Background (Infrastructure)

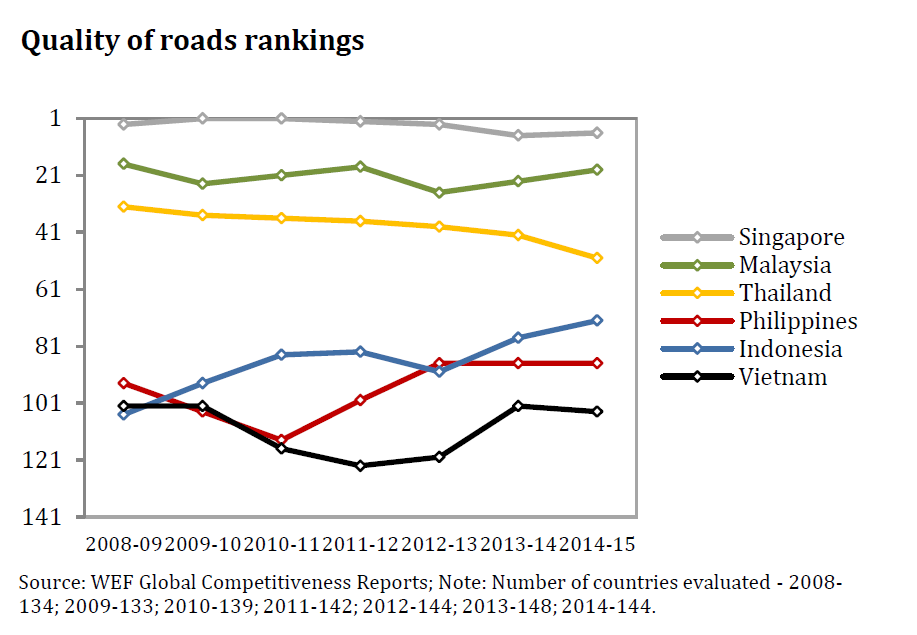

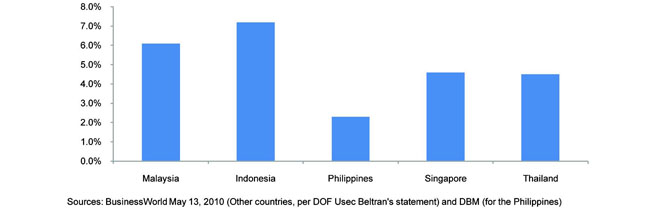

Sector Background and Potential The Philippines is significantly underinvesting in physical infrastructure, with its public sector infrastructure budget consistently below 3% of GDP. Spending on social infrastructure for education and health is also inadequate at slightly over 4% of GDP.53 Polls of businessmen repeatedly show poor infrastructure as one of the top challenges facing the Philippine economy, second only to corruption. Like corruption, poor infrastructure severely weakens economic competitiveness. In the last two WEF Global Competitiveness Reports, among the ASEAN-6 economies, the country’s overall infrastructure quality ranked below Singapore, Malaysia, and Thailand and about the same as Indonesia and Vietnam (see Figure 65).

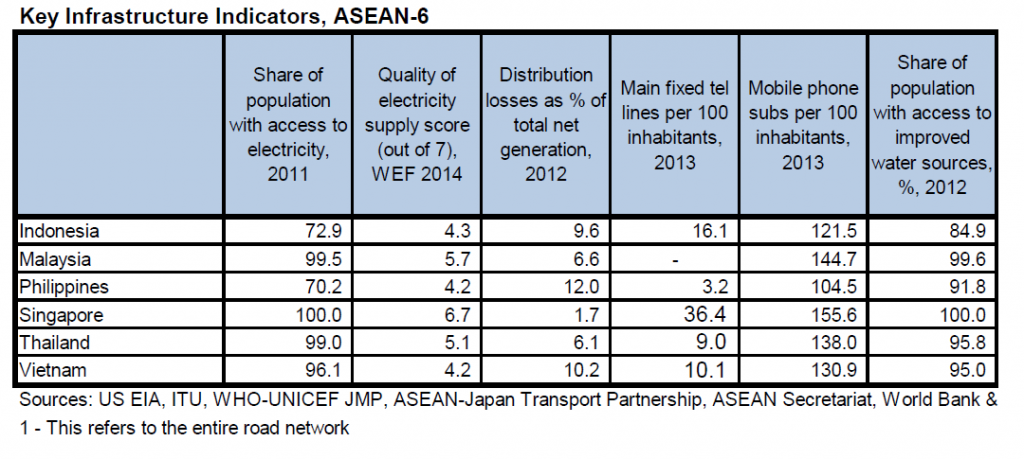

Table 27 shows a similar pattern of the Philippines in comparison to the ASEAN-6 countries for measures of power quality, telecommunications, access to water and sanitation, and roads. The Philippines is ranked the lowest for fixed telephone lines per 100 inhabitants and percentage of total road network paved.54

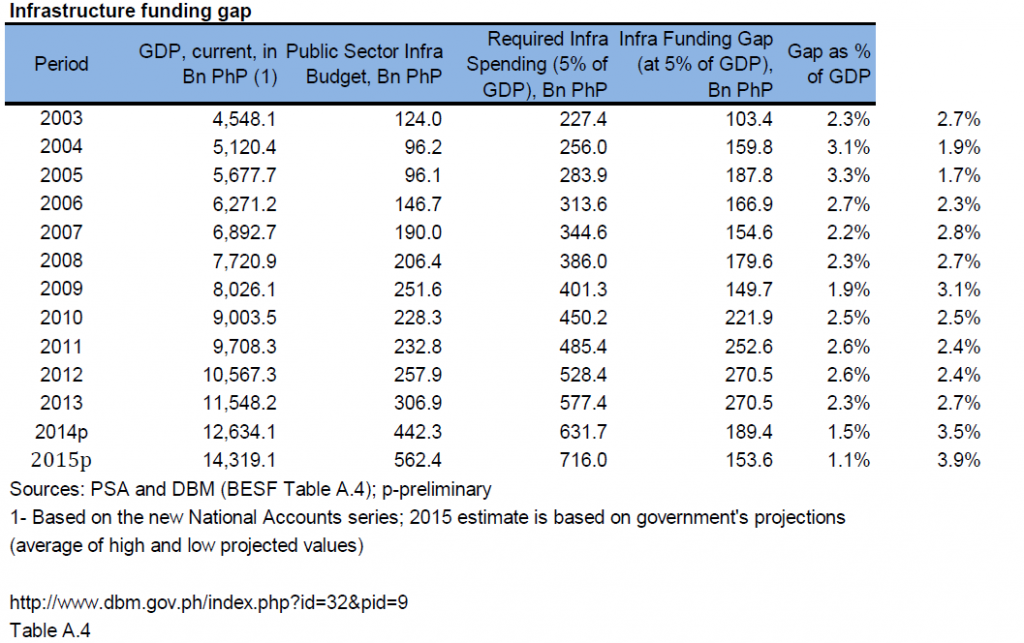

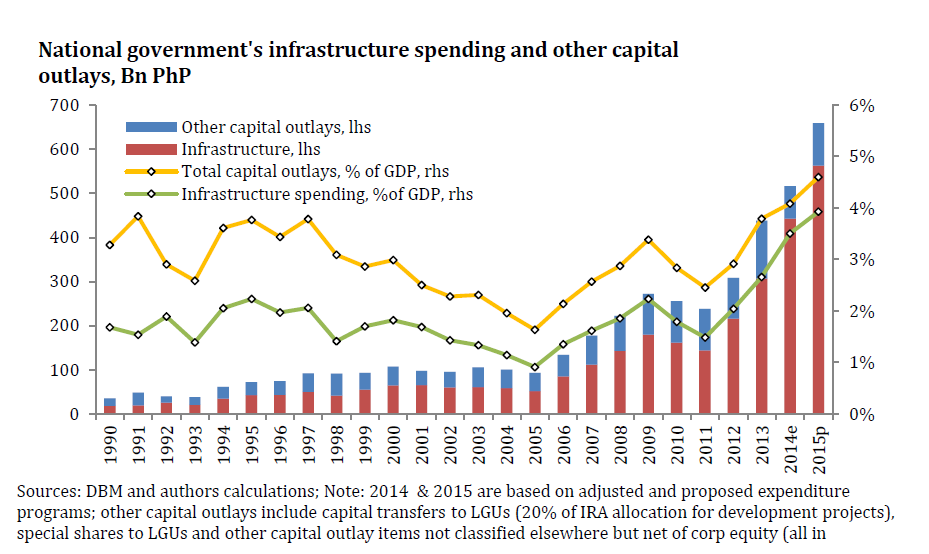

The Philippines spends a lower percentage of GDP on infrastructure than competing ASEAN economies, as shown in Figure 66. After reaching a low of 1% in 2005, the percentage increased to 2.1% of GDP in 2009 (see Figure 67). If spending on infrastructure continues to remain low, efficient modern infrastructure will not be built fast enough to meet the challenge of being an archipelago with a high and rising urban population density.

Figure 67: NG Infrastructure spending, Philippines, 1990-2015p

Figure 67: NG Infrastructure spending, Philippines, 1990-2015p View original figure here

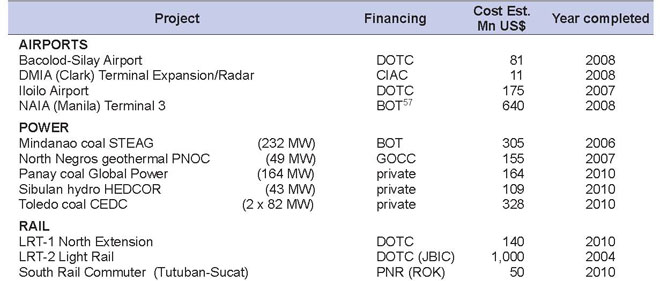

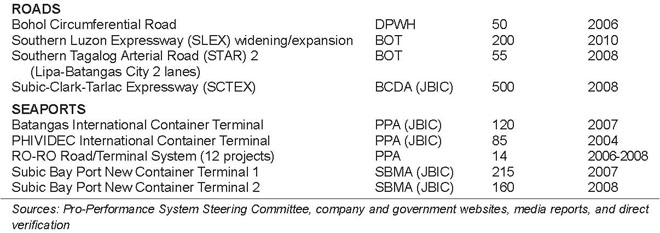

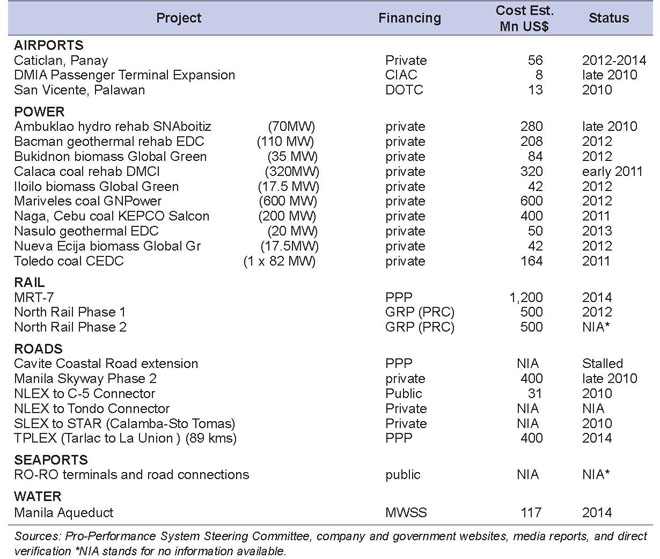

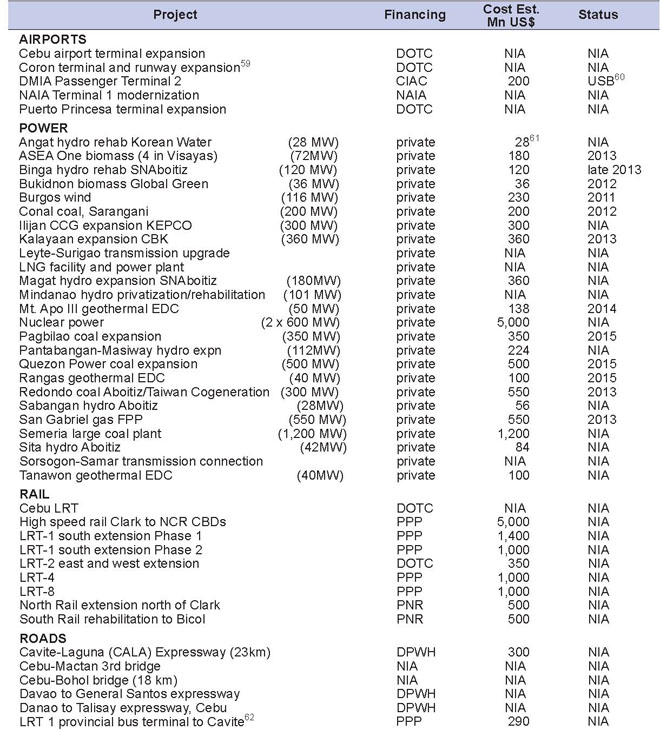

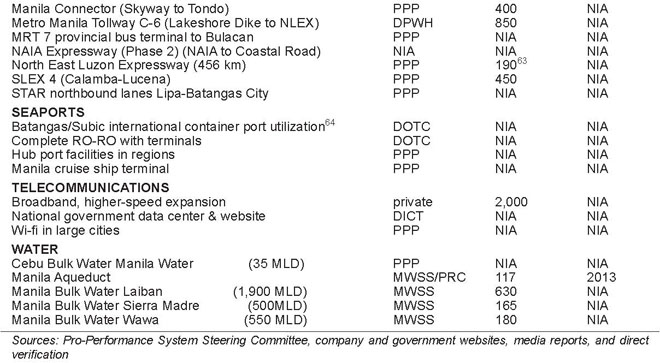

View original figure hereInadequate funding for infrastructure during the last decade contributed to the weakened competitiveness ratings for the country’s overall infrastructure as well as the continued listing of poor infrastructure as a major weakness in its investment climate. Despite the availability of external private and public sector financing, the government was unable to implement significant Public Private Partnership (PPP) projects nor could it avail of significant sums of low-interest loans for infrastructure from China. A lack of transparency and extraordinary levels of public controversy characterized what in most countries is routine infrastructure project development and implementation. The administration of former President Macapagal-Arroyo in 2003 began a policy initiative to improve inter-island connectivity through the RORO Road Terminal System (RRTS). In her 2006 SONA former President Macapagal-Arroyo highlighted more than 400 projects (mostly related to air, ground, and marine transport) targeted for completion before the end of her term in 2010.55 Some of the projects were criticized as politically motivated to dissuade congressmen from supporting an impeachment motion against the president. The overall infrastructure record of the outgoing administration is weak, considering it had almost ten years to complete projects. It neglected to start many major projects and to utilize several which were completed. The administration expropriated the privately-owned international passenger terminal at the national gateway airport in December 2004. The Philippine-German joint venture that built the terminal has not been compensated after more than five years, despite the assurances of the Philippine government that all issues would be settled expeditiously. There are new ports in Batangas and Subic which are hardly used. The Department of Transportation took seven years to approve a US$ 1 billion light rail project in Metro Manila. For ten years it was unable to decide how to bid and award another large light rail project. Manila residents paid a terrible price in lives and property when one typhoon’s torrential rains proved the high risk of neglecting flood control infrastructure and unregulated urban sprawl. Maritime safety remains a major issue, highlighted by many small and several large disasters. Power blackouts became frequent in the Visayas and Mindanao in 2010. The Philippines faces urgent infrastructure challenges. The most urgent is assuring an adequate supply of power, eventually reducing its cost through increased competition among generators. The second is improving the efficiency of transportation, by air, land, and sea, which is too crowded for a population growing in size and spending power. A third is the water supply, which is not enough for drinking and farming and too much during typhoon season, as well as poor sanitation and solid waste disposal systems. By contrast, telecommunications services, in the hands of competing private sector providers, are much improved following reforms initiated by President Ramos in the 1990s. The three following tables list major infrastructure projects of both the public and private sectors. The projects in each are listed by category as airport, power, rail, road, seaport, telecommunication, and water. The tables cover three different time periods, with the later including several projects still at the conceptual stage.56 • Table 28: Completed projects (2001-2010) • Table 29: Under construction or being financed in 2010 • Table 30: Priority future projects (2011-2020)

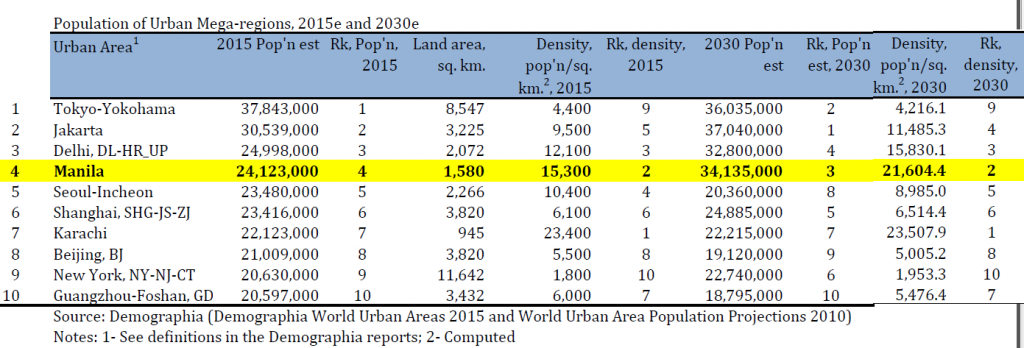

Arangkada Philippines 2010 does not analyze or make recommendations for the entire infrastructure of the Philippines.65 This policy paper focuses on major projects in Central Luzon and the NCR, where most of the country’s industry is concentrated and where one of the world’s largest urban mega-regions is rapidly expanding (see Table 31). Manila presently is the world’s 5th largest urban area with an estimated population of 20.8 million in 2010. By 2030 Manila is projected to be the world’s 3rd largest urban area (after Jakarta and Tokyo-Yokohama) with a projected population of 34 million inhabitants. An increase of 13 million residents will require very large investments, not just to maintain the current poor condition of infrastructure but to achieve substantial modernization to improve national competitiveness.

COMPONENTS OF QUALITY MODERN INFRASTRUCTURE: CENTRAL LUZON

- An extensive, seamless limited access road network

- An extensive, seamless light rail network

- North and South heavy rail lines for passengers and cargo

- Two international airports with modern teminals and high-speed railconnection (NAIA and DMIA) extendable to Batangas and Subic

- Three seaports with competing operators (a decongested Manila with international cargo to Batangas and Subic)

- Reliable, more affordable electric power

- Reliable water supply and flood control

- Reliable, low-cost state-of-the-art telecommunications with high-speed broadband and free public wireless coverage

Source: Presentation of John Forbes at a Transportation Workshop, January 15, 2010

Many of the recommendations made for the Seven Big Winner sectors require infrastructure in the country’s other urban centers and rural areas. The Agribusiness sector needs better farm-to-market roads and post-harvest facilities, including cold chain storage, and ports. Mining require better roads and ports. Interisland shipping needs to be safer, more efficient, and less costly. Most of the country’s most attractive tourist destinations need better air and sea access, improved roads, water, and sanitation. Increasing business processing investment at secondary and tertiary cities requires dependable telecommunication links, while reliable and lower-priced power is essential for the entire economy. Turning this vision into reality in a decade can be possible if recommendations in the following sections are implemented. Funding in the tens of – perhaps as high as one hundred – billions of dollars will be needed (see Table 32). Such large amounts of funding are not available from the public sector and ODA, but can be provided by the private sector, both domestic and foreign, investing in PPPs. However, private investors will only participate in well-prepared projects in an investment climate that provides them contractual and regulatory confidence of fair returns on their equity.

In the following pages, Arangkada Philippines 2010 presents recommendations developed at three FGDs on infrastructure hosted by the American Chamber of Commerce: (1) Airports and Seaports, (2) Power and Water, and (3) Road and Rail. With some exceptions, recommendations focus on the geographic area from Batangas north to La Union province, an area with a population of over 36 million and the highest PCI in the country at about US$ 2,468.66

“The Philippines is not just in a state of power crisis, or water crisis, it’s in a state of infrastructure crisis. It is not just the blackouts and lack of water the next president should worry about. It’s everything else—deteriorating roads, major railways not being a built, a nautical highway that has one of the world’s worst safety record(more thgan 200 maritime accidents every year), and an international airport that is a ational embarassment—to put it mildly.And one that’s been so for eight long, unnecessary years.” —Peter Wallace, Manila Standard, April 23, 2010 “We will level the playing field for businesses. We will encourage free and fair competition in a level playing field that stresses that one need not be a crony in order to be successful in this country. We will make our bidding and procurement policies and processes more transparent, and punish those who seek to circumvent procurement laws through collusion and other illegal means.” —Benigno Simeon Aquino III, www.noynoy.ph, accessed May 5, 2010

“What we Filipinos should realize is the need for logical continuity in long-term infrastructure, and not these outright and constant changes.” —Gilber Teodoro, GMANews, TV, March 4, 2010 Gilbert Teodoro said the construction of a Cebu-Bohol bridge will be given immediate attention if reflected into office. The anchors f the bridge will be Getafe and Cordova towns in Bohol and Cebu, respectively. Passing through shallow waters, the bridge is estimated to be 18 kilomenters long. —Philippine Star, January 22, 2010 Manuel Villar, Jr. said that all infrastructure projects would be bid out in the first year of his adminstrationso that the next five years ould be devoted to construction and project monitoring. He cited in particular the interconnection of NLEX and SLEX, and the extension of NLEX from Pampanga to La Union. —Business World, accessed May 5, 2010 “I am pushing for a lvive broadcast of the procurement processes of the government. This will have two desiarable effects: first, it can minimize if not totally eliminate your corruption in bidding out government contracts, and second, it would educate the citizenry on some important aspects of government operations.” —Manuel Villar, Jr., www.senate.gov.ph, January 15, 2010

Footnotes

- Based on calculations from the Asian Development Bank (ADB), as percentage of GDP, the Philippines spent about 2.9% on education, 1.2% on social security, 0.5% on health, and 0.1% on housing and community amenities in 2008. The 2009 DepEd budget of PhP 158 billion represents a per student spending of PhP 8,000 for each of the more than 20 million students in basic education, one of the lowest spending levels in Asia.[Top]

- While 70% of the national roads are paved, only 14% of the local roads, which comprise 85% of the total road network, are made of concrete or asphalt.[Top]

- Subsequently, the president issued several executive orders creating an Infrastructure Monitoring Task Force to oversee implementation of the projects and then renaming the Task Force as the Pro-Performance System Steering Committee and adding private sector representatives. The Presidential Management Staff serves as secretariat.[Top]

- Sources for the three tables vary but include media reports and government websites, data from the Pro-Performance System Steering Committee secretariat and industry experts. Project costs are approximated in dollar terms and may not reflect actual peso costs because of exchange rate conversion variations.[Top]

- Expropriated by the Philippine Government in 2004; the final amount of compensation due to the German-Filipino joint venture owner ($64 million has been paid) has been undergoing arbitration at the International Chamber of Commerce International Court of Arbitration in Singapore for several years, with final approval to be made by a Philippine court.

- Underway includes projects undergoing financing and under construction.[Top]

- Any policy to declare Coron and Puerto Princesa as pocket open skies airports should include upgrading each airport’s infrastructure to international standards including international flight rules (IFR) capabilities.

- Unsolicited bids have been submitted.

- Power generation cost estimates assume US$ 1 million per MW for coal and gas, US$ 2 million for hydro and wind, US$ 2.4 for biomass, and US$ 2.5 million for geothermal and nuclear.

- Provincial bus operations to and from the North and South could start and terminate at these bus terminals. The light rail system will provide inter-modal connectivity to and from the metropolis.

- US$ 190 million for Phase 1 6-lanes Quezon City to Baliuag, Bulacan; subsequent phases will traverse Nueva Ecija north to Tuguegarao, Cagayan.

- Arangkada Philippines 2010 recommends a policy to decongest Manila Port by gradually shifting international container traffic to the ports of Batangas and Subic to utilize the completed facilities at both ports for international container shipping.

- The World Bank’s extensive 2005 study “Philippines: Meeting Infrastructure Challenges” contains data and recommendations still valid. More recently, the Philippines-Australia Partnership for Economic Governance Reforms (PEGR) prepared the Draft National Transport Policy Framework document dated October 30, 2009.[Top]

- Per capita income is computed using the 2008 Regional Gross Domestic Product (RGDP) of NCR and regions 1-4 divided by the 2008 population estimates of NSO covering the said regions. 2008 RGDP data are the latest figures available. The average exchange rate in 2008 which is PhP 44.4746 per US$ (BSP) was used to convert the value in current dollar terms. Total population of the area was computed by simply summing up the 2010 population estimates of NSO for the provinces of La Union, N. Vizcaya, Quirino, Pangasinan, Tarlac, N. Ecija, Aurora, Zambales, Pampanga, Bulacan , Bataan, NCR, Rizal, Cavite, Laguna, and Batangas.[Top]