Background (Power)

Sector Background and Potential

Electric power and water are essential needs for modern man, to survive, and to thrive. In the globe’s fastest-growing region – Asia – they are especially critical to economic growth and competitiveness.

The Philippines is approaching the end of a two-decade transition from a public sector power generation monopoly to a private-sector-led “open access” competitive environment with enhanced government regulatory oversight. Yet its electricity prices remain among the highest in Asia, and supply shortages are present today in the Mindanao and Visayas grids and are possible in two years in the Luzon grid. Unreliable and expensive electric power is a serious deterrent to foreign investment.

The main objectives of the open access policy in the Electric Power Industry Reform Act (EPIRA) that became effective in mid-2001 are (1) to build a sustainable and reliable power supply and (2) to lower electricity rates in the long run. To encourage new investment in power supply, electricity rates have to go up in the short-run (reflecting both the limited supply of power generation capacity and the need to dispatch oil-fired plants to meet the demand). Rates will go down only when new and more efficient generating plants are commissioned that are profitable at a much lower cost per kilowatt-hour, such as coal-fired plants, thereby creating an abundant and more competitive supply of power and minimizing the dispatch of oil-fired plants.

The conditions precedent to open access will have been met by year-end 2010: (1) the unbundling of generation, transmission, and distribution; (2) elimination of subsidies; (3) initiation of the Wholesale Electricity Spot Market (WESM); (4) privatization of at least 70% of the power plants owned and operated by the GRP; and (5) transfer of management and control of at least 70% of the contracts between Independent Power Producers (IPPs) and National Power Corporation (NPC) to IPP administrators. Conditions 4 and 5 were only met recently. The Energy Regulatory Commission (ERC) is expected to declare open access no later than 2011.83

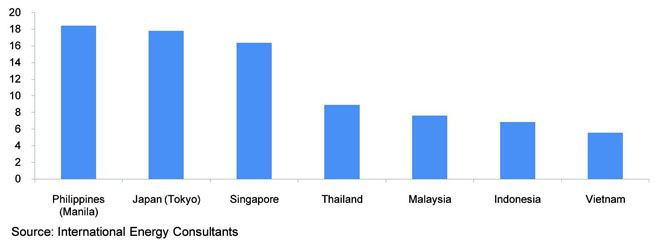

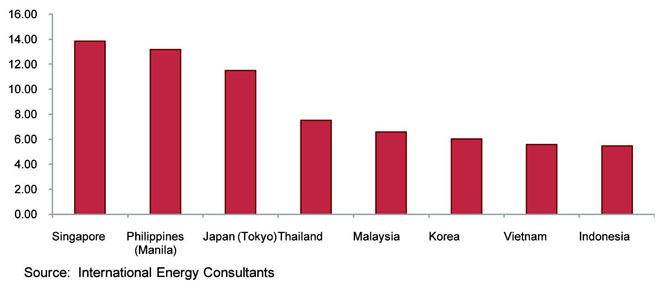

Eventually, open access should encourage more competition in the supply of electricity and lead to lower electricity prices. Electricity prices in the Philippines are the most expensive in Asia and harm competitiveness. Figures 70 and 71 show the cost of residential and industrial electricity in the Philippines and six other Asian economies.

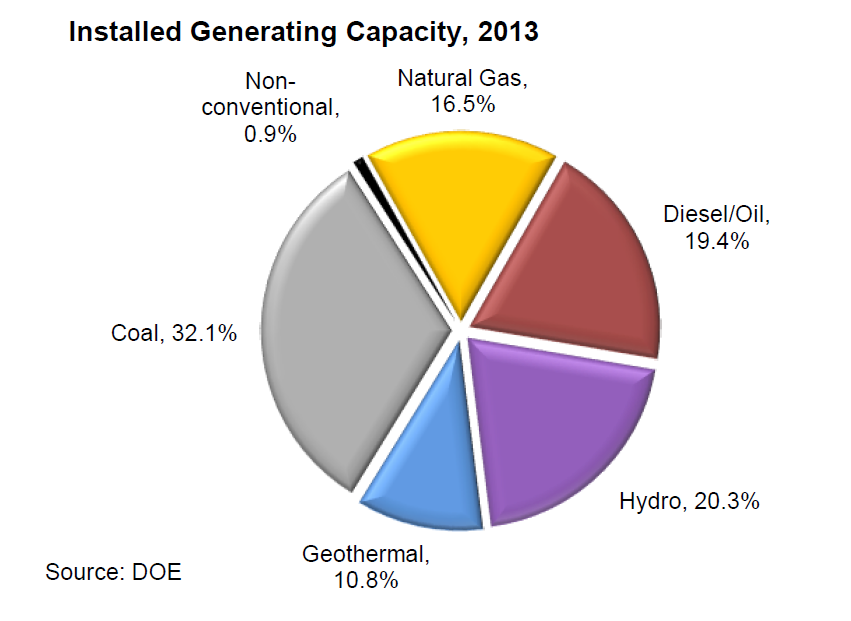

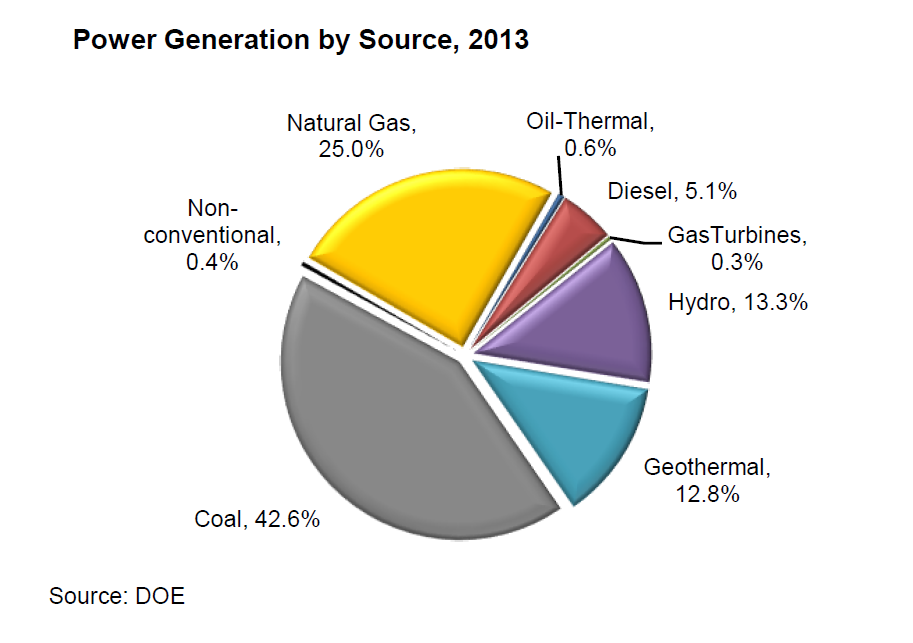

Figure 72 shows the percentages of installed generating capacity by type of power source. Hydrocarbon fuels (coal, gas, and diesel/oil) comprise 66% of the total. Figure 73 shows the percentage of the actual generation that comes from different fuel sources. Comparing Figure 72 to Figure 73 shows that the more expensive and more polluting diesel/oil capacity is not being dispatched by power regulators.

Renewable energy sources (geothermal and hydro) constitute 33.6% of generation capacity and 32.5% of the power mix. Unlike Indonesia, the Philippines does not have large unutilized geothermal fields to develop. A Renewable Energy Act of 2008 (RA 9513) was passed in 2009 providing generous fiscal incentives to investors. When the feed-in-tariff (FIT) is announced some of the many potential projects licensed in the past year with the DOE may begin to become real power generators.84

The current Administration could be the first to experience the positive effects of the EPIRA, i.e. a reliable supply of less expensive power. The policy it follows in this new environment will be critical to the success of open access. Unfortunately, as of early 2010, a serious policy deficiency exists. Without a clear energy policy that indicates where the country should source future energy requirements, taking into account its current power situation and what it is prepared to spend (affordability) and/or guarantee (such as credit enhancements), there will be underinvestment in power. Only through a well-conceived master plan will investors know the areas in which they can invest with reasonable certainty.

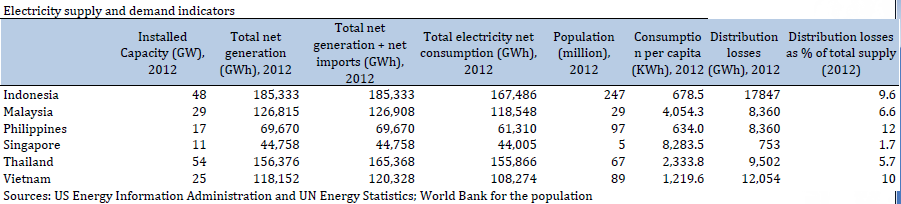

There is a limited supply of power in the Philippines (see Table 33). Thailand has 40,669 MW power capacity serving 67 million people. South Korea has 79,859 MW serving 49 million. The Philippines has only 15,680 MW (and not all is considered reliable) for 90.3 million people. Electricity consumption per capita in 2008 in the Philippines (588 KWh) was close to Indonesia (591) and Vietnam (799) but much less than Malaysia (3,506), Singapore (8,185), and Thailand (2,079).

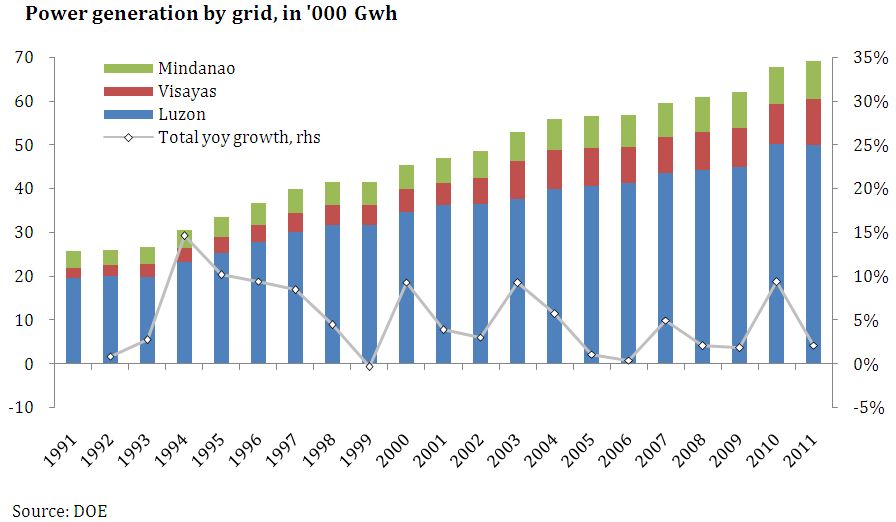

• Luzon

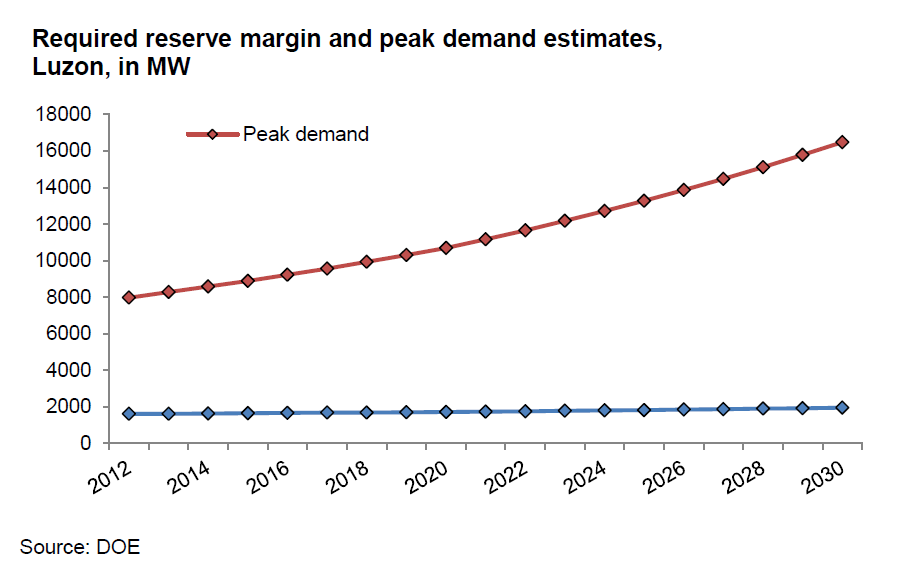

The power situation in the Luzon grid has been relatively stable since the late 1990s. As of late 2009, there is a surplus in generation due to a slowdown in demand growth brought about by the global financial crisis. Yet there was still positive growth in kilowatt-hour sales during the entire year. According to the WESM, peak demand in Luzon grew 5.2% year-on-year reaching 6,886 MW. On a good day in late 2009, the power supply to the Luzon grid was only about 8,000 MW (15-20% of which came from oil), falling below the statutory reserve margin. Under open access, there are 5 to 6 generators in Luzon that have capacity that is not locked up or sold under contract, 55 distribution utilities, and 1,500 contestable customers. Having 5 to 6 generators with only 1,500 customers is not balanced.

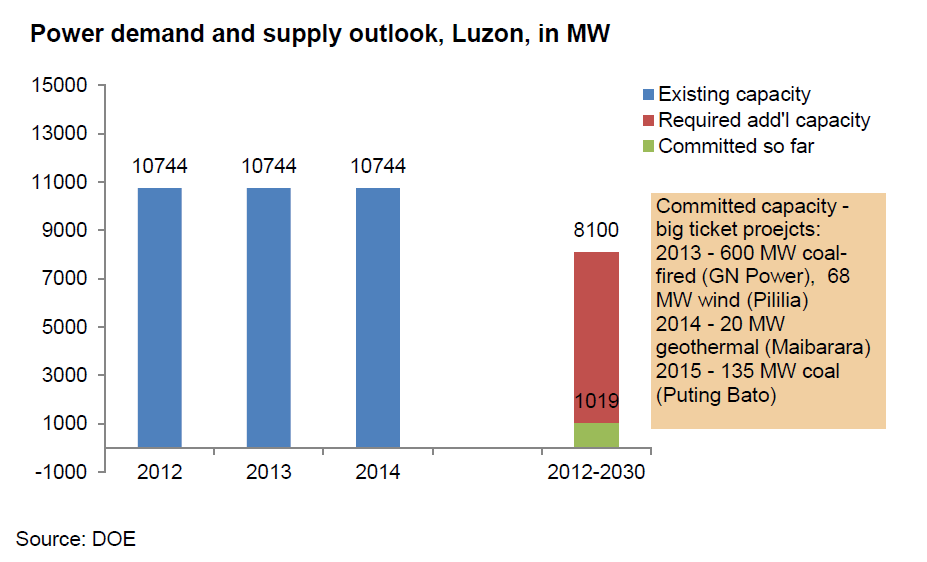

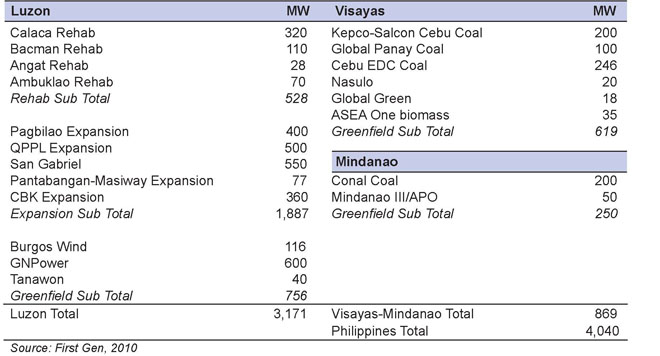

The coal-fired GNPower 600 MW plant in Mariveles, Bataan, began civil works in early 2010 and is expected to become operational in late 2012 or early 2013. Other additional capacity is expected from the rehabilitation and expansion of the privatized NPC hydropower facilities. The construction of additional baseload plants is essential to provide adequate reserve and to avoid power blackouts. With piers, designated sites, and Environmental Compliance Certificates (ECCs) in place, Ilijan, Pagbilao, and Quezon Power plant expansions can be brought into operation considerably faster than new greenfield plants.

• Visayas

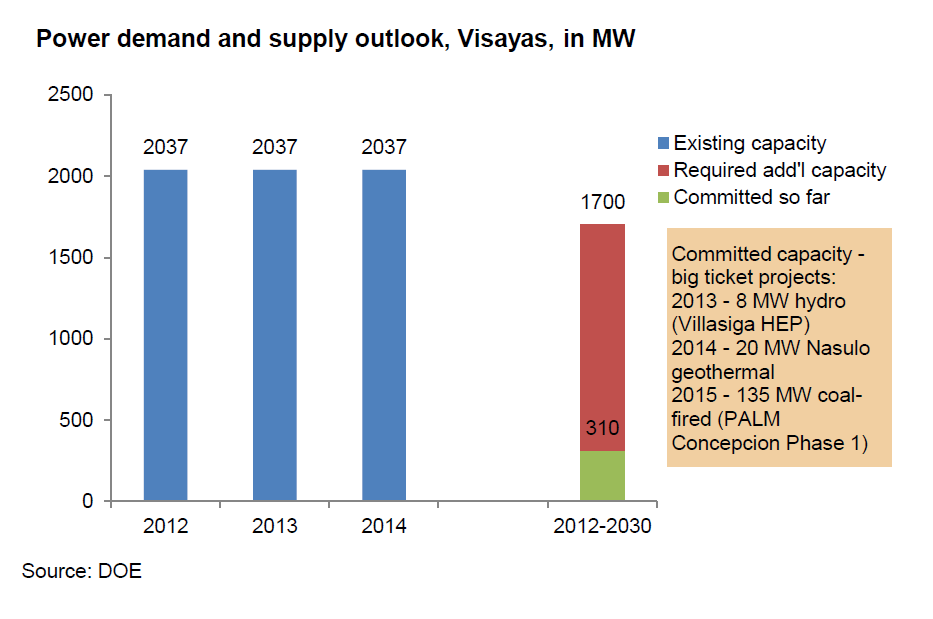

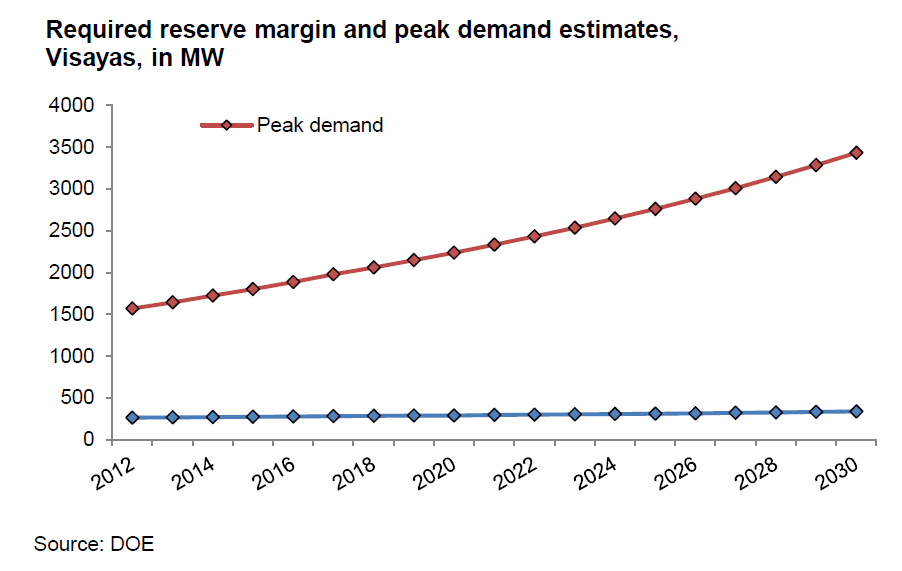

The Visayas grid suffers from long-standing problems in power supply. However, ongoing construction of coal-fired power plants scheduled to come on line in 2010 and 2011 will ease the supply shortage problem by adding some 600 MWs to the grid. Cebu Energy Development Corporation has constructed two of the three new 82 MW coal-fired power units in Toledo, Cebu, the third of which is expected to be commissioned in early 2011.85 Two of the partners in the same firm are constructing a 164 MW coal-fired plant in the Panay sub-grid in Iloilo City for completion in 2011. Another on-going development for the Cebu sub-grid is the 200 MW KEPCO-Salcon plant in Naga City to be operational in 2011.

• Mindanao

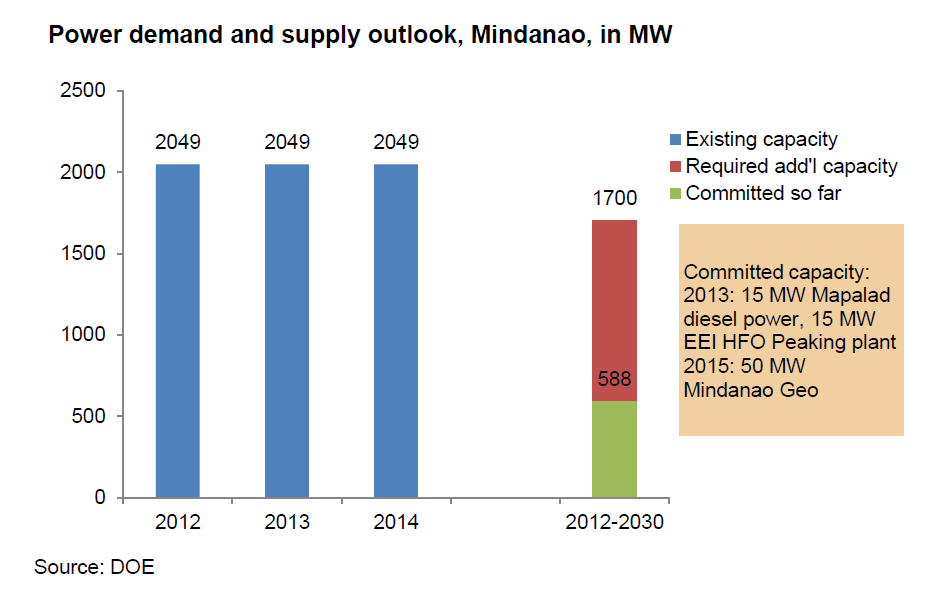

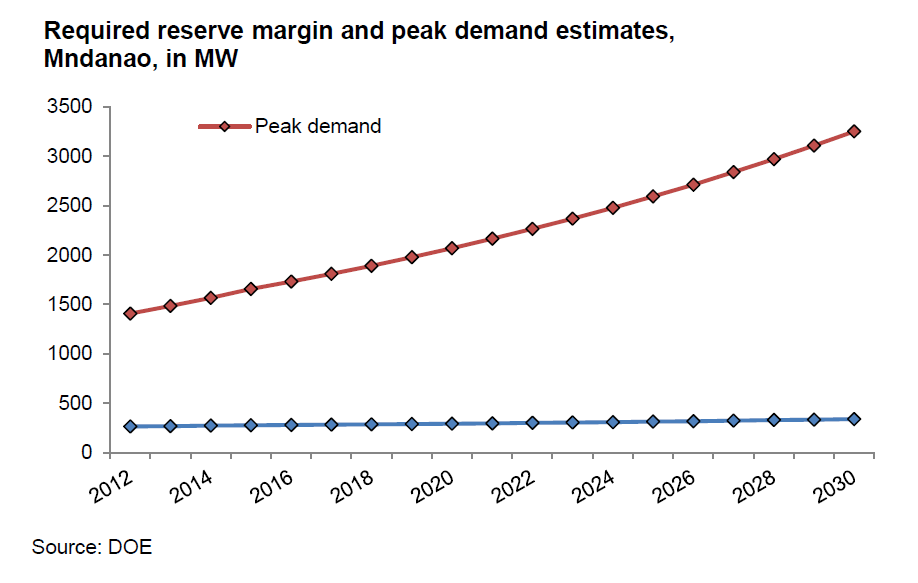

Mindanao also has been plagued with power supply problems and transmission constraints. The latter are being addressed by the new transmission concessionaire, National Grid Corporation of the Philippines (NGCP). Too few generating projects are under construction in Mindanao, including the Sibulan hydropower project of HEDCOR Inc to serve the Davao Light & Power Company and the Conal Holdings Corporation (2 x 100 MW) coal-fired plant in Maasim, Sarangani.

The Philippines should have an overabundance of supply for competition to work in lowering electricity prices. Is it realistic to expect that the new power capacity shown in Table 34 will be constructed in the near future (next five years)? Is it realistic to expect international financing absent take-or-pay contracts/guarantees?

It is difficult to find investors to construct a merchant plant. There is a very limited pool of deep-pocketed local investors who have made the effort to learn the Philippine energy market (e.g. Aboitiz, Ayala, First Gen, Metro Pacific, San Miguel, and SM) and limitations apply to foreign investment (e.g. the 40% minority public utilities and natural resources equity provision) for some forms of traditional and renewable energy projects. The poor reputation of Philippine courts and legal processes with respect to enforcing contract provisions on a timely basis further discourage investors.

Financial institutions conduct extensive due diligence investigations and do rigorous research to finance both merchant plants and those supported by off-take agreements. Banks look at creditworthiness (historical reliability in payment and sufficient cash reserves) and the ability of proposed power plants to produce reliable revenue and cash flows. In 2009 global credit markets shifted to short-term (5-7 year) financing. However, power plants require long tenors to make a project viable. Long-term (10-15 year) financing for generating projects with off-take agreements for a substantial percentage of their capacity is a challenge and becomes impossible if the merchant portion becomes too large.

Multilateral financial institutions such as the International Finance Corporation (IFC) and the ADB have been willing to finance merchant power plants under certain circumstances, if the technology is proven and operating risks are identified and mitigated. Both institutions emphasize climate change issues, making it difficult for them to finance coal-fired power plants. However, ADB is participating in financing the new coal-fired power plant in Naga, Cebu in light of the power crisis affecting the Visayas grid. At the same time, the ADB and the IFC are undertaking measures that would offset this decision, such as encouraging the development of renewable energy. The ADB is in discussions with the DOE to create a Clean Technology Investment Plan.

The creditworthiness of electric cooperatives as buyers of power is important for merchant plants for off-take. Cooperatives are being forced to be more disciplined in fulfilling their payment obligations now that Power Sector Assets and Liabilities Management (PSALM) has privatized much of the government-owned capacity serving the Luzon and Visayas grids. In their previous dealings with NPC, some cooperatives lagged behind in payments. Now dealing with the private sector, they risk being cut off if they do not pay their bills. Electric cooperatives face several challenges: (1) institutional preparedness to participate in WESM, (2) financial capacity or creditworthiness, and (3) technical capacity for power planning and maintenance.

Coal is a relatively inexpensive, plentiful, and reliable source of energy. If Europe, the US and other environmentally conscious countries still rely on coal to fuel their generating plants, then the Philippines should also be using coal to supply power to consumers. The main criticism of coal is it that is bad for the environment. To mitigate this, the Philippines can take advantage of its geography by choosing a small island that is not in close proximity with populous areas and make it a coal-fired power-generating island. For example, Semirara is an island with coal deposits and has very few inhabitants, making it easier to relocate affected families.

Contrary to public expectations, the Philippines does not have extremely high potential RE resources (hydro, geothermal, wind, solar, and biomass). The maximum capacity that can economically be extracted from RE sources may only be around 3,000 MW. The country has numerous run-of-river small hydro sites, but has limited undeveloped large hydro sites with seasonal storage capacity and has limited major undeveloped geothermal resources.86 Renewable energy is not sufficient to address the energy needs of the Philippines. Restrictions on foreign equity in the RA 9513 IRRs – which are not specified in the law itself – that limit foreign ownership to 40% will discourage foreign participation and slow the development of RE projects, except for geothermal which falls into a separate category.

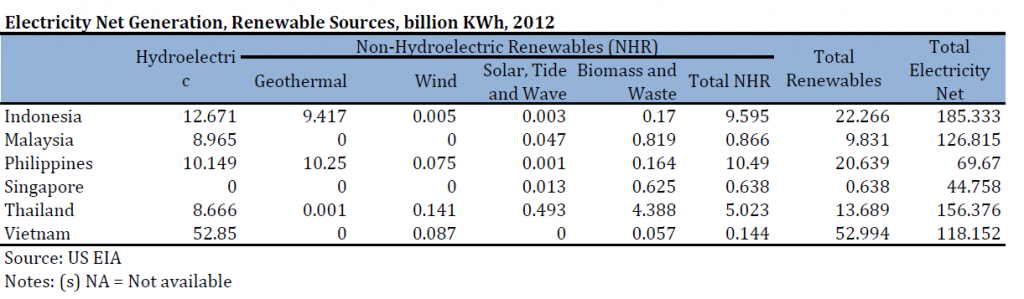

Table 35 shows estimated gigawatt capacity for biomass, geothermal, hydro, and wind for five Asian countries. While the Philippines already has significant current geothermal and hydro capacity and more potential to develop both resources, as well as biomass and wind, the potential resources are not sufficient to meet the country’s future generation requirements economically.

View original figure here

Liquefied natural gas (LNG) is a viable power fuel solution for the Philippines. The LNG trade in SEA is a very large business – with Japan, South Korea, and China as the largest markets. The Philippines is close to the major LNG exporters (Papua New Guinea, Australia, and Brunei) whose tankers can pass by the Philippines. However, LNG requires a major investment in infrastructure – much more than any single power plant of a capacity suitable for the Luzon, Visayas, or Mindanao grids. No investor or lender is willing to risk a major investment in the billions of dollars without reasonable assurances of a stable investment climate and sufficient volume to support it.

The San Miguel purchase of the 620 MW Limay, Bataan combined-cycle gas-turbine asset offers the potential for LNG in the Philippines, provided other customers can be found (power, industrial, commercial, and institutional). Hundreds of millions of dollars are needed to create the initial plant, but the opportunities for gas are immense. The Dominican Republic originally started LNG in a power station, then it was extended to transportation, to other power stations, and to generation facilities burning heavy fuel. The country now has the most diverse fuel mix in the Caribbean/Central American region, generating high savings (US$ 160+ million after 3-4 years). To replicate this, the Philippines has to have clear policies to attract investment in LNG.

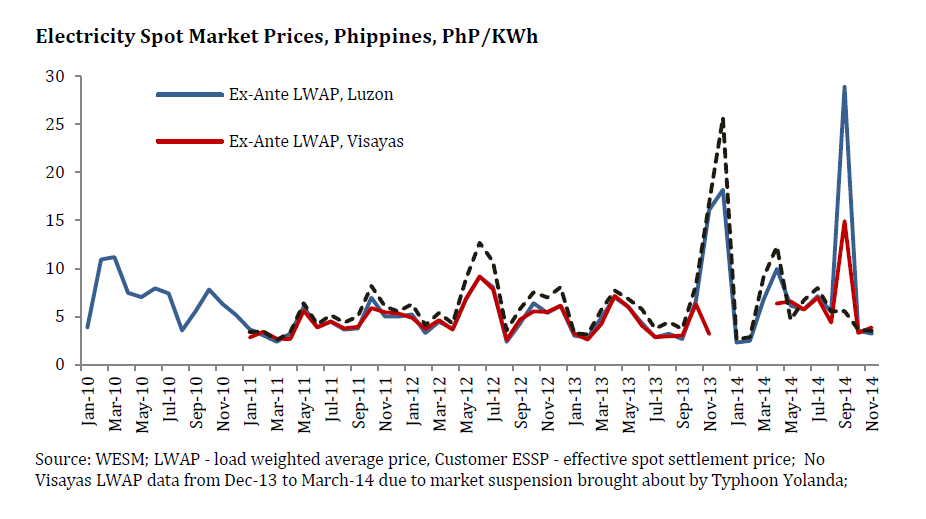

Retail power prices in the Philippines are among the highest in the Asia-Pacific region. How can the Philippines lower its power rates? Tariffs will not go down immediately after the declaration of open access because spot market prices must exceed the marginal cost of a new plant to encourage more investment in supply.

As of November 2009, the price of electricity at the WESM typically is PhP 2 per KWh, while the long range marginal cost of a new plant is about PhP 4 per KWh. Based on market studies, electricity rates in Luzon will not cross the long range marginal cost of a new plant until 2013 or 2014. Hence, there is minimal incentive to commit to building a new plant unless much of the infrastructure is already in place. When this happens two expansions may be the first to be financed and constructed: the Quezon coal-fired plant where additional capacity of 300-500 MW can be created by adding an additional unit using the same common facilities and, similarly, the Pagbilao coal-fired asset (also in Quezon province), where a third unit of 350 MW can be added.

Hydropower projects that were designed for capacity additions include the CBK pumped storage asset, with provisions for additional units 5 and 6 for about 350 MW; the Pantabangan hydro asset with provisions for another 112 MW; and the Magat hydro asset with provisions for an extra 180 MW. On the other hand, the development of the 600-MW coal-fired project of GNPower in Mariveles, Bataan is well advanced after its project financing closed in early 2010.

From the point of view of lender participants in power generation project financing, the main requirement is sustainable cash flows to cover debt service. A power generation project must have sufficient and reliable revenues from bilateral power supply agreements and spot market sales to make debt service payments and yield a return to its equity participants. Tariffs can decrease after the loans are repaid.

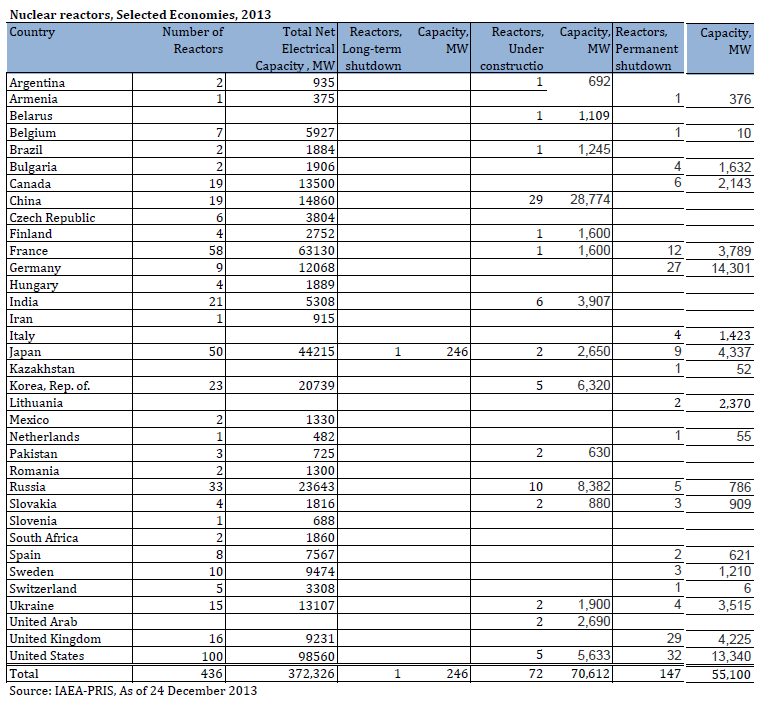

In the long run, nuclear technology offers the greatest prospect for cheaper power. But this option has been opposed by public concerns for the risk of accidents and the disposition of the wastes. However, experience around the world shows there are very few accidents. Furthermore, the technology for waste disposal is available and is only a small portion of overall operation costs. Both Japan and Taiwan have many nuclear plants and are considering building more. South Korea has 21 nuclear power plants serving 35 million people that account for 50,000 MW. Four more nuclear plants currently are under construction with two more planned within the next five years. China has nuclear plants and is building more in order to almost double its nuclear power capacity to 70 GW by 2020. Malaysia, Thailand, and Vietnam also have decided to introduce nuclear power in the next decade (see Table 36).

KEPCO was scheduled to submit a feasibility study to NPC at the end of 2009 to determine whether the Bataan nuclear power plant can be rehabilitated. Nuclear is a viable source of power supply for the Philippines, but not for at least 10 years. The smallest viable capacity for a nuclear power plant is 1,000 MW. At this time, the Luzon grid can only accommodate a maximum unit size of about 600 MW. The Bataan nuclear power plant would have operated at only 400 MW had it commenced operations in 1985. Measures were introduced in the 14th Congress to encourage operation of the Bataan Nuclear Power Plant.

Experts estimate that at least 15-25% of the consumption of electricity is wasted. Wastage can be mitigated significantly by reducing the system losses of distribution utilities and the national grid, including losses due to theft, as well as by implementing a wealth of energy efficiency and conservation measures. These can save most consumers 10-15%, yet recover associated costs within one to three years. The DOE is preparing to introduce an energy efficiency bill in the 15th Congress that will encourage and provide incentives for such measures. There are also ODA programs available to assist the Philippines to become more energy efficient. The IFC is working with local banks via a Sustainable Energy Finance Program to provide relevant technical knowledge to lend to energy efficiency and renewable energy projects. The IFC hopes to create energy savings by encouraging demand side conservation at private sector facilities such as factories, large offices, and malls.

Insufficient power transmission capacity (the transmission line transformers, reactors, and capacitors) affects system reliability, security, and stability. The Grid should remain stable after any Single Outage Contingency and should also remain controllable after a Multiple Outage Contingency. There are instances when the outage of a single transmission line or transformer causes power interruptions or deloading of generators. Insufficient power transmission capacity forces generators to be constrained-off and unable to deliver full power because of limited capacity. This situation could allow a more “expensive” generator to be dispatched in favor of a “cheaper” generator, in effect increasing WESM prices. NGCP needs to ensure sufficient transmission capacity at all times, anticipating the load growth in each grid, to adequately serve Generation Companies, Distribution Utilities, and Suppliers requiring transmission service and ancillary services.

Footnotes

- As of April 2010, 3,318 MW representing 88% of the government-owned generation plants had been sold yielding $3.47 billion which has been used to pay down NPC’s debt. National Transmission Corporation (TransCo) was privatized to a China-Philippine operating concessionaire in 2008.[Top]

- Feed-in tariff is the minimum price distribution utilities are required to pay, which will be passed on to consumers as a renewable energy (RE) charge. The FIT is required for RE power plants – because of their higher construction costs than conventional plants using hydrocarbon fuels – in order to assure that investors receive a reasonable return on their investments.[Top]

- Since its groundbreaking on January 26, 2008, the first of the three 82 MW units was switched on March 5, 2010. The plant’s second unit has been providing power to the grid since May 21 (Global Business Power Corporation website: www.gbpc.com.ph).[Top]

- In contrast, many undeveloped geothermal fields in Indonesia have capacities of 300 MW or more, while in the Philippines they mostly range from 30 to 50 MW. Indonesia, with potential for 22,000 MW of geothermal power, recently received a large World Bank loan to develop RE energy.[Top]