Background (Manufacturing)

Sector Background and Potential

The development path of each of Asia’s advanced and middle-income economies has been characterized by strong growth of the industrial sector and large shifts of workers from lower value-added agriculture and services into higher-value manufacturing and exports. This has yet to take place in the Philippines on a sufficiently large scale.

For much of the last century, industrialization in the Philippines consisted of import substitution and exports of agricultural and forestry products having limited value-added (e.g. coconut oil, copper metal, and plywood). Most factories set up by domestic and foreign investors in the Philippines made products primarily sold in the domestic market. Government protected their production with high tariffs, as well as quotas on imports. Elsewhere in Asia, beginning half a century ago, Japan, Korea, and Taiwan became manufacturing powerhouses with indigenous firms successfully exploiting global markets.

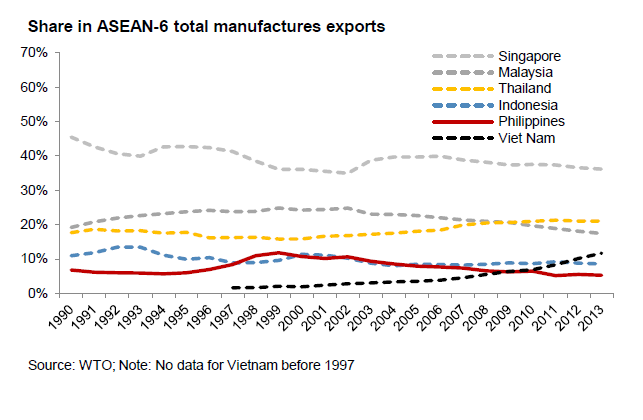

Over the last three decades, the Philippines benefited from the globalization of trade and manufacturing investment as multinationals from within and outside the Asian region moved into Southeast Asia to take advantage of lower production and logistics costs to serve global markets. However, primarily because of political instability in the 1980s, the Philippines benefitted less from these investment flows than Malaysia, Singapore, and Thailand. More recently, after joining the World Trade Organization (WTO), Vietnam has been attracting a large influx of foreign manufacturing investment because of its extremely low production costs.

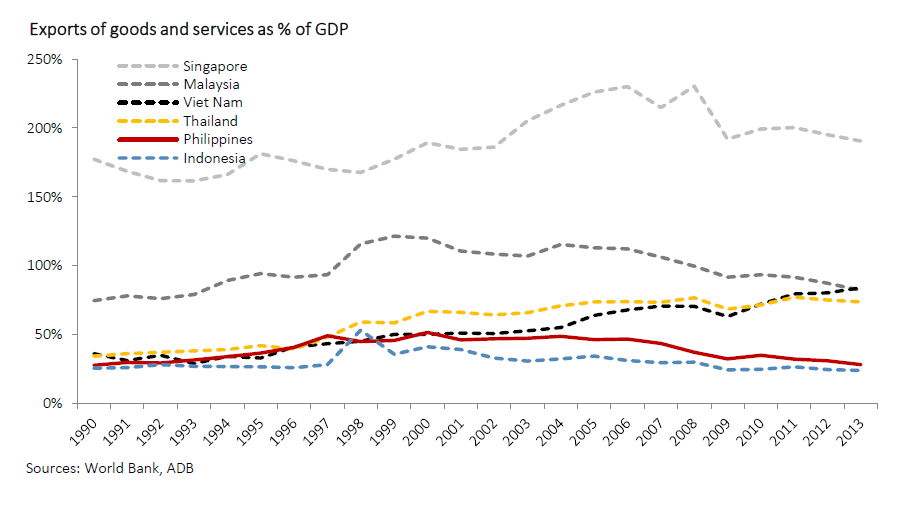

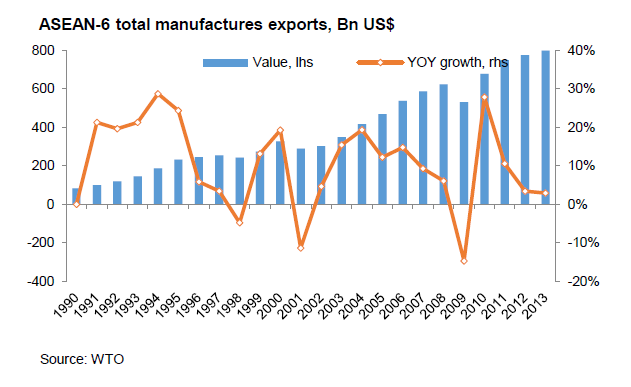

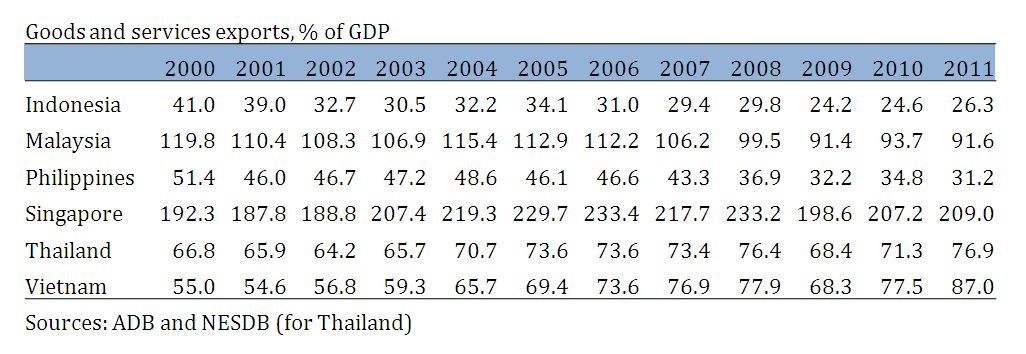

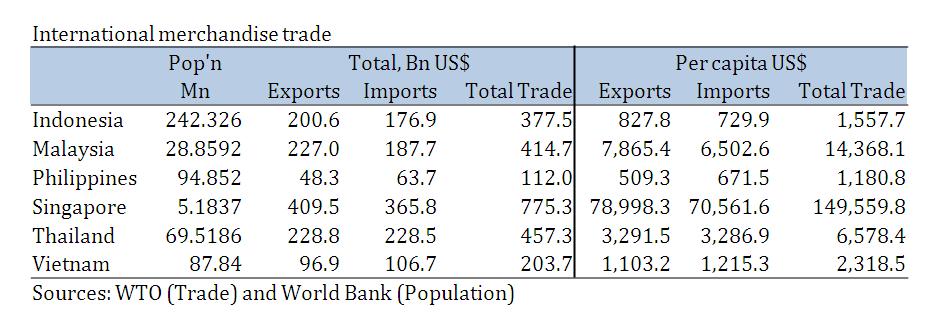

Figure 103 and Table 45 show the export percentage of GDP of the ASEAN-6 countries over the last three decades. Malaysia (81% in 2009), Singapore (199%), Thailand (68%), and Vietnam (61%) have increased their export percentage of GDP during this period, while Indonesia (24%) and the Philippines (32%) have not.

View original table here

View original table hereWhen global trade fell sharply in 2008 and 2009 during the global financial crisis, the Philippine economy was much less affected than the regional economies that became wealthy through manufactured exports. The Philippine government argued it avoided negative economic growth because it was “resilient,” when in fact it had not developed its potential to be a major exporter and had instead become dependent on remittances for most of its economic growth. Strong exports usually create quality jobs at home in the manufacturing sector and increase direct revenue for the public sector, which overseas jobs do not.

Garment Exports: Philippine manufactured exports benefitted from the Multi Fibre Agreement (MFA) that governed world trade in textiles and garments from 1974 through 2004. The MFA controlled the growth of textile and garment imports by developed countries by assigning annual quotas each developing country could export. The quotas by category of garment usually grew each year, and many Filipino and some foreign firms went into garment export manufacturing based on their allocated quotas. Being protected from competition, their businesses were guaranteed to be profitable.

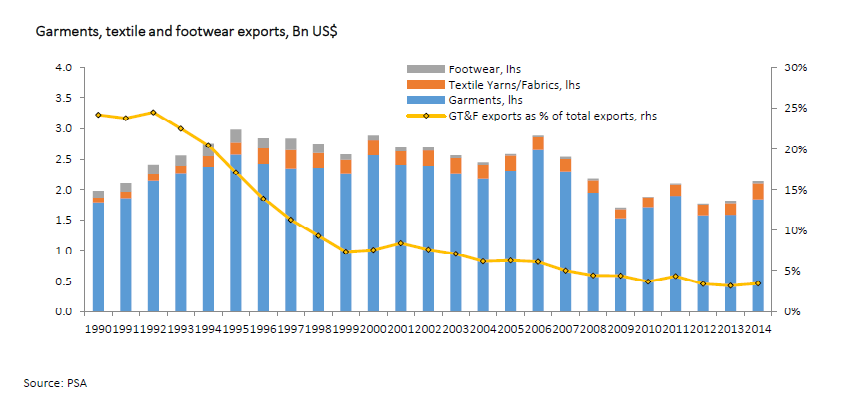

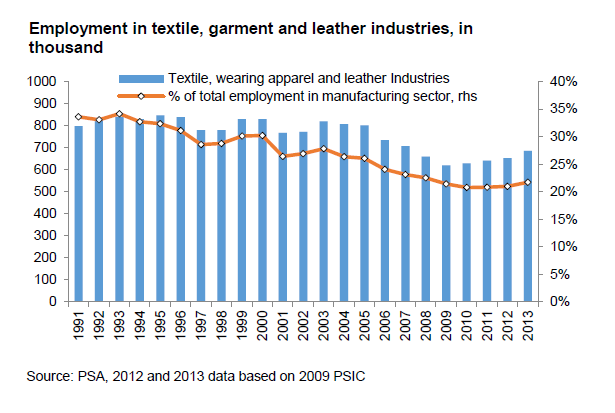

Figure 104 shows employment in the textile/garment sector in the Philippines, which grew to a peak of more than 840,000 in 1995. Since the expiration of the MFA in 2005, the Philippine textile and garment sector has lost some 150,000 jobs as guaranteed access to the American and European markets disappeared and competition from lower cost producers in Bangladesh, Cambodia, China, Indonesia, Vietnam, and elsewhere crowded out Philippine exporters, many of whom closed their operations. Figure 105 shows the share of Philippine garments in the total exports has declined since the early 1990s, as electronic product exports grew. In the last three years, however, the value of garments exports has dropped significantly. From an annual average of US$ 2.4 billion between 1995 and 2006, the industry only managed to take in just over US$ 1.5 billion in export receipts in 2009 – the lowest export revenue for the sector since 1988 in nominal terms.131

in thousands, Philippines, 1991-2013

View original figure here

View original figure hereThe Philippine garments industry, supported by the GRP, is seeking passage of the Save Our Industries Act (H.R. 3039 and S. 3170) in the US Congress.132 Under the proposed bill, Philippine garments made from imported American textiles would be allowed duty-free entry into the US, an arrangement in effect for Carribean Basin Initiative (CBI) countries since 1983. For some categories of garments, the preferential tariff treatment would be sufficient to make Philippine products competitive by removing the current US duty of more than ten percent. The Confederation of Garment Exporters estimates that, if passed, the law could add 100,000 jobs in the Philippines.

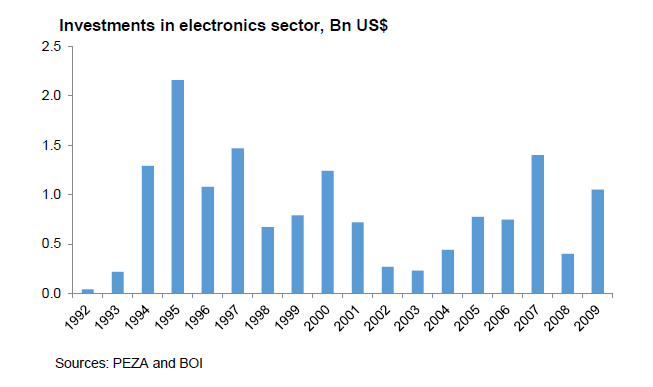

Electronic Exports: Beginning in the late 1970s, the Philippines developed a modest electronics manufacturing sector that has grown to nearly 1,000 firms employing over 400,000 Filipinos and producing about 2% of global electronics production.133 Starting with two American firms – Intel in Makati and National Semiconductor in Mactan – many global semiconductor manufacturers located factories in the Philippines.134 Texas Instruments (US), which operates two large facilities in Baguio and Clark, is the largest investor in the sector. Computers and computer components and accessories are also assembled in the Philippines by companies such as Acer (Taiwan), Epson (Japan), Lexmark (US), and Integrated Microelectronics (Philippines). More recently, several solar panel manufacturers have established factories in the Philippines. Figure 106 shows the value of investment in the electronics sector over the last two decades, exceeding US$ 1 billion in seven separate years.135

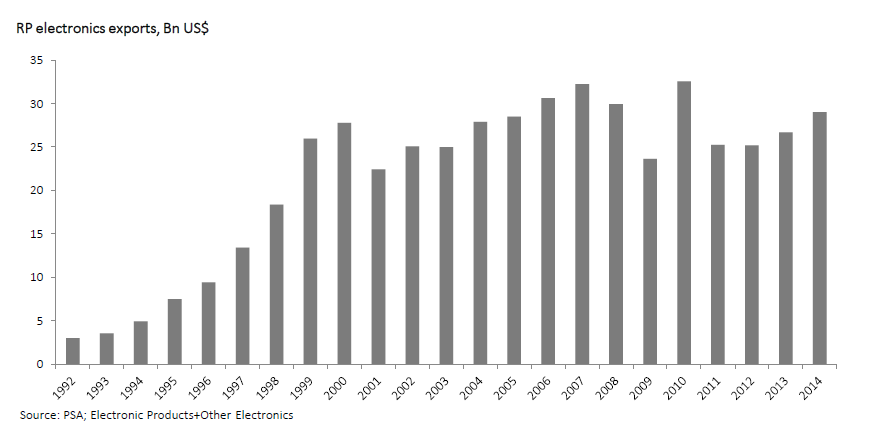

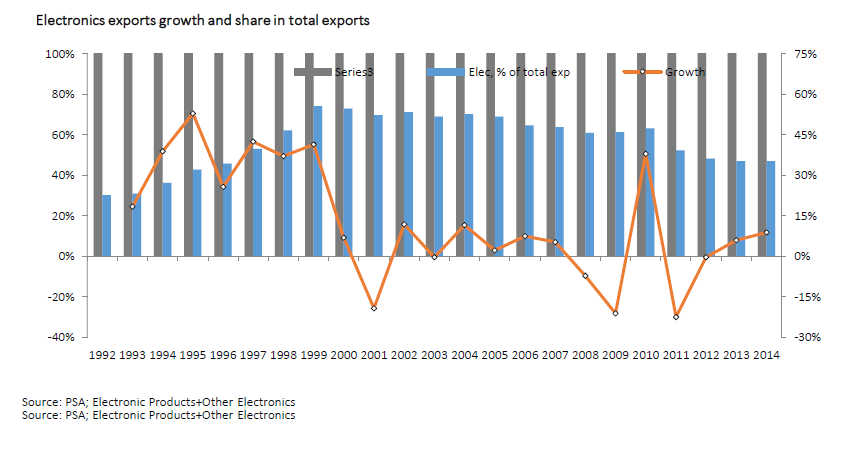

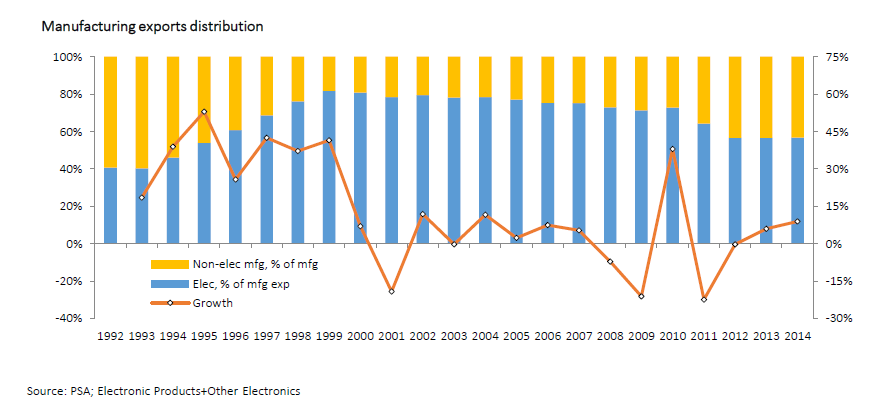

Figure 107 shows the value of electronics exports over the last two decades. Figure 108 shows the high rate of growth of electronics exports, growing as fast as 50% in 1995, and the large share of electronics exports in total exports, reaching more than 70% in 1999. Without electronics, Philippine export of manufactured goods would have grown very slowly over the last decade. Conversely, the high percentage of exports made up of electronics products indicates a failure to develop a diversified mix of manufactured exports and creates a risk should technological change, cost, or other factors reduce the viability of manufacturing electronics in the Philippines. Other countries that are significant manufacturers of electronics have diversified their exports. Malaysia, for example, has strong agricultural exports in addition to electronics. Thailand also exports food, as well as automobiles, in addition to electronics.

Other categories of manufactured exports are small in comparison with the dominant position of electronics exports. Garments are 3% of total exports, ignition wiring 2%, woodcraft and furniture 2%, and coconut oil 2%. Garment exports comprised 7% of total exports in 2000. Automotive Manufacturing: Another industry subsector that has declined in recent years is automotive manufacturing. More than two decades ago the GRP established the Motor Vehicle Development Program (MVDP), which attracted one American and several Japanese manufacturers to invest some US$ 2 billion in Philippine factories, entirely for the local market, with the exception of one firm that exports. A small parts and components manufacturing subsector has developed to supply local assemblers and for export, notably electric wire harnesses, which reached a peak total of US$ 902 million in value in 2008.136

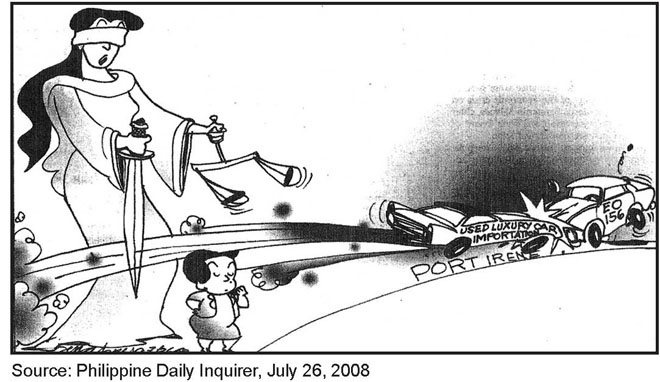

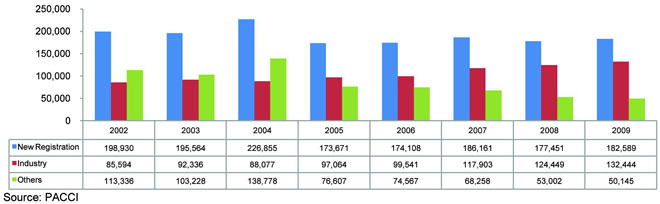

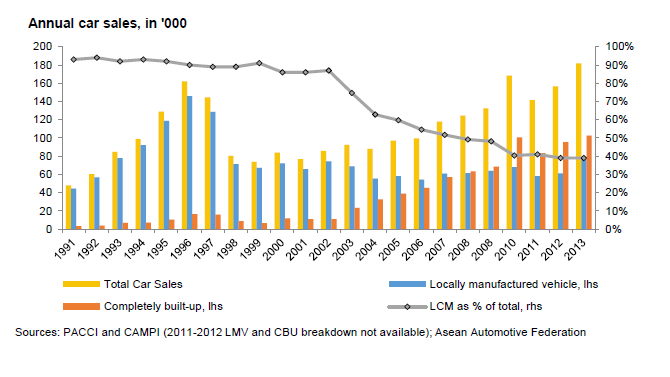

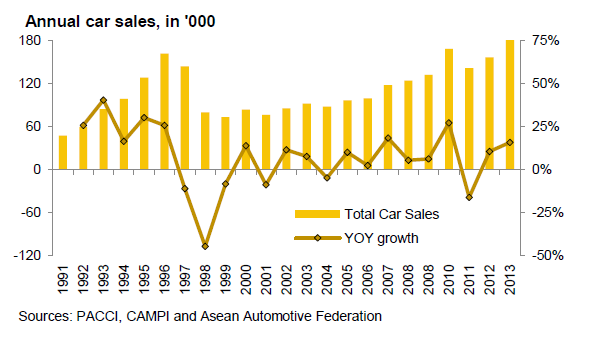

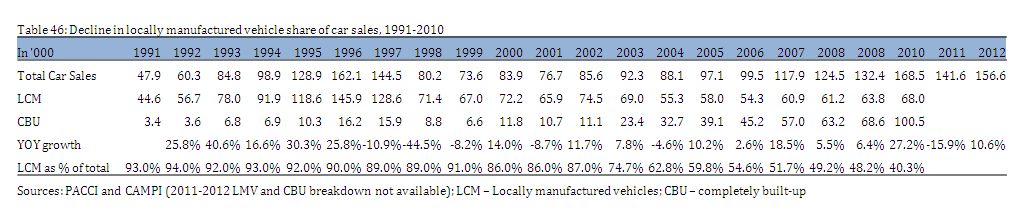

Over the last decade the government has failed to protect the domestic automotive manufacturing industry and was for years unable to prevent large volumes of used car imports despite their prohibition in 2002. The industry in 2009 produced only 48% of total new car sales in the country, while in 2002, 87% were produced domestically (see Figure 109 and Table 46). Imports of new cars have been liberalized, and some 200,000 “illegal” used cars have been imported through the Subic and Cagayan economic zones in less than a decade.

View original figure here

View original figure here

View original table here

View original table hereAlthough former president Macapagal-Arroyo issued EO 156 in 2002, which prohibited almost all used car imports, small used car importers at the Subic Bay Freeport Zone and later the Cagayan Special Economic Zone and Freeport obtained injunctions from local courts in Olongapo and Aparri that blocked implementation of national government policy (see Figure 110). During the years needed before the government succeeded in appealing the injunctions, huge sums of duties and taxes may have not been paid to government coffers, with “illegal” car importers profiting in the hundreds of millions of dollars. Figure 111 shows the number of cars newly registered which includes those sold by the industry and those legally, as well as illegaly, imported.137 Critics, including a former SBMA administrator, pointed to extensive corruption to allow the imports to flow despite the ban.

Employment in the Philippine automotive manufacturing industry has declined from a peak of 130,000 in 1996 to 70,000 in 2010. By contrast, Thailand’s automotive industry employs 150,000 people in assembly and auto-parts manufacturing, with the capacity to produce 1.5 million vehicles a year. In 1996, Thailand’s automotive industry produced 555,821 automobiles. By 2008, production reached 1,391,728.

A new Comprehensive Motor Vehicle Development Program (EO 877) was signed in 2010 to create stronger support for domestic automotive manufacturing. Pointing to the higher cost of production in the Philippines, the elimination of tariffs on auto imports from ASEAN and Japan under the ASEAN FTA and Japan-Philippines Economic Partnership Agreement (JPEPA), and continued used car imports, some experts believe domestic automotive production is likely to further decline unless the government adopts a more supportive industrial policy.

In 2010 the Export Development Council (EDC) listed the following products as the sector’s future revenue streams: electronics, textiles and apparel, automotive products and parts, food, home decor, organic products, and construction materials.

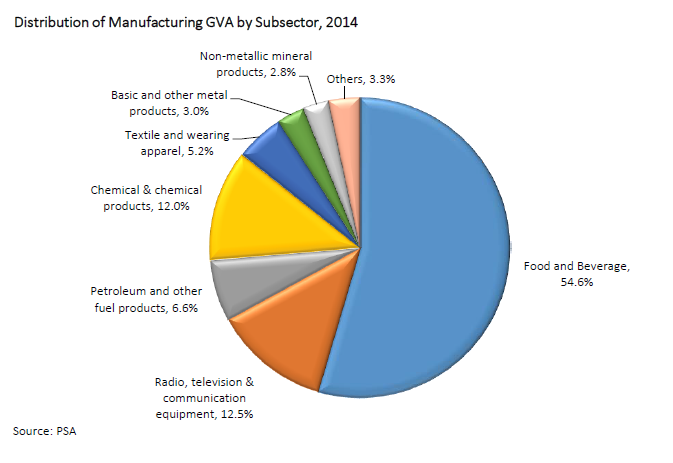

The construction materials sector has good prospects. Cement is an example of a domestic manufacturing industry that can survive because the transport cost of imports is fairly high. Beverages are a similar category, as are many food products. Food and beverage manufacturing comprised 58% of total manufacturing GVA in 2009 (see Figure 112).

View original figure here

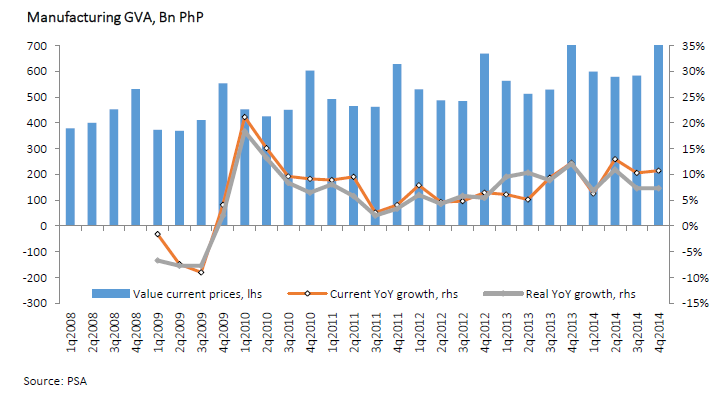

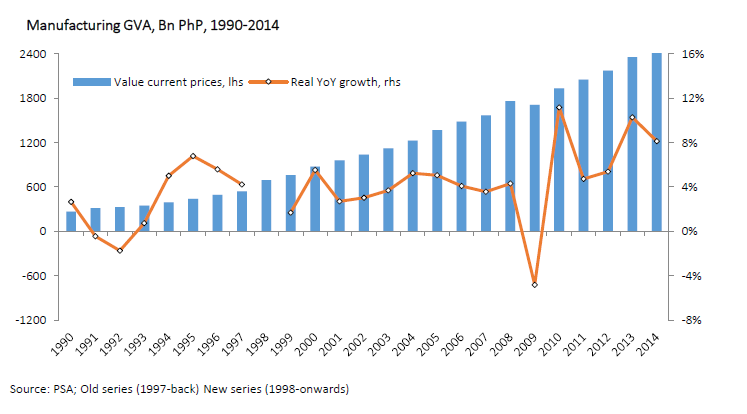

View original figure hereFigure 113 shows the total value of manufacturing in the Philippines and its rate of growth. With total value above PhP 1.6 trillion and a normal growth rate of 4-5%, the sector remains a very important part of the economy. Manufacturing growth rate fell to zero or less in 1991-92 (power crisis), 1998 (Asian financial crisis), and 2009 (global financial crisis), all years in which GDP growth was very low. In 2009, around 8.3 million workers were employed in manufacturing.

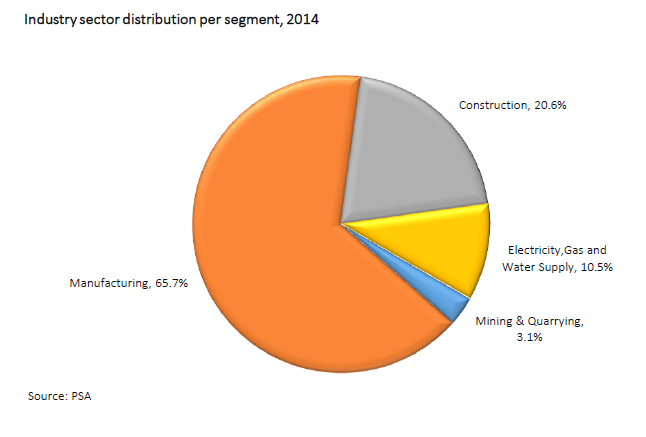

Manufacturing is the largest component of the industry sector (68%), which also includes construction (16%), electricity, gas, and water (11%), and mining and quarrying (5%) (see Figure 114).

View original figure here

View original figure hereFigure 115 clearly shows the expansion of the services sector in the Philippine GDP since 1990 (from 44% to 55%) and the relative shrinkage of the industry sector (from 35% to 30%) and the agricultural, fishery, and forestry sector (from 22% to 15%). The services sector has grown steadily with increased remittances from overseas Filipino workers and the rise of business process outsourcing. This data also underlines the need to rebalance the economy by investing more in agricultural and manufacturing to create jobs in these sectors.

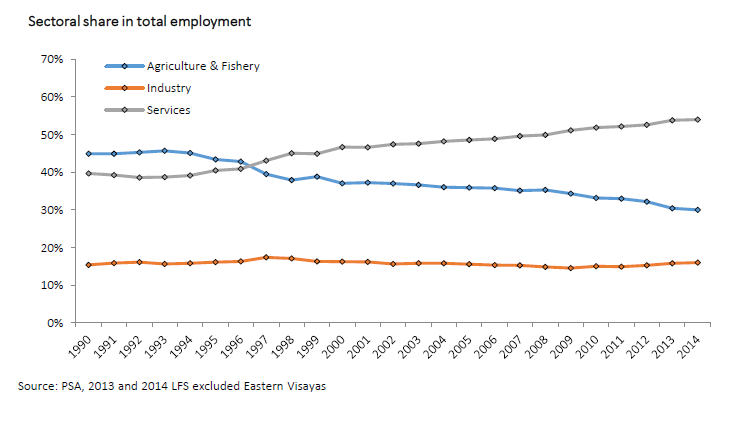

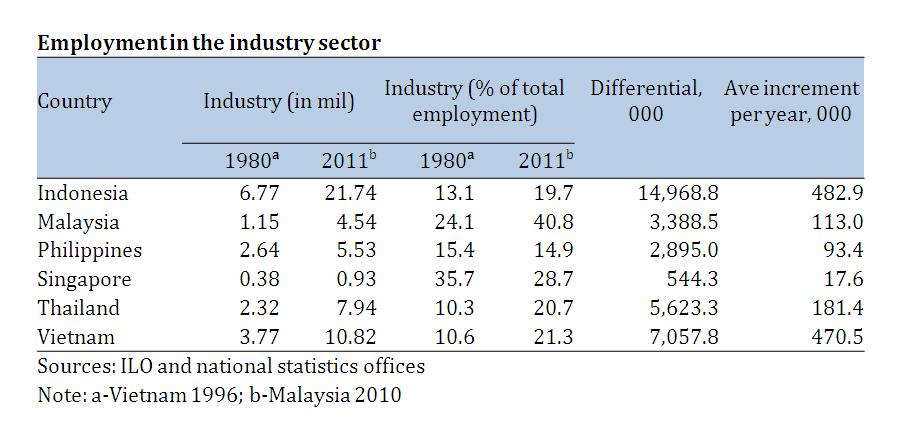

Employment in the industry sector in the Philippines, measured as a percentage of total employment, has failed to grow during the last two decades, remaining below 20%, while the relative shares of agriculture and services exchanged places as the country’s fast-growing population moved into low paying service work (see Figure 116).

Clearly, the development path of Asia’s advanced and middle-income economies, with large shifts of workers from lower value-added agriculture and services into higher-valued manufacturing and exports, is not occurring fast enough in the Philippines.

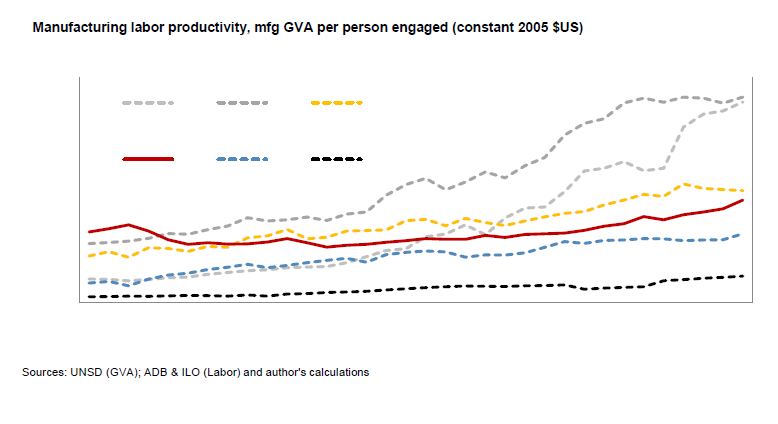

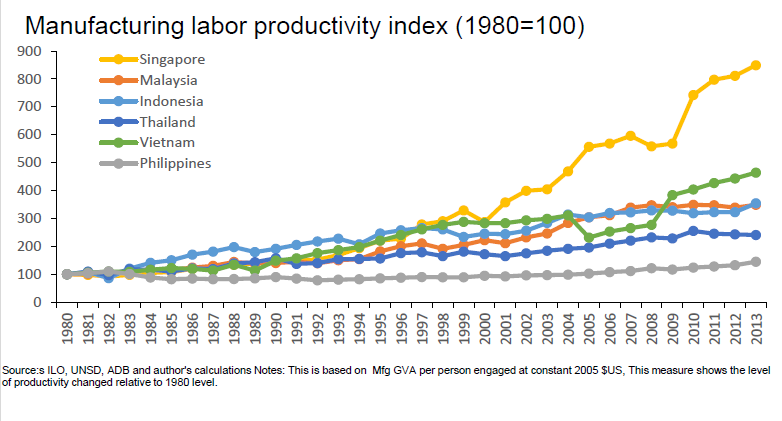

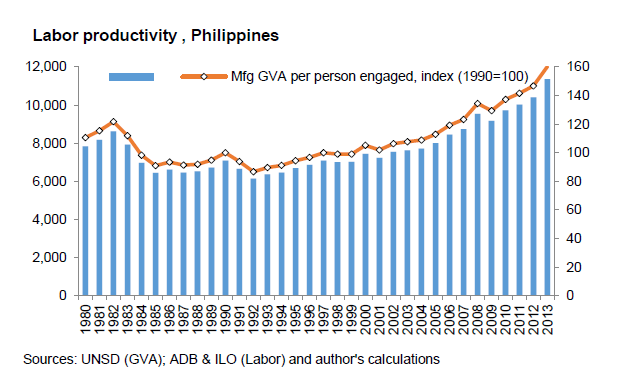

Labor productivity in manufacturing has not improved and remains only slightly above its index level in 1980 (see Figure 117). However, since 1980, total employment in the industry sector has doubled, but in Indonesia, Malaysia, and Thailand total employment in industry grew much faster, roughly tripling in each case (see Table 47).

View original figure here

View original figure here View original table here

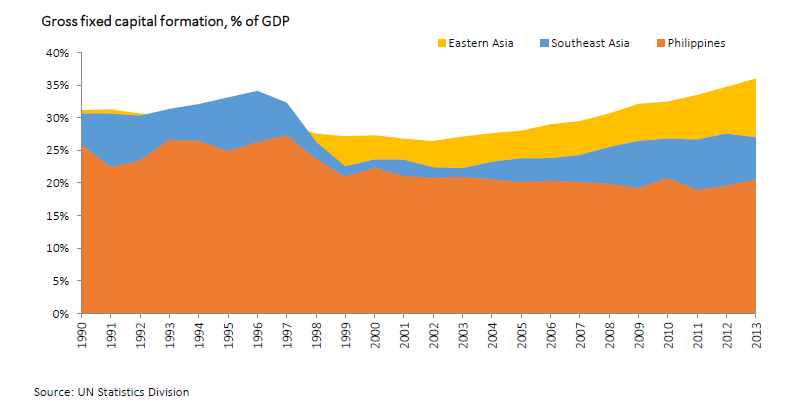

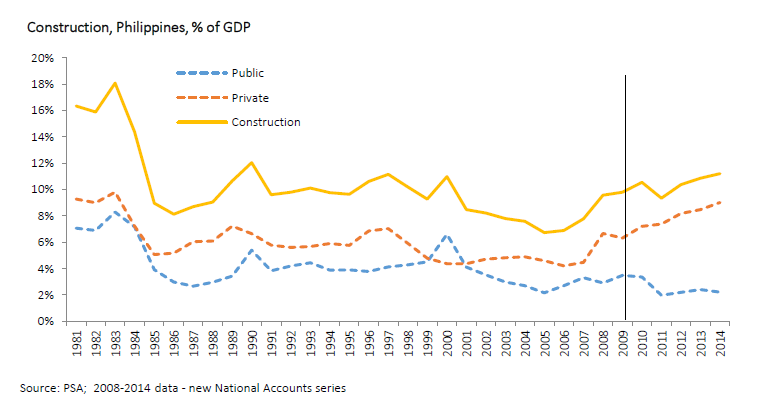

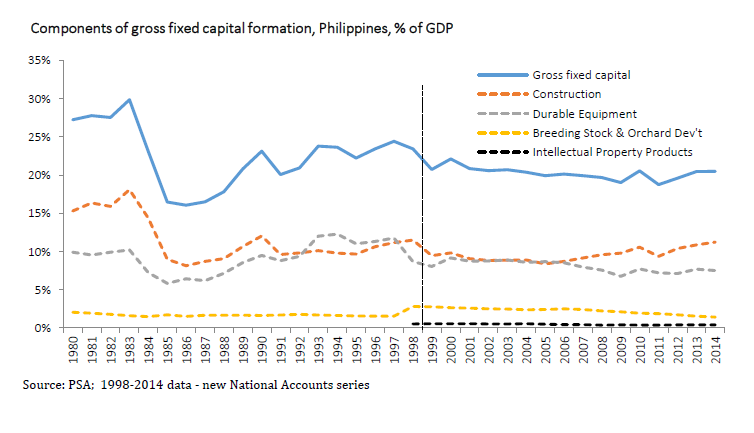

View original table hereSince industry is more capital intensive than agriculture and services, one explanation for the slow growth of the sector can be found in the low levels of investment in the Philippines. As a percent of GDP, these have fallen considerably below 20% and are currently at 14% in the Philippines, while in the Asia region they are above 35% (see Figures 120 and 121).

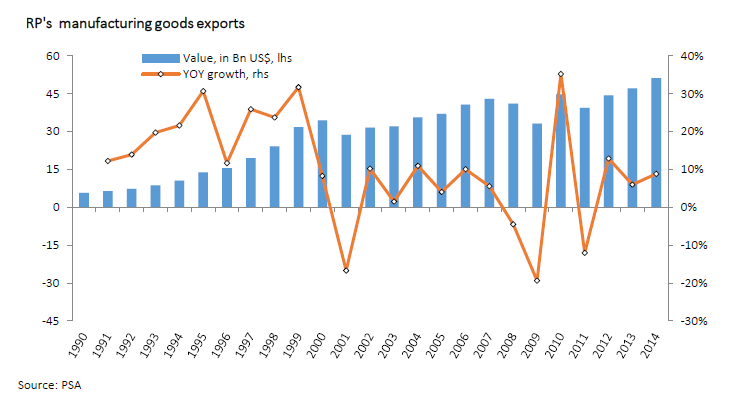

The relatively weak industry sector in the Philippines is reflected in the share of exports as a percent of GDP in comparison to more developed Asian economies. While the Philippines never became an export powerhouse, its exports have steadily grown, until the last two years when they fell sharply in tandem with the decline in global trade following the financial crisis in the United States and Europe (see Figures 122, 123 and 124)

View original figure here

View original figure here View original table here

View original table hereDomestic manufacturing in the Philippines has never faced more challenges to its survival than today. Smuggling has become been a serious threat to the operations of local manufacturers.138 Costs of production of many goods are higher than in several competing Asian economies at a time when more and more free trade agreements are coming into effect with ASEAN, Australia, China, India, and Japan.The sector’s landscape has changed radically from the days of import substitution policies when investors (predominantly local) were protected from foreign competition by high tariffs and import quotas. Since millions of Filipinos are employed in manufacturing, the future of the sector is not only extremely important to them and future generations but to the overall economy and to government revenues.

Many in the private sector believe government agencies are generally complacent when major manufacturing investors close and exit the country.139 Their attitude appears to be that eventually another investor will enter, because they believe there always are business opportunities in the Philippines given its domestic market and strategic location as a gateway to the fast-growing Asian region. These bureaucrats seem to believe businesses stay or leave regardless of what government does. However, by maintaining the status quo and standing passively by when companies leave, the Philippine economy risks stagnanting, while Asian competitors grow faster.

Government agencies are stymied by the lack of direction, commitment, and follow through from top Philippine leadership. There appears to be no strong, unifying policy that manufacturing is a key component in the nation’s economic development. Other countries, such as Indonesia, Malaysia, and Thailand, were successful in developing industrial exports because they had clear policy direction from the top. As a result, Thailand became the leading automotive manufacturer in Southeast Asia and able to produce 999,378 vehicles in 2009 of which 535,596 units were exported, comprising over a quarter of the total shipments from the ASEAN region (1.9 million units).140 In the same year, the Philippines only exported 7,277 vehicles. The Federation of Thai Industries (FTI) is targeting produce to 1.45 million units in 2010 on the back of a recovering global demand.141

During the global financial crisis, the Philippines lacked an industrial policy and the former DTI secretary was not effective in creating one. There has not been sufficient industrial sector planning for where the country wants to go and which sectors it wants to develop. The periodic BOI Investment Priorities Plan (IPP) is a mere list of sectors eligible for fiscal incentives and not a comprehensive industry sector policy development plan.

By contrast, in 1986, the government prioritized 11 sectors for economic growth. Each sector had a government-funded master plan created and headed by the private sector, whose leaders were called the G-11. All agencies of the government were guided by that plan. As a result, the sectors developed until the failed 1989 coup d’etat attempts damaged investor interest. In the last decade, the government implemented uncoordinated and immediate policy actions, rather than following a strategic plan.

Any future master plan should be private sector-led. The government may not have the resources to draft a master plan for manufacturing and logistics but can hire expert consultants. As major stakeholders, the private sector should take the initiative of recommending inputs, which the government should incorporate, support, and implement.

PEZA is an institution that has been successful in creating a competitive business environment due to an effective and consistent leadership. The PEZA staff, who develop and implement policies, understand the issues very well. PEZA was exempted from salary standardization over a decade ago, allowing it to pay professional level salaries to its personnel. There has been continuity in its leadership through several administrations.

The DTI did not support the pharmaceutical industry when the Department of Health imposed maximum retail prices (MRP) on several medicines and asked companies twice, in 2009 and 2010, to reduce prices voluntarily. When a similar policy was followed in New Zealand, the prices of some medicines were lowered so much that several companies pulled out. As a result, some medicines are not being sold in New Zealand. This may happen in the Philippines if the MRP policy continues.

Price controls also were extended to gasoline prices. After severe flood damage in Metro Manila and Central Luzon following two typhoons in 2009, the government imposed price controls on petroleum, arguing this would benefit citizens harmed by the floods. Since most of the people who were displaced did not own motor vehicles, any savings in fuel expenses could only benefit the small percentage of flood victims owning cars. Because petroleum retailers were buying imported fuel above the government-set prices, fuel imports were about to dry up and create shortages, which would have harmed the economy. Philippine politicians often appear oblivious to the realities of the international oil market, blaming oil companies for fuel increases, when the oil companies are passing on prices set by oil-rich governments.

The government’s funding for trade promotion is insufficient to participate in large international trade shows to help market Philippine products. The private sector receives no DTI assistance to attend. The small budget for international marketing for tourism results in limited promotion of the Philippines compared to other countries in the region. In Hong Kong, a small tax was levied on exports to fund trade promotion and exhibitions abroad. The Philippines could consider this as an option to raise revenue for marketing. Industry associations could designate which trade exhibitions have the greatest impact and should have a Philippine presence. Each association can organize participation from among its members, and the government should provide some financial support, as is done in other countries.

Corruption in the Bureau of Customs (BOC), especially prevalent in provincial offices, increases the cost of international transportation of goods. In Manila, anecdotal evidence suggests that corruption in the BOC has declined in comparison to past years. In some provinces, so little cargo enters the ports that customs officials charge very high illegal fees per transaction. There should be a complete change in the attitude of the BOC towards trade facilitation.

There have been efforts to reduce fiscal incentives for investors, primarily led by the DOF. There should be a dialogue between the government and the private sector to make sure that incentives tied to export performance and other industrial policy priorities that are measurable and auditable continue to be provided.

The cost of power is a serious competitive disadvantage for the Philippines, especially for manufacturers. For example, over 10% of the expense of manufacturing an automobile in the Philippines is for electricity. A car assembly plant in the Philippines pays 50% more than its counterpart in Thailand and 100% more than in Vietnam, where power is government-subsidized. This is the case even with discounted power rates for firms in PEZA zones.

Minimum wages in the Philippines are higher than elsewhere in Southeast Asia, except Singapore (see Part 4 Business Costs). While it is appropriate to increase the minimum wage for industrial workers to keep up with the cost of living, there should also be concomitant focus on improving labor productivity. Industrial sector wages in different parts of the world increase as workers achieve higher productivity and better efficiencies.

The minimum wage policy of Malaysia should be studied by the Philippines. Prime Minister Mahatir prioritized manufacturing as a key driver of Malaysian economic growth. Because the government regarded manufacturing for export as a global industry, government policy allowed global market forces to dictate the price of labor in Malaysia. Global manufacturing is exempt from the minimum wage. By contrast in the Philippines, hundreds of thousands of jobs were lost when garment export firms became unprofitable because of high production costs, especially wages and power costs. In the Philippines, the minimum wage is linked to inflation and living costs, rather than global wages and labor productivity.

Smuggling is a major problem for many domestic industries. Foreign goods entering without paying proper duties and VAT compete with domestic goods that are taxed. Following complaints from the private sector, the government established the Ports Transparency Alliance (PORTAL) to discuss remedies. Within PORTAL, subgroups were established to devise anti-smuggling strategies and monitor compliance for oil smuggling, used car smuggling, vegetable smuggling, and other products.

Despite Supreme Court rulings affirming the validity of the prohibition against importing used cars, they continue to enter the country. In the Cagayan Freeport, some 600 cars each month are reportedly sold to buyers outside the freeport. Vendors there were previously located at Subic Freeport and relocated in anticipation of the Supreme Court decision that closed their business at Subic. The national government has rationalized that it can do nothing to stop imports at CEZA so long as the local judge who issued an injunction delays his ruling on whether the imports are legal.

Well-entrenched syndicates protected by elected politicians run smuggling activities. Until the politicians have the political will to stop smuggling activities, there will be little progress in curbing smuggling.

Oil smuggling in the last half decade deprived the national government of hundreds of billions of pesos in tax and duty revenue. There was no smuggling problem before the EVAT applied a 12% VAT to petroleum. But with the EVAT, large volume importations of refined gasoline, with paperwork that misdeclares the true volume, are processed with a much lower tax. This has been immensely profitable for a syndicate of gasoline retailers, their collaborators in the BOC, and their high-level protectors. Despite seizures of illegal imports and an oil-marking program funded by the oil industry to identify illegal petroleum being sold at retail stations, no prosecutions have resulted in imprisonment of smugglers.

As long as smuggling provides better profits than manufacturing, the Philippines will move towards becoming an economy of traders and smugglers rather than manufacturers. The auto industry has lost almost 50% of its manufacturing jobs in the past 10 years. Claims in the press that auto industry sales are rising fail to explain that only 48% of the vehicles are Philippine-assembled. Ten years ago, 90% of the vehicles sold domestically were built in the country. Currently, imported new cars from Japan, Korea, and Thailand are very competitive, even with a 30% duty. Legitimate businesses find it hard to invest in an economy lacking a level playing field.

FTAs make it easier to import less expensive foreign goods that compete with products manufactured locally. Consumers choose products based largely on price and rarely because of “buy local” campaigns. Duty-free importation of capital equipment should be allowed for local manufacturers; however, it currently is only granted to firms that export 70% of their production.

The E2M program depersonalizes doing business with customs, thus removing opportunity by custom officials to ask for bribes. In PEZA zones, automation has already been achieved in customs offices. However, some officials do not support these programs.

Footnotes

- This is not yet adjusted to inflation[Top]

- While attending a global summit on nuclear non-proliferation in Washington in April 2010, former president Macapagal Arroyo visited the US Congress to urge passage of the proposed legislation.[Top]

- Foxcomm Technology, the world’s largest contract manufacturer, has 920,000 employees in China and will have as many as 1.3 million by the end of 2011 (International Herald Tribune, August 26, 2010). This single Taiwanese company, which supplies Apple, Dell, and Hewlett-Packard, employs more than the entire electronics sector of the Philippines, and has annual revenues larger than the value of total exports of the Philippines.[Top]

- Intel closed its Philippine plant in 2009 along with a plant in Malaysia and several in the US following the sharp drop in global demand during the financial crisis.[Top]

- 1994, 1995, 1996, 1997, 2000, 2007, and 2009[Top]

- In 2006, the country recorded its highest number of units sold at 62.3 million worth US$ 787.5 million (in 2006 prices).[Top]

- In the Philippines a vehicle is registered only one time, after its importation or local production.[Top]

- Smuggled goods include angle bars, cars, cement, clothing, flour, fruit, galvanized iron sheets, oil, rice, sugar, textiles, and vegetables.[Top]

- The Philippines was a first mover in Southeast Asia in the semiconductor electronics export sector in the mid-1970s and has grown consistently since. However, the government in recent years had no consensus policy to support the industry. There were champions at DTI and PEZA, but the importance of the industry was not well understood at the DOF and in the Congress. While the former president understood the sector and met with the CEOs of top American, European, Japanese, and Korean electronics firms to encourage them to invest in the Philippines, there was inadequate policy support to make the country more attractive to more electronics investors. The same situation has been repeated for automotive, petroleum, pharmaceutical manufacturing, and electricity generation. Companies that have closed manufacturing operations in the country include Chevron, Goodyear, Intel, and Toshiba.[Top]

- ASEAN Automotive Market Report (May 2010). International Trade Administration.[Top]

- https://www.export.by/en/?act=news&mode=view&id=19852[Top]