Twice as Much Investment Needed for Higher Growth

Many Filipinos believe that the Philippine economy should not rely to such an extent on the diaspora of its citizens for growth in the decade ahead. Much higher investment in the domestic economy – above the steady base of growth that remittances provide – is seen as a means to propel the economy to an increasingly higher rate of growth. Even sustained double-digit growth of 10% or more is possible, if the investment climate can be greatly improved to make the economy more attractive to both domestic and foreign investors. Subsequent sections of Arangkada Philippines 2010 spell out many recommendations that can enable this to happen, if the nation’s leaders muster sufficient political will.

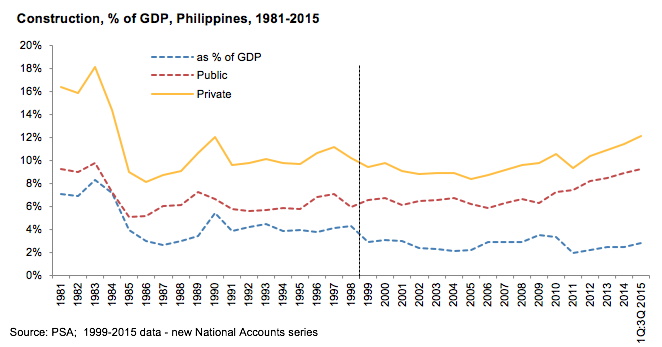

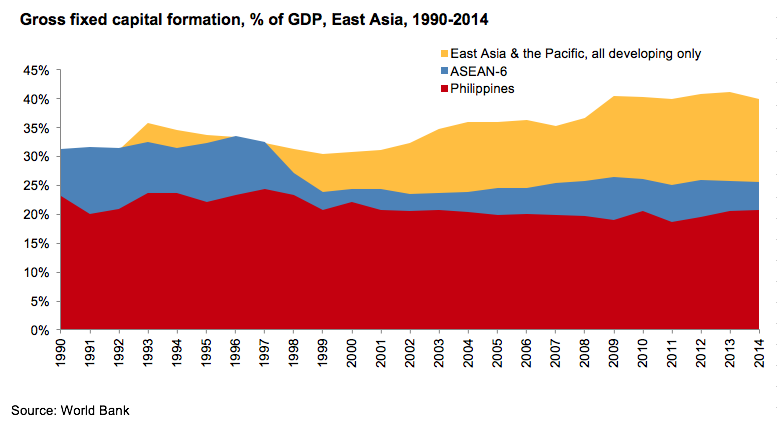

However, recent levels of overall investment in the Philippine economy have been very low. As a percent of GDP, public and private sector investment has fallen from 25% in 1997 to 15% in 2009, while in the East Asia and Pacific region the figure exceeds 30% and in Southeast Asia 25% both in 2008 (see Figures 18 and 19).

Figure 18: Construction in the Philippines as percent of GDP from 1981 to 2015

Source: PSA; 1999-2015 data – new National Accounts series

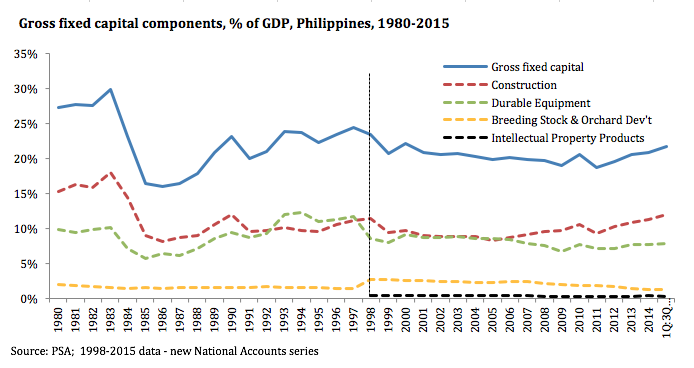

Figure 18.2: Component of gross fixed capital formation in the Philippines as percent of GDP from 1980 to 2015

Source: PSA; 1998-2015 data – new National Accounts series

Figure 19: Gross fixed capital formation as percent of GDP from 1990 to 2014

Source: World Bank

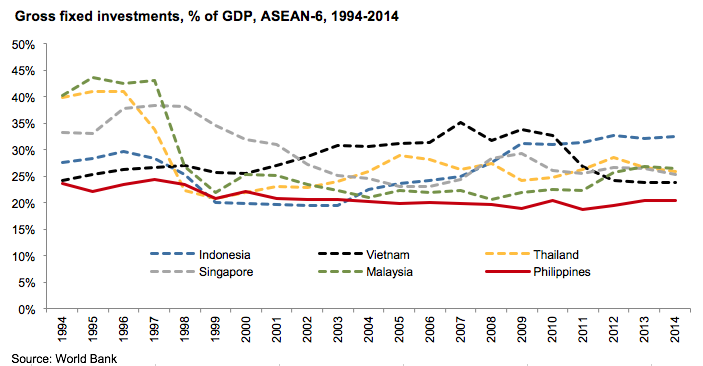

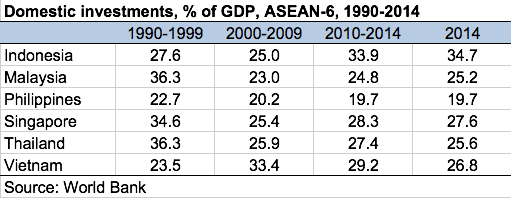

Further, in comparison to the other ASEAN-6 economies, the Philippines is investing much less (see Figure 20 and Table 5). Over the last two decades the other five ASEAN economies have invested considerably higher percentages of GDP than has the Philippines. The investment ratio in the Philippines averaged 22.4% in 1990-1996 but declined to 14% by 2009.

Figure 20: Gross fixed investments as percent of GDP among the ASEAN-6 from 1990 to 2014

Sources: World Bank

Reasons for low gross domestic capital formation include low foreign direct investment (FDI), inadequate public sector revenues, anemic spending on infrastructure, weak domestic market created by low income consumers despite a large population, among others. While the savings rate in the Philippines has been growing to around 30% of GDP,15 not enough is being invested in capital assets essential for sustained long-term growth. Furthermore, the country appears to be exporting capital which otherwise could be invested toward long-term growth at home.

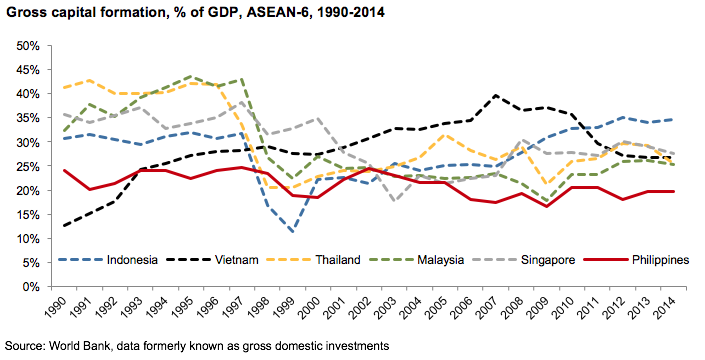

Figure 21 shows that the Philippines almost 30 years ago had about the same 30% gross domestic investment ratio as other ASEAN-6 economies except Singapore. Investment fell sharply in the 1983-1986 period during the political crisis preceding the ouster of the dictator president Marcos and recovered under Presidents Aquino and Ramos and then declined steadily after the 1997 Asian financial crisis to its current level below 15%.

Figure 21: Gross investments as percent of GDP among the ASEAN-6 from 1990 to 2014

Sources: World Bank, data formerly known as gross domestic investments

A major challenge for the Philippines is to funnel the abundant financial resources available to the country more into investment by creating better opportunities for the private sector through an improved investment climate. Higher revenue collection and more effective public spending will improve public sector investment. Doubling spending on physical infrastructure16 (to 5-6% of GDP) and social infrastructure17 (to 8-9% of GDP), thereby reaching levels of more developed East Asian economies would greatly improve the overall investment climate and would support higher and sustainable rates of growth. Doing so would give investors more confidence that a large and well-educated labor force will be available in the future and that the quality, cost and efficiency of power, transportation, telecommunications and water infrastructure would become more cost and quality competitive.

Footnotes

- According to data from the BSP, gross savings as a percent of GDP was 22.7 in 2001. In 2008, this grew to 27.7.[Top]

- Government Capital Outlay (% of GDP, 2005): Philippines (2.5), Indonesia, (8.5), Vietnam (8.2), and Malaysia (6.5) per Dr. Raul V. Fabella.[Top]

- 2009 levels of social spending as % of GDP: Education – 2.9%; Health – 0.5%; Social security and welfare – 1.2%; Housing and other amenities – 0.1% (Source: ADB Key Indicators, 2010). [Top]