Local Government

Foreign investors not only deal with national government agencies but also with local government units (LGUs) where their business facilities are located.235 These are usually the provincial, city, or municipal office, and generally not the next lower level of barangay (village). An exception is when the facility is located in a PEZA zone or SEZ/freeport, the investor does not deal with the LGU but with the national PEZA authority or the administrator of the SEZ/freeport, for example, at the former American military bases at Clark and Subic, who are appointed by the national government.

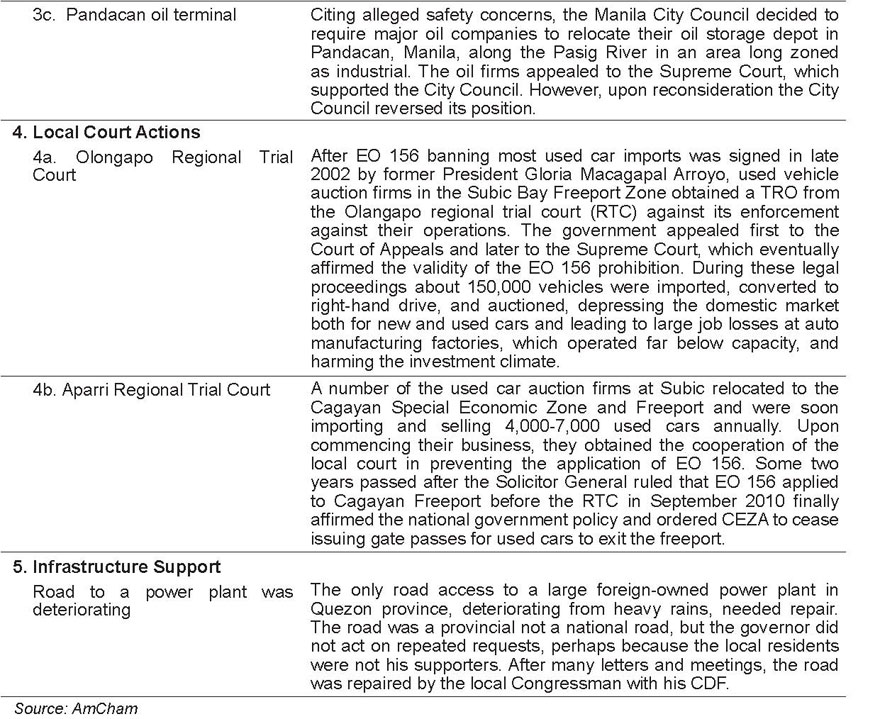

Like LGUs throughout the world and like the national government, LGUs in the Philippines levy certain taxes and fees and require various licenses and permits for business operations. Complaints are rare when these processes are transparent, efficient, fast, and honest. When they are not and when bribes are hinted at or even demanded, investors complain of “red tape” and corruption. Various surveys of domestic and foreign investors in the Philippines over many years have rated “corruption” as the top business problem, with “inefficient government bureaucracy” as the second-most concern (see Figure 193).

View original figure here

View original figure here

• Reducing LGU corruption and red tape

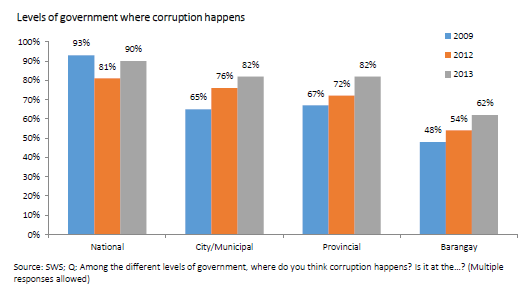

Reported corruption in LGUs has been measured in surveys, conducted by the leading public opinion survey firm Social Weather Stations (SWS) for eight years, on behalf of The Asia Foundation and the Transparent Accountable Governance (TAG) project. The surveys show a continuing high level of corruption in LGUs.

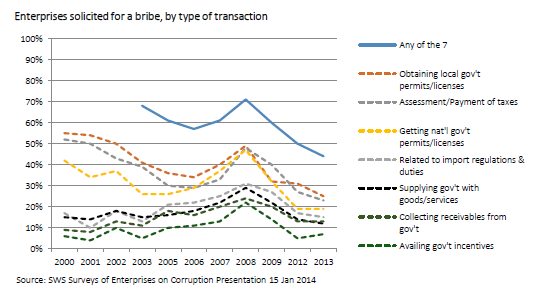

Figure 194 shows a majority of respondents confirming there is corruption in their local government at the provincial, city, and barangay level. Figure 195 shows the percentage of enterprise respondents who report being solicited to pay bribes when applying for local permits and licenses. The percentage, which was an astounding 55% when the surveys began in 2000, has declined to 32% in 2009, a very hopeful sign, especially if progress can be continued.

View original figure here

View original figure here

obtaining local permits and licenses, 2000-2013

View original figure here

View original figure here

The solution most often recommended for bureaucratic corruption, in which numerous small fees are requested to process paperwork, is to reduce the number of signatures required and to introduce e-governance.236 This saves what is very valuable for businessmen – their time and money – thus reducing business costs.

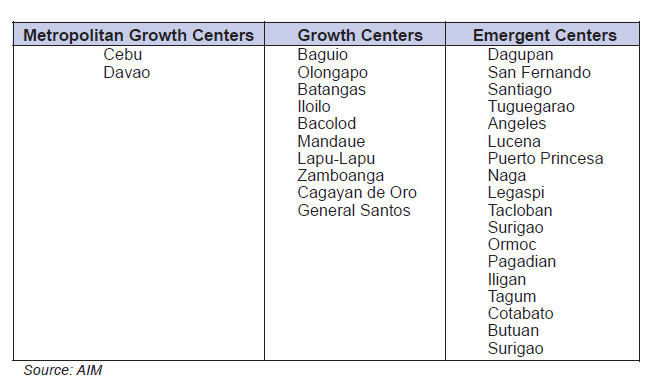

The World Bank Group annual survey “Doing Business” tracks the number of steps and time needed for a variety of business processes at the national level. Since the first survey in 2004, various efforts have been undertaken to work with local governments to increase the efficiency of these processes.237 Programs to measure and rank cities for their “competitiveness,” ongoing for several years, are intended to encourage more cities to improve their business services and to become more investor-friendly (see Table 75). Although they are slowly showing positive results, the Philippines still appears to be more inefficient than most members of the ASEAN-6.

The World Bank Group also released “Subnational Doing Business” reports which captures differences in business regulations and their enforcement across locations in a single country. “Doing Business in the Philippines 2008” compared business regulations across 21 Philippine cities in three key areas: starting a business, dealing with licenses, and registering property.

“Other local governments units should follow the simplified registration and licensing procedures of cities like Marikina, Mandaluyong, Quezon City, and Manila to attract more investors,” said Donald Dee, PCCI Chairman Emeritus, commenting on cities identified by the WB/IBC as models in simplifying business registration by substantially cutting the average 18 stages to 2 — filling and payment

Business World, May 18, 2010

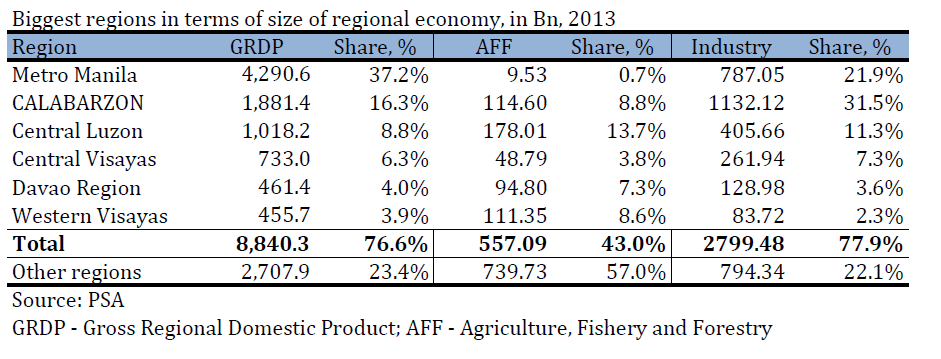

Another approach might be to improve the quality of LGU governance in the regions that contribute the largest percentages of economic activity to make them more efficient and transparent, thereby reducing business costs and improving competitiveness (see Table 76).

The Aquino Administration Secretary of Trade and Industry Greg Domingo has announced that the DTI will introduce in October 2010 on-line registration for new businesses that can be completed in 15 minutes. He has also announced that a new Philippine Business Registry service will begin operations by the end of 2010, providing a single website where a business can register with the BIR, pag-IBIG, Social Security System (SSS), and the like. The plan of the DTI is to make it possible for procedures that are now taking several weeks to accomplish to be done in 20 minutes. LGUs will be encouraged to follow the example of the DTI to put more of their procedures on-line.

• LGU actions can damage the investment climate

In most cases, LGUs and foreign investors work well together in their local communities, with the investors complying with local regulations and paying all taxes and fees that are legal under national law. The investors also usually contribute to the local community by hiring local residents, procuring goods and services locally, and supporting CSR projects.

However, there have been enough instances of provinces and cities taking actions having negative effects on existing foreign investors to create a perception that LGUs are a potential risk to investing in the Philippines. These incidents are usually reported in the local press and can receive worldwide coverage through business reports and consultants. Their unfortunate consequences can be to discourage existing investors from additional investment and to deter new investors from locating in a particular LGU or even from considering the Philippines.

“The attitude of many bureaucrats, specially at the government level, is to screw the business entrepreneurs, because they can afford it.”

—Boo Chanco, Demand and Supply, June 28, 2010

When LGUs impose taxes or fees contrary to national policy, they sometimes can harm the investment climate. Headquarters of multinationals made decisions to invest in the Philippines based on assurances and approvals from the national government and on the advice of their lawyers. If after an investment is made, an LGU imposes unusual taxes or fees that were not anticipated and for which the investor does not feel liable, an impression of policy instability is given.

Some types of foreign investors are granted an exemption by the national government from local taxes and fees as a fiscal incentive to invest in the Philippines. There have been instances in which an investor has had to go to court to oppose what it considers illegal taxation expense to defend their position. Section 202 of the Local Government Code of 1991, which authorizes local governments to assess real property taxes against corporations whose properties are in the territory of the local government, has been cited in several claims against foreign investors.

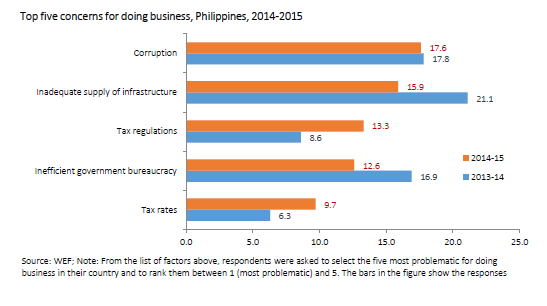

Table 77 describes several of these cases that have taken place over the last decade. They fall into several categories: (1) tax issues, (2) local corruption, (3) LGU does not follow national law or policy, (4) local court actions, and (5) infrastructure support.

Headline Recommendations

- Intensify programs to improve LGU governance to make them more efficient and competitive, prioritizing LGUs in the fastest-growing regions. Expand e-governance services on LGU websites to enable routine transactions and to provide information on budgets and procurement. Increase efforts to correct issues identified in IFC Doing Business ratings and reduce solicitation of bribes. It is essential that the National Government pays LGUs their tax share fairly and promptly. Intensify programs for LGU capacity building.

- LGUs should observe incentives, such as exemption from local taxes, awarded by the national government to investors under national laws. The LGU Code, when amended, should include language to make the foregoing application of national laws clear. Declare certain investments as strategic to take them out of the influence of LGUs.

- LGUs should strongly support the Seven Big Winner sectors: Agribusiness, BPO, Infrastructure, Manufacturing and Logistics, Mining, and Tourism, Medical Travel, and Retirement.

Recommendations: (16)

A.Programs to make LGUs (provinces and cities) more efficient and competitive in attracting investment should be continued and even intensified. Develop model LGUs – with better management, governance, and reduced red tape – that are transparent and investor-friendly. (Immediate action DTI, DILG, NCC, and LGUs)

B. Such programs should give priority to the fastest-growing regions, while allowing for the encouragement of model cities in other regions. (Immediate action DTI, DILG, NCC, and LGUs)

C. LGU websites in the Philippines are well-developed, colorful, and varied. LGUs should expand e-governance services on their websites from providing information to enabling routine transactions and to providing information on budgets and procurement. A basic template should be available so that similar information and services are provided on most websites throughout the country. (Medium-term action CICT, DILG, and LGUs)

D. LGUs should increase efforts to correct the issues identified in the IFC Doing Business ratings, in order to improve efficiency and reduce business costs and also to improve Philippine competitiveness rankings within ASEAN-6 economies. (Medium-term action DTI, DILG, LGUs)

E. Through improved governance, LGUs should achieve a steady reduction in the solicitation of bribes for bureaucratic services, as recorded in the annual SWS survey. (Long-term action LGUs)

F. LGUs should observe incentives, such as exemption from local taxes, awarded by the national government to investors under national laws. A mechanism should be created to coordinate the approval and implementation process of investment projects between the national government and LGUs, including tax incentives, right-of-way acquisition, and the like. (Immediate action DTI, DILG, other department, and LGUs)

G.When the LGU Code is amended, language should be included to make the foregoing application of national laws clear.Declare certain investments, such as mining and power plants, as strategic to take them out of the influence of LGUs. LGUs should model their support for investors on PEZA; a major reason investors prefer PEZA registration is the insulation provided against LGU corruption, as well as more efficient bureaucratic interface with multiple government agencies. (Immediate action DTI, DILG, LGUs, and Congress)

H.DILG and other departments should intensify programs for LGU capacity building (e.g. data collection and analysis), streamline and set standards for business permits and licenses, and implement its Working Group on Local Investment Reform (regulatory processes, governance, investment promotion, information and data support, and consumer welfare) (Medium-term action DILG and LGUs)

I.LGUs should choose which among the Seven Big Winner Sectors could be significantly promoted in their localities to bring in more jobs and investments.

I1.Agribusiness. LGUs in key agricultural areas should strengthen their agricultural extension and training services for farmers and improve farm-to-market roads. (Immediate action DTI, DA, LGUs, and private sector)

I2.BPOs. LGUs should respect the status of investor operations established in PEZA/IT zones. At the same time, guidelines should be developed and followed on which fees for local services (e.g. garbage collection) are acceptable. (Immediate action CICT, DTI, DILG, LGUs, and private sector)

I3.Creative Industries. LGUs should fully support the development of the creative industries in their locality and encourage them to export their products/services. (Immediate action DTI, LGUs, and private sector)

I4.Infrastructure. LGUs should strongly support rapid implementation of priority infrastructure projects, including PPP projects, that will develop their regions, e.g. for tourism. (Immediate action DTI, DILG, various departments, and LGUs)

I5.Manufacturing and Logistics. LGUs should fully support manufacturing, and logistics, which provide local jobs, procurement, and LGU revenue, and prioritize reducing and minimizing business costs. Investments are long-term, done on the basis of existing rules and based on established zoning regulations. It is essential that LGUs maintain the rules long-term too and that LGUs avoid rezoning developed industrial zones. (Medium-term action DTI, DILG, DOTC, LGUs, and private sector)

I6.Mining. LGUs should help develop local community support for national government policy to develop mining projects that observe social and environmental regulations. (Immediate action DTI, DENR, LGUs and private sector)

I7.Tourism, Medical Travel, and Retirement. LGUs can help mobilize local communities to make the local tourism experience better through a clean and safe environment, more efficient transportation, and the like. LGUs will have a greater role under the Tourism Act, becoming involved in master planning, tourism zone site selection, implementation of standards, putting one-stop shops in place, upgrading local infrastructure, and the like. (Medium-term action DTI, DOT, LGUs, and private sector)

Footnotes

- As of June 2010, the Philippines has 80 provinces, 138 cities, and 1,496 municipalities (Source: NSCB).[Top]

- The Anti-Red Tape Act of 2007 (RA 9485) mandates government agencies to streamline their frontline services by limiting the number of required signatures to five and establishing a standard processing time (maximum of five days for a simple process and 10 days for a complex process)[Top].

- The World Bank Group also released “Subnational Doing Business” reports which captures differences in business regulations and their enforcement across locations in a single country. “Doing Business in the Philippines 2008” compared business regulations across 21 Philippine cities in three key areas: starting a business, dealing with licenses, and registering property.[Top]