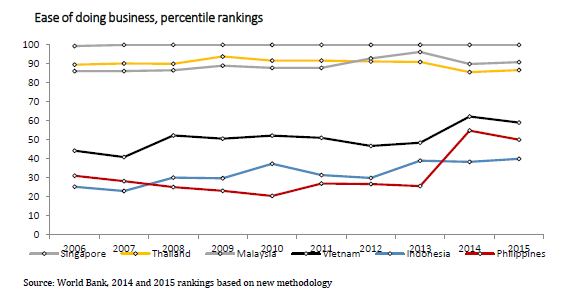

Since 2006 the World Bank Group’s International Finance Corporation (IFC) has ranked economies on factors related to the ease of doing business. Of the ASEAN-6, the Philippines was the lowest ranked for 3 of the 5 surveys (see Figure 139). The high rankings in 2010 of Singapore (1), Thailand (19), and Malaysia (21), sharply contrast with the poorer performers Vietnam (78), Indonesia (121), and the Philippines (148). The survey could offer motivation for Philippine government leaders to review and reform processes for interacting with businesses, especially those related to permits and licenses, which present opportunities for corruption (see Figure 139 for percentile rankings).

The National Competitiveness Council (NCC) established in October 2006 and co-chaired by the DTI Secretary and a former DTI Secretary – both veterans of business sector careers – has endeavored to identify and reduce business costs, including red tape and shipping fees, but with mixed success.183 One of the drawbacks facing the NCC has been limited resources (from both the public and private sectors) and a lack of authority to direct government agencies to take actions to improve competitiveness. A review of the structure and mandate of the NCC would be appropriate at the beginning of the new presidential administration.184

In addition, an Anti-Red Tape Task Force (ARTTF) chaired by the DTI, was organized in 2006. The ARTTF held a series of interagency meetings focusing on 10 “worst” red tape processes identified in a survey of the American Chamber of Commerce (AmCham) but with limited success in reforming bureaucratic behavior. The ARTTF has worked closely with the WB/IFC to improve the low ranking of the Philippines in the “Ease of Doing Business” survey. In 2007 the Anti-Red Tape Act (RA 9485) was enacted, adopting the concept of a Citizen’s Charter for the public to be informed of regulations and to receive prompt service from government offices. As the IRRs were promulgated through Civil Service Commission Resolution No. 081471 only on July 24, 2009, there has been insufficient time to judge the law’s effectiveness in reforming the bureaucratic culture that has contributed to repeated low competitiveness rankings. An AmCham membership survey in 2009 asked members if they were aware of the Anti-Red Tape Act; most respondents answered in the negative, indicating a need for more publicity to inform the business community about the law. The following data examines several types of business costs in selected Asian countries, including daily minimum wages, paid holidays, office rental costs, electricity prices, telecommunications expenses, transportation costs, red tape, and expatriate living expenses.

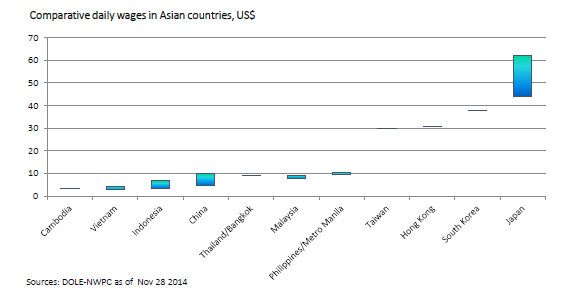

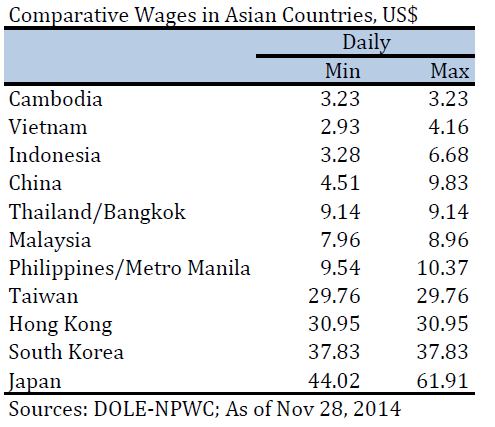

• Minimum wages Most multinational investors in the Philippines pay above the minimum wage. More advanced industries, such as electronics firms, pay entry level and legacy workers considerably more than the minimum wage. The fast-growing business process outsourcing industry pays several times the minimum for new hires but rejects around 90% of applicants. Demand from new entrants is often so high that pirating of workers has become an industry issue. For such industries, market forces set wage rates. But for a large part of the workforce and many export firms the minimum wage is a critical business cost. Minimum wages in the Philippines – while low by developed country standards – have steadily risen to become much higher than regional competitor economies, including Cambodia, China, India, Indonesia, Thailand, and Vietnam (see Figure 140 and Table 57). Most ASEAN governments, including the Philippines, have minimum wage policies.Three exceptions where market forces determine minimum wages are Singapore,185 Malaysia,186 and Hong Kong.187

Formerly, the Philippine minimum wage was legislated or issued by presidential decree. Since enactment of the Wage Rationalization Act (RA 6727) in 1990, the current system of minimum wage setting following tripartite consultations among representatives of government, labor, and management appointed to the Regional Tripartite Wages and Productivity Boards in each region has been followed.

The minimum wage was raised in 1990 and almostevery year since to its current mid-2010 level of PhP 404 in the National Capital Region.188 Raises in theother regions will follow.

The minimum wage “seeks to provide the incomerequired by a family of six to meet its basic food and non-food requirements and savings for social security.”189 This definition makes it almost inevitable that the minimum wage will be higher than in competing regional economies, where families are smaller and often have more than one adult member with full-time employment.

In addition, the price of rice and other food in China, Thailand, and Vietnam is lower than in the Philippines. The Philippine worker must earn more than his regional counterpart to feed a larger family, with less help from income earned by other employed family members.

“The National Wages and Productivity Commission (NWPC) is reviewing existing wage-fixing mechanisms.(Labor Secretary) Baldoz has ordered the commission to come up with guidelines in implementing a two-tier wage fixing system. Under the system, the minimum wage, considered a floor wage, is added to performance-based wage increases and bonuses.”

“The idea is to determine additional wage increases on top of a new minimum wage increases on top of a new minimum wage that will keep body and soul together, which will be in the form of incentives, profit sharing, bonuses… on the basis of productivity and company vialibility,” Baldoz said.

Baldoz said the current system discourages foreign investors from hiring Filipino workers. “Compared to other countries… Filipinos are no longer competitive in terms of wages. Our minimum wage is too high compared to other countries,” Baldoz said

—Philippine Star, July 12, 2010

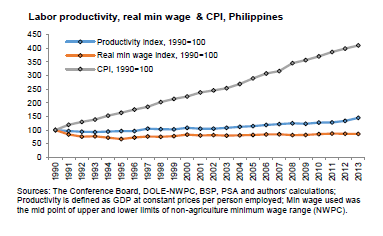

Over the last two decades, the Filipino worker has faced rising living costs. Figure 141 shows Consumer Price Index (CPI), minimum wage, and productivity index. While the average national minimum wage rose by 279% during the last 20 years in nominal terms, prices more than tripled ( up 256%) between 1990 and 2009. Food (50% of CPI) rose 225%. Clothing (3% of CPI) rose 168%. Housing (17% of CPI) rose 325%. Fuel, light, and water (7% of CPI) rose 306%. Services (16% of CPI) rose 404%. Minimum wage, when measured in real terms, has closely tracked productivity.

If wages, adjusted for inflation, have maintained a strong correlation with productivity, then other factors may be responsible for the relatively higher minimum wage in the Philippines. Inefficiencies in the economy increase prices of domestic goods (e.g. electricity, rice, and transportation), and the high population growth rate and absence of an effective population management policy create an environment that challenges the ability of Filipino workers to earn enough to support their often-large families. Unfortunately, the market forces of international competitiveness do not take such local factors into account. Other policies than regular increases in minimum wages could be considered to support the lowest-paid workers, such as conditional cash transfers, food stamps, and exemption from income taxes.190

The process for setting the minimum wage by the National Wages and Productivity Commission includes a provision for the exemption of “distressed establishments” to provide temporary relief to such firms in order to preserve jobs. A financially distressed firm may avail of the exemption, but only for one year. If this policy was liberalized for specific export industries – such as footwear and garments – it might be possible to end the gradual disappearance of these industries and restore hundreds of thousands of jobs lost over the past decade.

An alternative could be to allow compensation in such distressed export industries on the basis of piecework. Under this model, motivated workers would increase their productivity and could often earn more than the daily minimum wage. However, should new policies such as these be adopted, they should not be short-term. Investors need longer-term horizons in order to invest with confidence.

Labor-intensive export industries, such as footwear and garment manufacturing, have moved out of the Philippines during the last decade for lower production cost economies, such as Bangladesh, Cambodia, China, Indonesia, and Vietnam. As discussed in Part 3 Manufacturing and Logistics, the garment export industry in the Philippines has lost nearly 200,000 jobs in the last decade and hundreds of factories have closed, following the end of the garments export quota system.

• Holidays

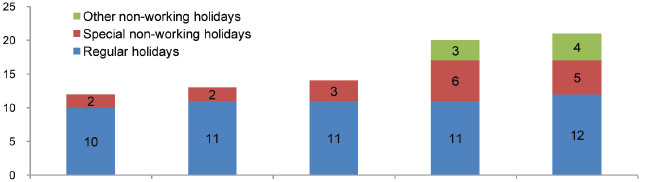

Countries celebrate important cultural, historical, and religious days that occur on working days as paid holidays. The Philippines has quite a few more than its competitors, imposing added costs of doing business and reducing national competitiveness.

“Too many holidays make the country less competitive.”

—President Benigno Aquino III, Philippine Star, August 8, 2010

The Philippines has national and local holidays, which are variously designated as “working” or “non-working” and “regular” and “special.”191 The “non-working” category increases business costs and affects national competitiveness when its number exceeds competing economies with fewer paid holidays. Every paid non-working holiday means the employer has to pay a salaried employee for a day his working services are not rendered. And if his services are required on the holiday, the employee must be paid a substantial premium of 100%.

Every paid holiday goes to the bottom line of the balance sheet and, like minimum wages, can pressure firms that operate on low profit margins to reduce their workforce, close, or move into the underground economy, especially for SMEs.

In recent years, more special non-working days were created by legislation and proclamation. The government rarely consults business stakeholders, although each holiday adds tens of millions of dollars to their payrolls.192 Sometimes non-working days are declared by the national government on very short notice, disrupting schedules and adding unexpected and therefore unbudgeted sums to corporate budgets.

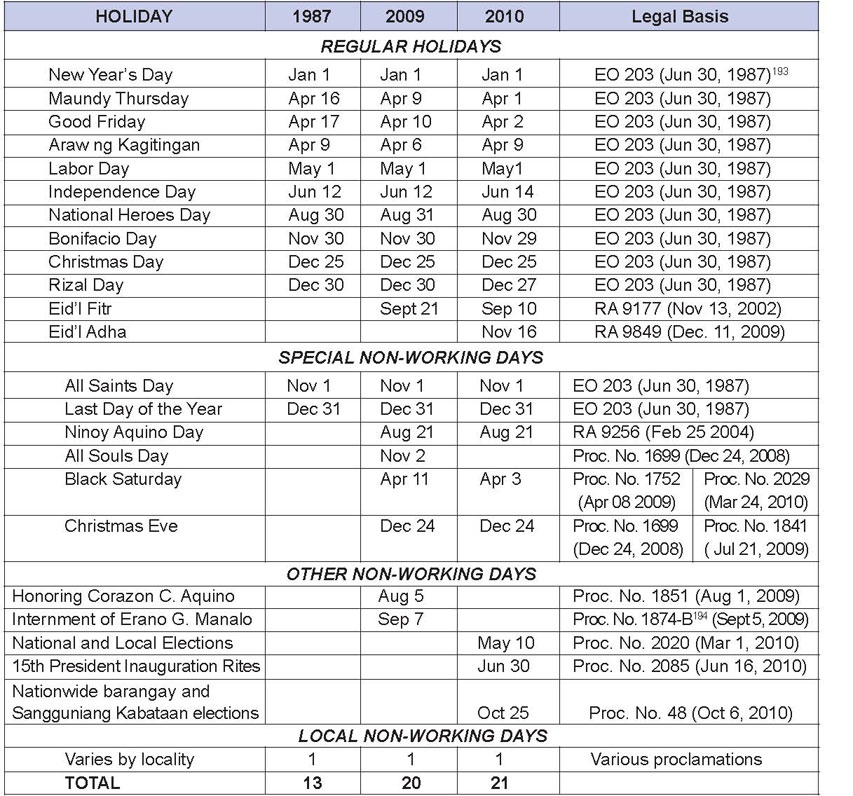

Table 58 and Figure 142 summarize the history since 1987 of paid holidays in the country. Former President Corazon Aquino by executive order in 1987 rationalized Regular Holidays at 10 and Special Non-Working Days at 2. Additional paid holidays in each category were created in 2002, 2008, and 2009, and several non-recurring non-working holidays were declared for the internment of a former president and a religious leader, for national elections, the inauguration of the new president, Nationwide barangay and Sangguniang Kabataan elections and other purposes.

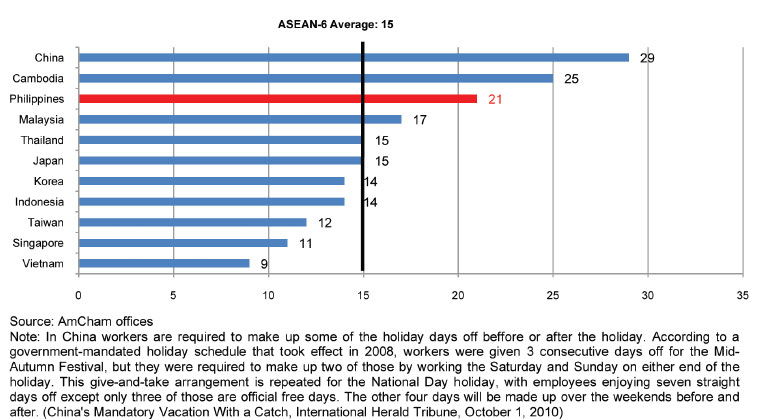

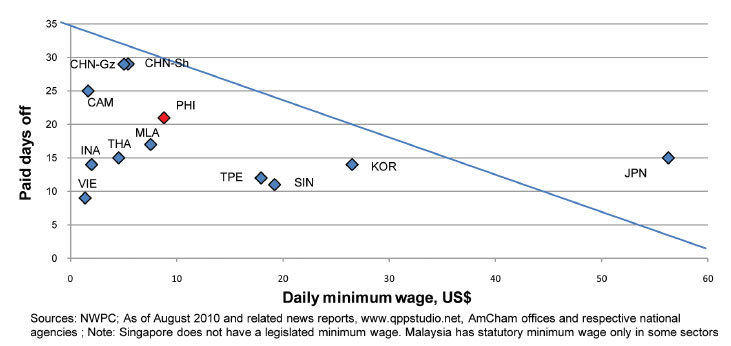

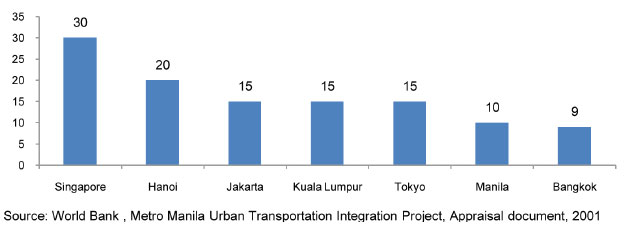

A recent study (see Annex 2) shows that the Philippines will have the highest number of non-working holidays among the ASEAN-6 economies in 2010 (see Figure 143).195 From this data it is clear that investors in the Philippines bear a heavier cost for labor than in countries with fewer paid holidays and comparable wages. At the two extremes, Vietnam has only nine paid holidays, while firms in the Philippines are expected to have as many as 21 paid holidays in 2010, counting Regular Holidays, Special Non-Working Days, and one local Non-Working Day. The average annual number of paid days off for the ASEAN-6 was 15 days, which the Philippines exceeded by 6 days.

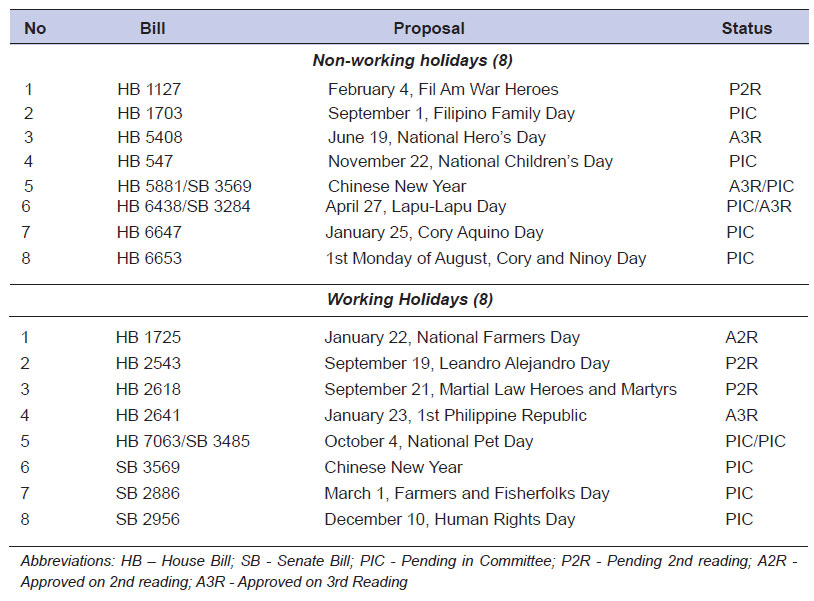

Congressional proposals for new holidays continue (see Table 59). In the 14th Congress, at least 19 bills to create new holidays were introduced but not enacted into law. Eight of these were for non-working holidays. The creation in recent years of new holidays and proposals for more has created a worrisome competitiveness issue for the economy. It may be difficult for the government to reduce the number of holidays. Just as the frequent declaration of holidays by the former president may have been intended to increase her low popularity ratings, the incoming administration may not be willing to take the unpopular step of reducing the number of paid holidays, although such a reform would improve competitiveness and contribute to creating more jobs. A final argument in favor of fewer holidays is the burden too many holidays place on SMEs, which often have less resources than large firms to meet additional payroll expenses created by more holidays (as well as ever increasing minimum wages) and may be forced into the informal economy.

Philippine competitiveness is adversely affected when the country has both more non-working holidays and a higher minimum wage than its competitors. The scatter diagram (Figure 144) shows that the Philippines is competitively disadvantaged by exactly such a situation. By this measure, the Philippines is not among the five most competitive countries, which are clustered nearest the intersection of the two axis of the figure.

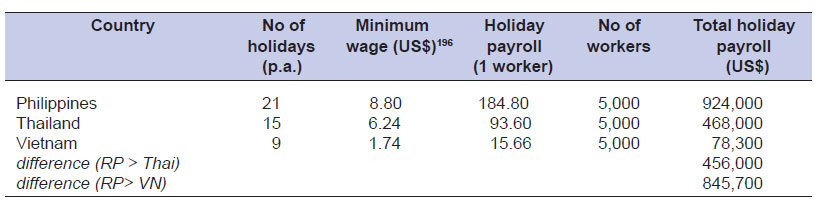

The following hypothetical calculation (Table 60) is the kind that could be made by a multinational firm comparing the Philippines with Thailand and Vietnam for a factory employing 5,000 workers. The table shows that the higher minimum wage and the higher number of holidays in the Philippines would add significantly to annual operating costs and could discourage the firm from further consideration of an investment in the Philippines, especially if profit margins are low.

• Office rental costs

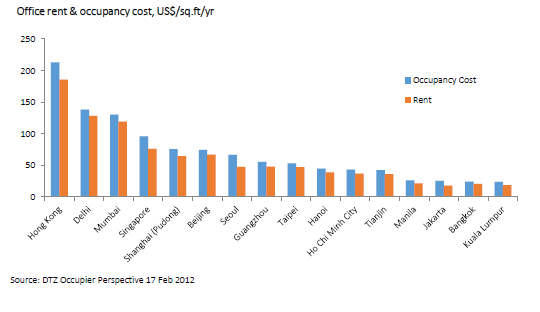

Renting office space in Manila is a relative bargain, according to the latest data from the CB Richard Ellis publication Global Office Rents, May 2010. Rentals in Manila (US$ 24.38 per square foot) are higher than in Jakarta (US$ 17.89), similar to Bangkok (US$ 23.54) and Guangzhou (US$ 27.50), and less than Bangalore (US$ 33.28), Ho Chi Minh City (US$ 48.56), and Taipei (US$ 45.09). Rents in Singapore (US$ 57.49), Shanghai (US$ 60.14), Seoul (US$ 71.82), Hong Kong (US$ 80.27), are two to three times higher than Manila, while Tokyo (US$ 143.99) is six times more (see Figure 145).

196 Higher range of minimum wage used in calculations.

• Power costs

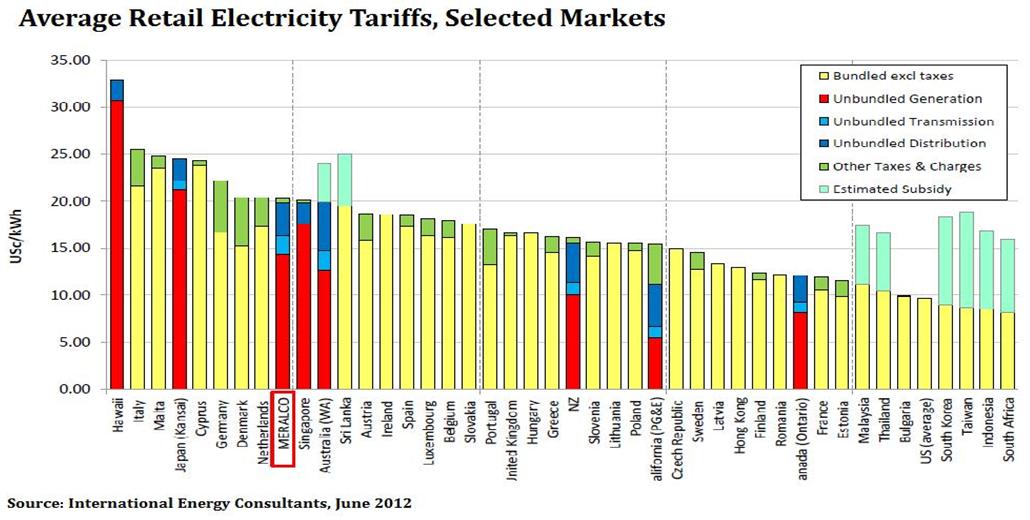

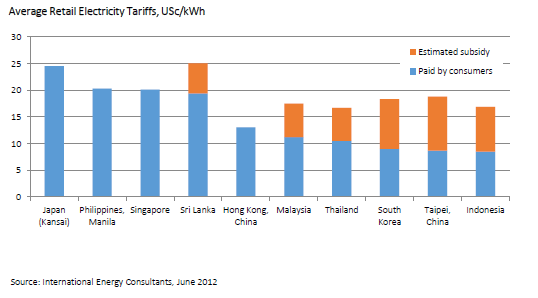

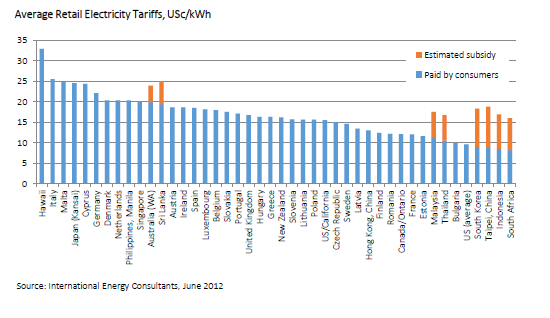

The very high cost of power remains a common complaint of businesses in the Philippines and a very important negative factor for national competitiveness. As Figure 146 shows, in 2010 a factory in the Philippines could pay more than twice as much for power than a factory in Indonesia and Vietnam and almost twice as much as a factory in Malaysia and Thailand.

“The most important urgent economic issues that would be need to be addressed by a new President are infrastructure development and lowering power costs.”

—Gilber Teodoro, The Philippine Daily Inquirer, January 24, 2010

Reform of the Philippine electricity sector has been underway for nearly a decade and is eventually expected to produce somewhat lower prices through creating contestable markets and replacing old inefficient plants with new more efficient baseload plants. The inefficient and corrupt public sector power monopoly built under the Marcos dictatorship has been steadily dismantled through the privatization of government-owned generation assets, as well as the operation of the national transmission grid. A wholesale market for surplus electricity has been created for Luzon. Open access, which will allow competing private sector generators of electricity to sell directly to large customers, is expected to begin in the second half of 2010 or 2011 at the latest.

Despite these reforms, electricity prices are not expected to become significantly lower in future years. The country has limited additional geothermal and hydropower sources to develop. Wind power has strong potential but currently costs more than twice as much as coal per megawatt to build. Solar is even more expensive, and the country has considerable cloud cover during the rainy season which reduces potential power generation. New efficient baseload coal plants can provide less expensive power, so long as the price of coal does not increase significantly. Nuclear power, which China, India, Japan, and Korea, are using increasingly, was abandoned as an option in 1986 when former President Corazon Aquino decided not to operate the 600MW BNPP (which ultimately cost the country US$ 2 billion including interest). Any nuclear plant the government may approve will not become operational until late this decade.

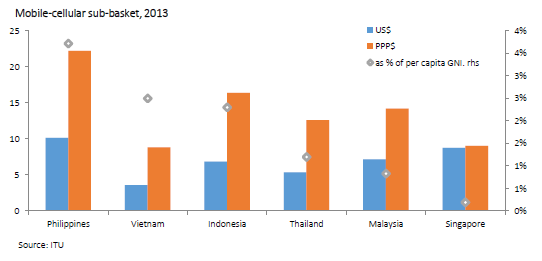

• Telecommunication costs

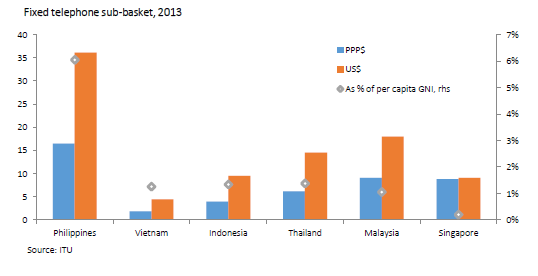

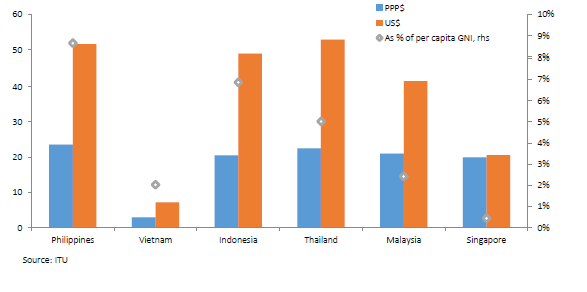

Telecommunication costs are also higher in the Philippines than other ASEAN-6 economies and China and India, whether measured in US$ or Purchasing Power Parity (PPP), according to International Telecommunication Union (ITU) data. The four figures below (Figures 147, 148, 149, and 150) show the Philippines is the most expensive of eight economies for the monthly costs of a fixed line, a mobile phone, and broadband.

View original figure here

View original figure here View original figure here

View original figure here• Transportation costs

In addition to power, the cost of ground and marine transportation is cited in investor surveys as adding to business costs. Philippine ports, with some exceptions, are dilapidated, inefficient, and require massive modernization (see Part 3 Infrastructure: Seaports). Inland marine transportation is costly, with observers (especially from Mindanao) commenting it can be cheaper to ship from a foreign port to Manila than from Mindanao, as well as cheaper to ship refrigerated goods by land from Manila than by sea.

By contrast, domestic air transportation for both passengers and cargo is inexpensive, the result of domestic civil aviation deregulation initiated during the Ramos Administration and the resulting competition from new airlines that entered the market.

Creating efficient ground transportation infrastructure remains a major challenge to the government, especially on Luzon and in the densely crowded National Capital Region (NCR), predicted to grow to 30 million by 2030, when it could be the world’s third largest megalopolis. Traffic in Manila and many surrounding provinces is often extremely congested and likely to increase in volume with higher economic growth. Vehicles often average well under 10 kilometers an hour moving through NCR traffic.

Figure 151 shows average travel speeds in seven Asian capital cities. Singapore, which boasts of one of the world’s ultra-efficient limited access road and light rail networks, has the best flow of traffic, and Bangkok the worst. Since this data was researched, however, Bangkok has opened new light rail systems and a subway, and its traffic flow has improved. Jakarta, which has no light rail, is now the most congested of this group and is predicted to be approaching serious traffic paralysis, as strong economic growth puts more vehicles on its inadequate roads.

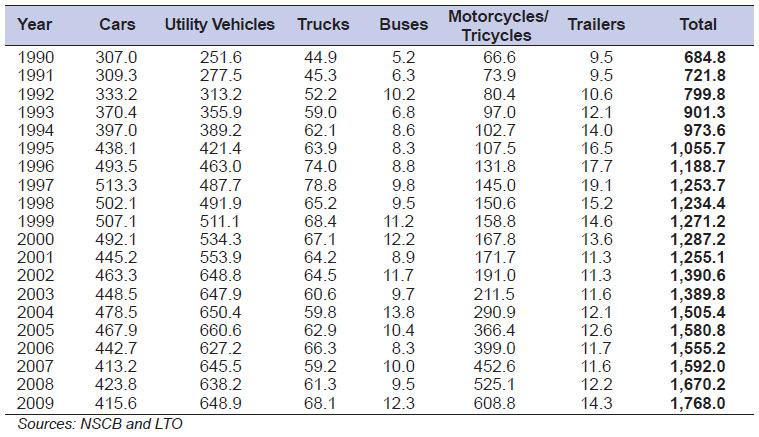

The road network of Metro Manila exceeds 5,000 kilometers. Almost two million vehicles (buses, cars, motorcycles, tricycles, trucks, utility vehicles) are registered in the NCR, according to the DOTC Land Transportation Office (see Table 61).

Over the last decade several studies have estimated the annual economic costs of traffic in Metro Manila at more than PhP 100 billion.197 One study by two UP professors estimated the value of time lost in traffic by executives and other professionals and workers. According to the DOTC, some PhP 140 billion is lost each year counting direct and indirect economic losses due to traffic congestion. These studies considered the costs to the economy caused by traffic jams and accidents, fuel wasted in stop-and-go and snail-paced traffic, lost productivity of workers and managers stuck in traffic, wages and salaries of larger than necessary numbers of police officers and traffic aides during rush hours, increased wear and tear on motor vehicles traveling in slow traffic, and the ill health of persons exposed to toxic-air while commuting in jeeps and buses.

While there are short-term traffic management solutions that the Metropolitan Manila Development Authority (MMDA) has applied, such as building more overpasses, special U-turn lanes, the Uniform Vehicular Volume Reduction Scheme and color-coding, new light rail lines and limited access expressways must be built to enable efficient traffic flow and avoid future gridlock. Figure 87 in Part 3 Infrastructure: Railroads shows the steady increase of passengers riding on the three light rail lines in Metro Manila. More lines will move millions more passengers, giving them options to commuting through Metro Manila in vehicles on crowded surface streets. Limited access expressways, especially if elevated, will also provide the means to move faster through the city.

• Red tape

All governments impose bureaucratic controls on citizens, but the Philippines has long had a reputation for excessive and corrupt bureaucratic impositions. In the absence of red tape, government employees would have no opportunity for receiving small amounts of extra income for granting their approvals of the many forms citizens and businesses must complete.

Over the years, efforts have been made to reduce red tape, such as the creation of the ARTTF to improve Philippine rankings in the WB/IFC Doing Business reports and enactment of the Anti- Red Tape Act. Other examples of anti-red tape actions include the 2001 order of former President Macapagal to reduce red tape for Philippine maritime workers by 50% and various programs to train LGUs to improve their business services and to compete in annual ratings of the Philippines most competitive cities.

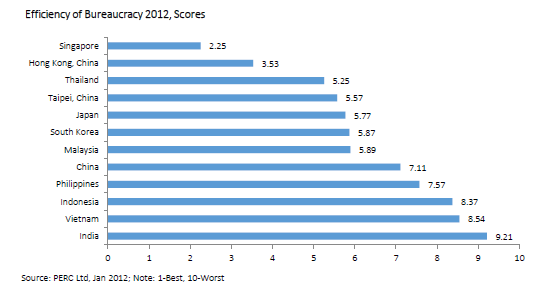

Respondents to a 2010 survey by the Political and Economic Risk Consultancy (PERC) in Hong Kong on the efficiency of bureaucracy in Asia rated the quality and efficiency of the civil service in Singapore as the best in Asia and the Indian bureaucracy the worst. The civil services of China, Indonesia, the Philippines, and Vietnam were each graded poorly, but not as bad as India (see Figure 152).

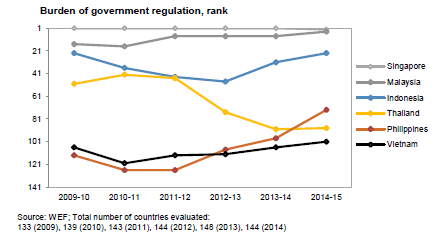

The WEF Global Competitiveness Report measures the burden of government regulation. The Philippines was ranked 126 of 139 countries (see Figure 153).

View original figure here

View original figure here“Regulatory burden and corruption can appreciably raise business transaction costs. Such costs include… time spent dealing with bureaucratic hurdles, delays in processing of government requirements for business, and direct costs of irregular payments… Corruption can impair the government’s ability to exercise appropriate regulatory controls and inspections to correct market failures… firms have to deal with public officials regarding regulations and administration, entailing considerable management time that could otherwise be used more productively. According to the World Business Environment Survey in 2000, about 80% of firms report that up to 10% of management time is spent for this purpose, while 20% of firms spend more than 10% of management time.”

—Philippines: Moving Toward a Better Investment Climate, pp. 20-21. ADB.

Experts agree a strong correlation exists between bureaucracy and corruption. Countries considered to have the most inefficient bureaucracies are also considered to be the most corrupt. When civil servants are paid well and penalties for corruption are implemented, then bureaucracies are more efficient. Singapore pays its civil servants very well, while punishing infractions severely. By comparison, the Philippines pays poorly and rarely punishes corruption. Corruption is so ingrained, some argue, that the only way to motivate workers in some government agencies is to pay a bribe to cut through the red tape. These agencies are often characterized by the presence of many “fixers” or facilitators.

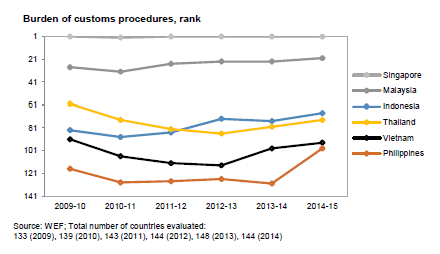

One of the worst agencies for paperwork and corruption has long been the Bureau of Customs. The poor performance of this agency is recognized with a low rating by the World Economic Forum, 129 of 139 countries, and the worst among the ASEAN-6 (see Figure 154). Technical smuggling through the BOC during the past decade has resulted in estimates of hundreds of billions of pesos of lost revenues and required at two different periods the president to establish anti-smuggling task forces, separate from the BOC, to combat smuggling

View original figure here

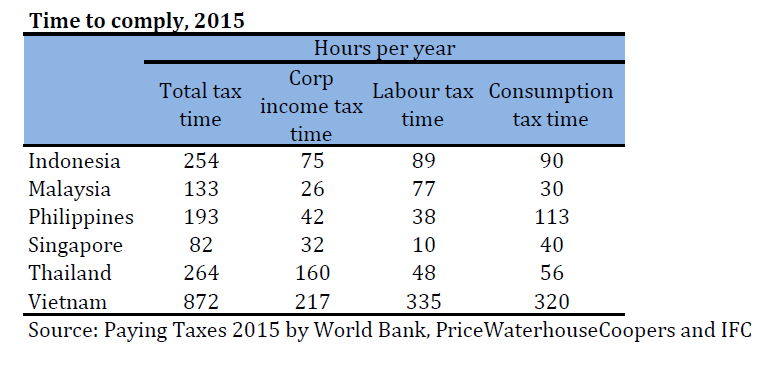

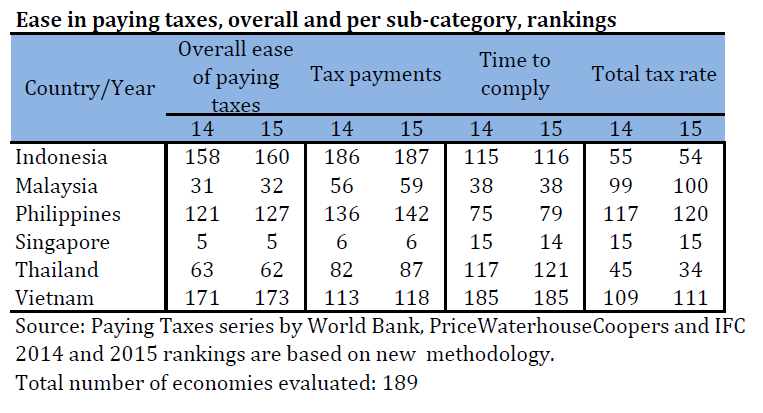

View original figure hereAnother measure of the paperwork burden on Philippine firms is the number of hours per year spent complying with tax payments, as measured by the Paying Taxes 2010 survey of the World Bank. While Singapore requires 84 hours to complete payment of consumption, corporate, and labor taxes, the Philippines requires 195 hours (see Table 62). The Philippines, however, is mid-ranked among the ASEAN-6 between the better performing Singapore and Malaysia, and ahead of the worst performing Thailand, Indonesia, and Vietnam (see Table 63). The Philippines also has, among the ASEAN-6, the highest total fees rate.

View original table here

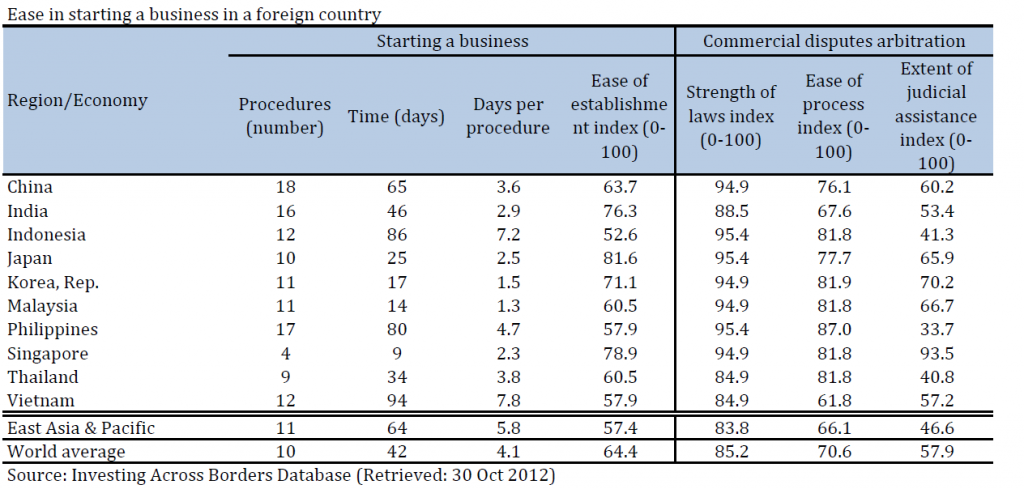

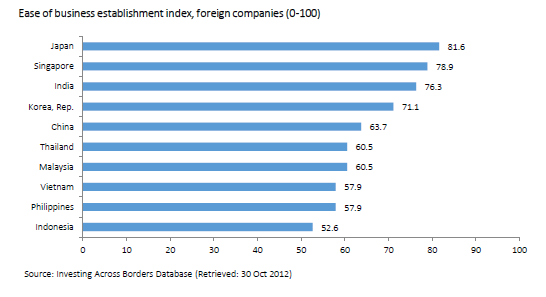

The World Bank Foreign Investment Advisory Service global rating of 87 countries Investing Across Borders measures the ease for foreign companies to start a business. Among the Asian economies covered by the survey, the Philippines was low-ranked along with Vietnam with ratings of 58 each, while Indonesia with 53 was slightly worse (see Table 64 and Figure 155).

View original figure here

Salaries at several government agencies, e.g. at PEZA, have been exempted from salary standardization, allowing these agencies to compensate employees closer to private sector levels. PEZA renders efficient, professional, and honest services to locators, making its export processing and information technology zones preferred locations for export manufacturers and BPO locators.

The Anti-Red Tape Act, if fully implemented, has the potential to become a major reform for the Philippine bureaucracy. Processing time for documents should be reduced greatly, since the law directs government offices to act upon a simple request within 5 days and complex ones within 10 days. The new law also limits the number of signatories of officials or employees directly supervising frontline services to a maximum of five. Government offices are required to draw up a Citizen’s Charter, identifying the frontline services they offer, documents that must be presented, the amount of fees, and procedures for complaints. The charter must be posted at a prominent place in the government office building.

A proposal has been made for a single government call center that links all frontline government. Under this scheme, a citizen or firm making an enquiry about a government service or document will only have to call one hotline number, where an operator would redirect the call to the concerned government agency. Physical follow-up at agencies would be reduced, saving citizens time and money.

• Expatriate living costs

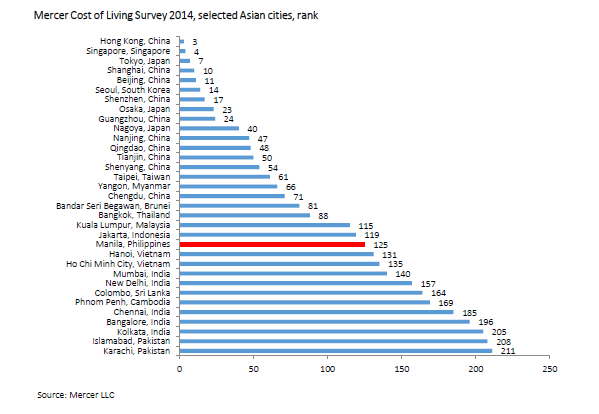

In addition to office rental and telecommunications, another category of business costs where the Philippines compares well to most competitors is the affordable cost of living for executives. Manila remains one of the least expensive major cities in Asia for expatriates, according to the 2010 Cost of Living Survey by American consulting firm Mercer LLC. The Mercer survey is often used by multinationals to decide levels of compensation for employees outside the US.

The total cost of housing, transport, food, and other goods and services in Metro Manila was rated 157th most expensive among 214 cities in the world, placing the Philippine capital in the bottom third among the least expensive (see Figure 156). Metro Manila was the least expensive for expatriates among the ASEAN-6 capitals. Several similar surveys not reproduced here assign Manila the same approximate rank.198

View original figure here

View original figure hereHeadline Recommendations

- Senior levels of public and private sectors should create a national culture of competitiveness. Strengthen national efforts to improve competitiveness by reducing business costs, including the NCC, and prepare an annual presidential report on competitiveness.

- Adjust minimum wages to be more in line with similar regional middle income economies, allow relief from minimum wages or piece work for distressed industries or other measures that maintain jobs instead of losing them to other countries, including developing new industrial zones with infrastructure that offer much lower wage rates. Reduce the burden of high holiday payroll expenses by reducing the number of non-working holidays.

- Reduce power costs for firms needing to maintain global competitiveness to survive. Introduce open access and power discounts. Modernize ground and marine transport to achieve competitive efficiencies.

- Accelerate efforts to greatly reduce the red tape burden on citizens and firms.

Recommendations: (16)

A. The most senior levels of government and the private sector should create a national culture to improve Filipino competitiveness. The leadership could make citizens more aware of the competitive environment in which the nation exists, calling for behavioral reforms that will enable the Philippines to become more competitive. Improving cost competitiveness should be an important public sector priority because of its close relationship to employment creation.

B. Continue and strengthen the National Competitive Council following a review of its mandate. Provide the NCC with adequate resources and authority to direct government agencies to take actions to improve competitiveness. The NCC could be asked to draft an annual comprehensive State of National Competitiveness Report for the president to submit to the Congress. (Immediate action OP, DTI, NCC, and private sector)

C. Introduce a more flexible minimum wage and/or piecework policy for distressed industries, in jeopardy due to foreign competition, to be more globally-competitive. Such new policies may be able to slow and perhaps reverse the decline of the garment, footwear, and other export industries threatened by more efficient foreign competitors. Consider using the provision to exempt “distressed industries” from the minimum wage. Develop new industrial zones with infrastructure that offer lower minimum wage rates. Any new policies should be long-term and not short-term measures. (Immediate action DOLE, DTI, and private sector)

D. There should be an absolute moratorium on new non-working holidays. The president could announce his intention not to proclaim any special non-working holidays and to veto any legislation creating any new non-working holidays. He could direct DTI, NEDA, and the NCC to make a study of the effect of non-working holidays on national competitiveness and to make recommendations on how to rationalize non-working holidays. Some non-working holidays should be changed to working holidays to improve national competitiveness. (Immediate action OP, DOLE, DTI, NEDA, and NCC)

E. Implement the open access provision of EPIRA to allow more competition among generating firms in the provision of electric power (see Part 3 Infrastructure: Power). (Immediate action DOE, ERC, and private sector)

F. As part of industrial policy, consider expanding power cost relief/discounts that are being provided for certain strategic investors, possibly using Malampaya gas royalties received by the government. (Immediate action DOE, NPC, PEZA)

G. Continue and intensify the ARTFF and projects to improve the WB/IFC Doing Business ratings. (DTI, NCC, and private sector)

H. Continue aggressive efforts to reduce red tape by assiduously implementing the Anti- Red Tape Act. Undertake a national campaign to inform the public of the law and to change gradually the culture of civil servants so that they become better public servants for the Filipino people. (Immediate action OP, CSC, and all departments and agencies)

I. Encourage citizen feedback over the internet and through call centers at all major government agencies. Implement the Civil Service Commission (CSC) proposal for a central government hotline connected to frontline government agencies for persons and firms to obtain information and follow-up. (Immediate action OP, NEDA, and each agency)

J. Anonymously validate the effectiveness of implementation of the Anti-Red Tape Act by assigning a team of checkers (perhaps from a consumer rating agency) who visit frontline agencies acting as ordinary citizens and rate their experiences.199 The ratings would be published on the agency website and in newspapers. Media could be encouraged to publicize the best and the worst agencies. (Immediate action CSC, DTI, and NEDA)

K. Apply computer and internet technology to increase the provision of government services through e-governance, following the example of the BIR and DTI. (Immediate action CICT and all government agencies)

L. New rules and regulations of the national government should not be issued without the approval of a central office (e.g. the ARTTF and/or the CSC) and many of them should contain a sunset provision to expire within a set number of years unless rejustified. (Immediate action OP, DTI, and CSC)

M. Exemptions from salary standardization could be made for more critical front-line agencies, such as the BIR, BOC, and LTO. As revenue collections improve and rationalization of government agencies advances, civil service salaries may be brought more into line with the private sector. (Medium and long term action DBM, CSC, NEDA, and Congress)

N. Reduce ground transport costs (see Part 3 Infrastructure: Roads and Rail for specific recommendations).

O. Reduce telecommunications costs, especially for mobile telephones and broadband, in order to better avail of modern communications and internet technologies.

P. Reduce marine transport costs (see Part 3 Infrastructure: Seaports for specific recommendations).

Footnotes

- The Japan External Trade Organization (JETRO) periodically issues reports on comparative business costs in Asia.[Top]

- The NCC was organized following deterioration of the international competitiveness rankings of the Philippines into the lower third of economies; its announced but unrealized goal has been to raise the country’s rankings to the top third.[Top]

- The NCC has recommended creation of a Presidential Council on Governance and Competitiveness chaired by the Executive Secretary (public sector) with a private sector co-chair. National Competitive Council Performance Report, mid-2010.[Top]

- “There is no minimum wage/salary in Singapore. Salary is subject to negotiation and mutual agreement between an employer and an employee or the trade union representing the employees.” Singapore Ministry of Manpower website, July 2, 2010.[Top]

- Malaysia has statutory minimum wages for several trades, but in 2010 the national government rejected a parliamentary proposal to establish a national minimum wage.[Top]

- Hong Kong in July 2010 decided to establish a minimum wage for the first time. Press reports stated the new minimum wage will be set between US$3 and US$ 4 an hour.[Top]

- An increase of PhP 22 in the non-agricultural minimum wage in the NCR became effective July 1, 2010, raising this wage from PhP 382 to PhP 404 or almost US$ 8.80.[Top]

- NWPC presentation during an AmCham symposium at AIM, June 9, 2010[Top]

- Since July 2008, the income of minimum wage earners is exempted from income tax.[Top]

- Some Philippine cities have an annual non-working holiday, e.g. Manila Day (June 24), while others do not require businesses to close on their local holiday, e.g. Makati Day. The first proclamations under the Aquino Administration (no.1, 2, 3, and 4) signed by Executive Secretary Ochoa on July 7 declared special non-working holidays in Isabela City, Basilan for the town fiesta (July 8), for the anniversary of the founding of the Cordillera region (July 15), for the golden jubilee of the city charter of Gingoog, Misamis Oriental (July 23), and the anniversary of the foundation of Batangas City (July 23).[Top]

- In one case, two industry associations, whose members employ nearly one million Filipinos, became aware of the imminent presidential proclamation of a paid holiday for the funeral of the leader of a religious sect to whom the former president seemed indebted for political support. They separately protested to the Trade Secretary, who intervened at Malacañang to exempt their sectors from the holiday, thus assisting the competitiveness of these firms but not others, who would have requested similar treatment had they been consulted.[Top]

- Also see Executive Order 292, “Administrative Code of 1987”, Book 1, Chapter 7, Section 26

- The BPO and electronics sectors were exempted from this non-working holiday

- The study was conducted by a student of the College of Saint Benilde at De la Salle University during his internship at AmCham in 2010.[Top]

- Higher range of minimum wage used in calculations.[Top]

- Paper entitled “Economic Impact of Traffic Congestion in Metro Manila” by Professors Ricardo Sigua and Professor Noriel Tiglao of the University of the Philippines’ National Center for Transportation Studies (NCTS), reported in November 2007.[Top]

- Three other cost of living surveys examined were those of ECA, the Economist Intelligence Unit, and UBS.[Top]

- This recommendation is inspired by a suggestion of Philippine Star columnist Boo Chanco who wrote on July 7, 2010 “P-Noy can have somebody put together a kind of mystery shopper program used by the big retailers in the US to see how the consumer is being treated by the staff. Such a program will give the President a direct feel of how things are at the frontlines where it matters the most. Are people getting fast courteous service when they apply for passports or try to secure copies of birth certificates? Are people being asked for bribes when they register their cars or get driver’s licenses?”[Top]