Background (Airports)

Sector Background and Potential

With its archipelagic character, the Philippines depends on air and sea transport much more than countries with large continuous landmasses. Since a high percentage of domestic and international commerce and travel is by air and sea, the efficiency of aviation and maritime transportation has become increasingly critical to national competitiveness. There is much room to improve efficiencies and improve the logistics costs for goods and associated services. The high cost of domestic marine transport has long been questioned, while the enormous potential for tourism – both domestic and international – is greatly influenced by the quality of airports and seaports. Solutions to the numerous challenges involved in creating an efficient modern air and sea transportation system require addressing policy and regulatory impediments as well as upgrading and rationalizing airport and seaport infrastructure and networks.

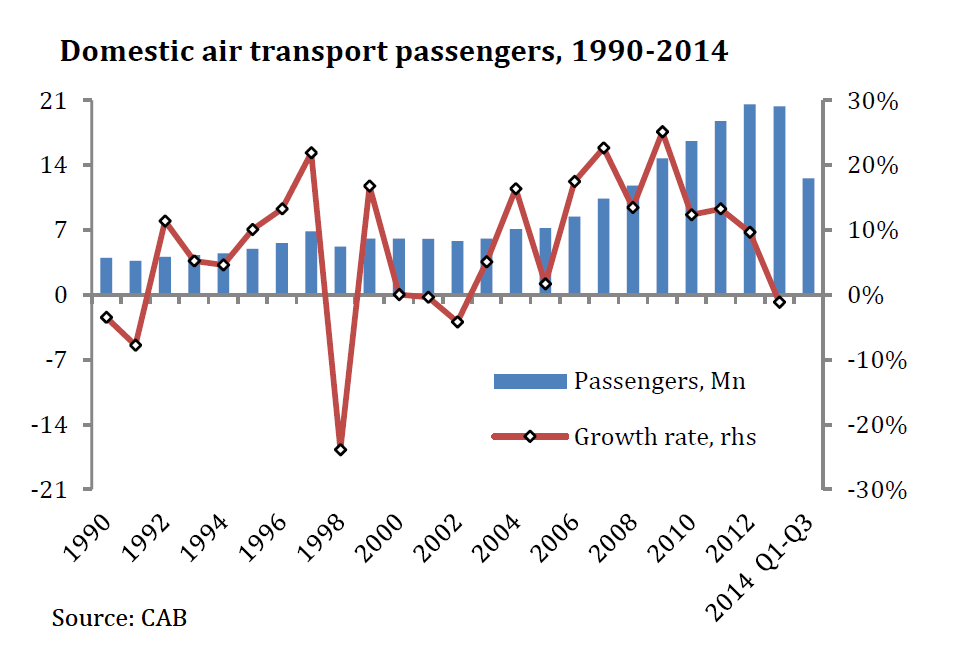

Figure 68 shows the high rate of growth in passenger volumes for domestic air transport, tripling following the deregulation of the industry by former President Ramos in the early 1990s.

For several years (e.g. 1996-1997 and 2006-2007) annual increases were roughly 20%. Filipinos are flying more than ever, as competition in the aviation sector has provided affordable alternatives to maritime travel. More affordable air fares since the mid-1990s have also stimulated the growth of domestic tourism. Similar high rates of growth can be expected in the next few years, which will require more investment in modernizing airport infrastructure. Not only new terminals are needed. Few airports are equipped for night operations and most need navigational and radar improvements. Policies that encourage more direct international flights to secondary cities are urgently needed to relieve congestion at the Ninoy Aquino International Airport (NAIA).

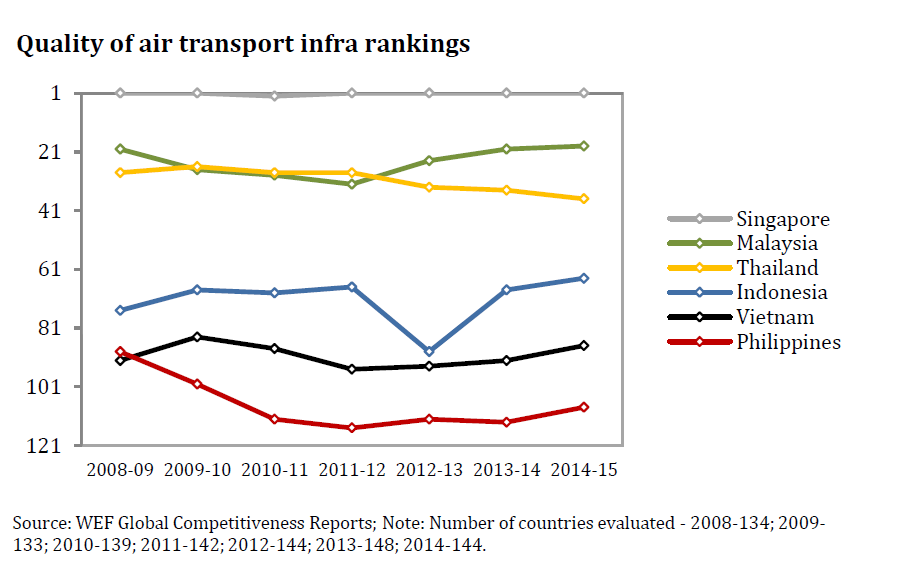

Figure 69 shows the WEF ranking of air transport infrastructure for the ASEAN-6 with the Philippines ranked lowest, slightly lower than Vietnam and Indonesia and considerably lower than Malaysia, Singapore, and Thailand.

The Philippines lacks a modern showcase international gateway airport. Currently, the country has no airport even close to the quality of new facilities as regional competitors such as Bangkok, Beijing, Guangzhou, Hong Kong, Incheon, Kuala Lumpur, Nagoya, Narita, Osaka, Shanghai, Singapore, and Taipei. First impressions of foreign visitors arriving at the leading international gateways Manila, Cebu, and Clark are that terminal facilities are modest (NAIA Terminal 2 and Terminal 3 and Mactan), small, or dilapidated (Clark and NAIA Terminal 1 and domestic).

At NAIA, the airport master plan of the early 90s for three new terminals has not been followed. The cargo terminal has yet to be built, while new domestic Terminal 2 (T-2) and international Terminal 3 (T-3) terminals were built but have not been used for their original purposes. The new GOJ-financed domestic terminal that opened in 1999 has been used exclusively for domestic and international flights of Philippine Airlines (PAL) despite not being designed for requirements of international aviation (customs, immigration, and lounges).

The new international terminal, built by a Philippine-German joint venture, was expropriated by the GRP in 2004 when the owners were accused of corruption and overpricing. The two arbitration cases filed in the International Criminal Court in Singapore and International Centre for Settlement of Investment Disputes in Washington, have been decided in favor of the government in that the Anti-Dummy Law was violated. The DOF has given assurance that the government is committed to pay any amount the local Expropriation Court decides is due investors. Meanwhile, Cebu Pacific, the other major Philippine-owned airline, and Air Philippines and PAL Express have been allowed to relocate their NAIA flights from the ancient domestic terminal to T-3. International carriers, unwilling to move to T-3 until the ownership dispute is resolved, continue to operate from the very outdated Terminal 1 (T-1).

Full operation of T-3 will require the present taxiway to be closed so that only one runway will be available to all domestic, international, and general aviation flights. A fuel depot and lines must also be in place. Aside from T-3 being underutilized, the lengthy period since the government expropriation has created an irritant in RP-European relations and harmed the country’s investment image abroad. Expansion of NAIA beyond its current area of 600-hectares would require extensive demolition of business and residential areas.

The 1991 eruption of Mt. Pinatubo and subsequent erosion of Philippine political support for American military bases gave the GRP operational control of two extremely large installations at Clark and Subic in Central Luzon. Two decades later the special economic zones together host almost 145,000 employees and are becoming increasingly integrated, with Subic the international seaport and Clark the international airport serving the adjacent provinces.<sup “>72 DMIA has room to build a 2nd and even a 3rd parallel runway adjacent to the two existing runways.

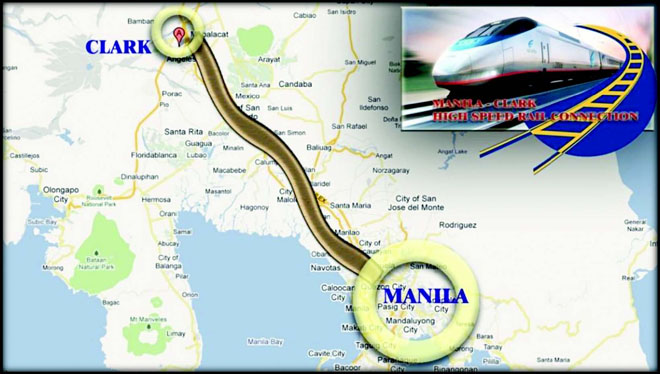

The Subic-Clark zone has tremendous potential for aircraft and ship assembly and maintenance, education, ITES, logistics, manufacturing, medical tourism, retirement, and tourism and could host many hundreds of thousands of more jobs with sound policies, promotion, and investment. Road connections from Manila to Clark and to Subic have greatly improved. In the decade ahead, the North Rail will become operational to San Fernando. A high-speed rail to link NAIA and DMIA has been proposed, and extension of rail service to Subic in the future should be considered, should the project be implemented (see Map 1).

Outside Central Luzon, airports in the various regions are being improved, although only a few have international service. Under the new National Tourism Act of 2009 (RA 9593), a province can be declared a Tourism Economic Zone, which could allow air or cruise ship service of any flag to operate with low taxes. Pocket open skies, which has stimulated tourism in several places in Asia, has not been tried in the Philippines, despite urging of such a policy for Clark from domestic business groups and foreign chambers.

However, the GRP negotiated bilateral air traffic rights agreements with 26 countries from May 2007 through February 2010, greatly expanding the potential number of flights between the Philippines and each country.73 These agreements are effectively bilateral open skies agreements since it will take many years to fully utilize the allowable inbound flights. Foreign airlines are burdened with the Common Carriers Tax (CCT) and Gross Philippine Billings (GPB), as well as customs, immigration and quarantine (CIQ) overtime charges, taxes and fees not imposed elsewhere and which make serving the Philippines less attractive for foreign airlines than more business-friendly regional destinations.

Map 1: High-speed rail connecting NAIA and DMIA

“I’m struck by Bali’s example. Here’s an island destination that’s gone from a few hundred thousand visitors to three million in part because of an open-skies policy. We need to adopt the same approach in the Philippines”

—President Benigno Aquino III, Jakarta Globe, Karim Raslan, March 3, 2010

“We have natural traits and skills for tourism. We can be the beach capital of the world… Our problem is e have to do the same policy on the certain airports to be declared open skies. Thailand, Cambodia and Vietnam have open skies.”

—Richard Gordon, Philippine Daily Inquirer, May 5, 2010

Foreign airlines and international courier delivery firms are currently considered public utilities and cannot serve the domestic market except as minority partners owning no more than 40% of equity. The two foreign courier delivery firms with hubs in the Philippines have shifted their hub flight operations from Clark and Subic to China to serve the latter’s fast-growing market.

Footnotes

- Clark: 57,118 (2010) and Subic: 86,631(2010); total for freeports is 143,749. [Top]

- Australia, Bahrain, Brunei, Cambodia, Canada, Finland, Hong Kong, Iran, Japan, Kuwait, Libya, Macau, Malaysia, Netherlands, New Zealand, Oman, Qatar, Russia, South Korea, Singapore, Spain, Thailand, Turkey, United Arab Emirates, United Kingdom, and Yemen. [Top]