Background (TMTR)

Sector Background and Potential

Given the natural, cultural, and human resource endowments of the Philippines, tourism has been identified as an important sunrise, globally competitive industry by the national government under the MTPDP 2004-2010 and by the NCC (created by EO 571). The new Tourism Act of 2009 offers opportunities to develop the sector at a more rapid pace.

Health and wellness tourism, medical travel, and retirement are priority sectors under EO 372 whose development are expected to generate investments, employment, and foreign exchange and create more opportunities for retirement and health professionals in the Philippines.

Tourism development can have strong poverty reduction effects in remote and rural areas. It has been calculated that for every foreign tourist that visits the country and spends about a thousand dollars, one job for one year is supported. Each US$ 1 spent by a tourist to pay for accommodation services gets multiplied 2.1 times. Thus, a dollar spent by a tourist on accommodations generates a total of US$ 2.1 for the Philippine economy. The range of direct and indirect income effects of tourism is enormous, involving agriculture, industry, and services. Tourism is also a pull factor to medical travel, long stay, and retirement markets. Tourism (specifically medical travel) serves as an entry point for potential retirees, who need to visit and positively experience the Philippines first before deciding to come back on a long stay or permanent basis.

Tourism

Travel and tourism is currently the fourth largest source of Philippine foreign exchange revenues.156 From 2000 to 2009, the average annual spending of US$ 2.2 billion by international visitors contributed 43.5% and 4.8% to the service export and total export revenues of the Philippines, respectively.157

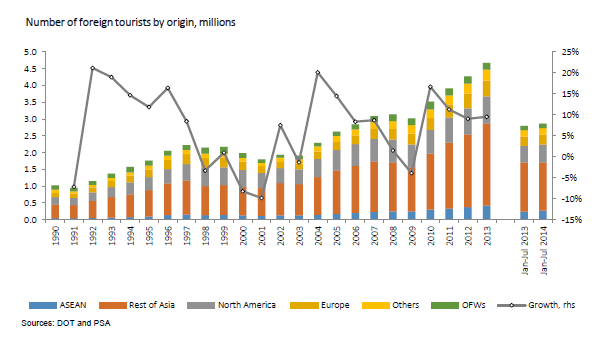

Philippine international arrivals reached 3.145 million in 2009, a small decrease of 1.5% from 2008 after several years of stronger growth that increased the total by some 50% since 2001 (see Figure 130). The number of foreign visitors is expected to climb modestly during the next few years, as the country’s three largest markets Northeast Asia, North America, and Europe recover from recessions.

View original figure here

View original figure hereFortunately, the Philippines is strategically located in the heart of the Asia Pacific region, which showed strong recovery in 2009 and is expected to receive 5-7% more visitors in 2010 according to the United Nations World Tourism Organization (UNWTO).158 The International Air Transport Association (IATA) also expects the region to be the world’s fastest growing area for tourism.

In 2009 intra-Asia Pacific travel surpassed North America as the world’s largest aviation regional market; IATA expects 217 million more travelers to fly within Asia by 2013. The UNWTO’s Tourism 2020 Vision forecasts that international arrivals are expected to reach nearly 1.6 billion by the year 2020. Of these worldwide arrivals in 2020, 1.2 billion will be intraregional and 378 million will be long-haul travelers.

Total tourist arrivals by region data shows that by 2020 the top three receiving regions will be Europe (717 million tourists), East Asia and the Pacific (397 million), and the Americas (282 million), followed by Africa, the Middle East, and South Asia. East Asia and the Pacific is forecasted to have record growth at rates of over 5% a year, compared to the world average of 4.1%.

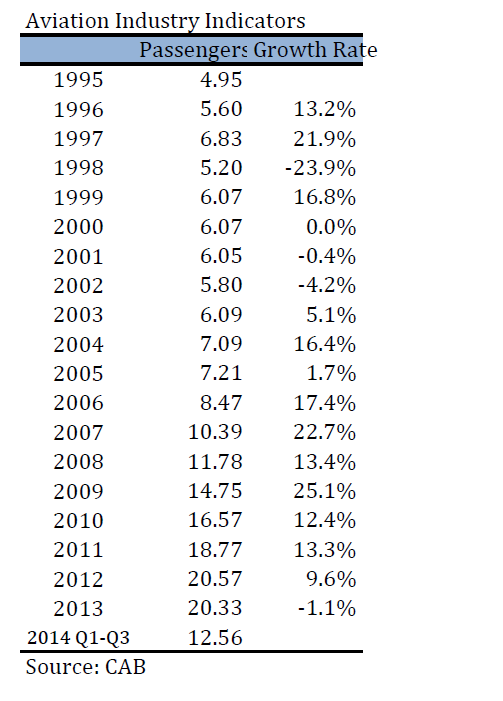

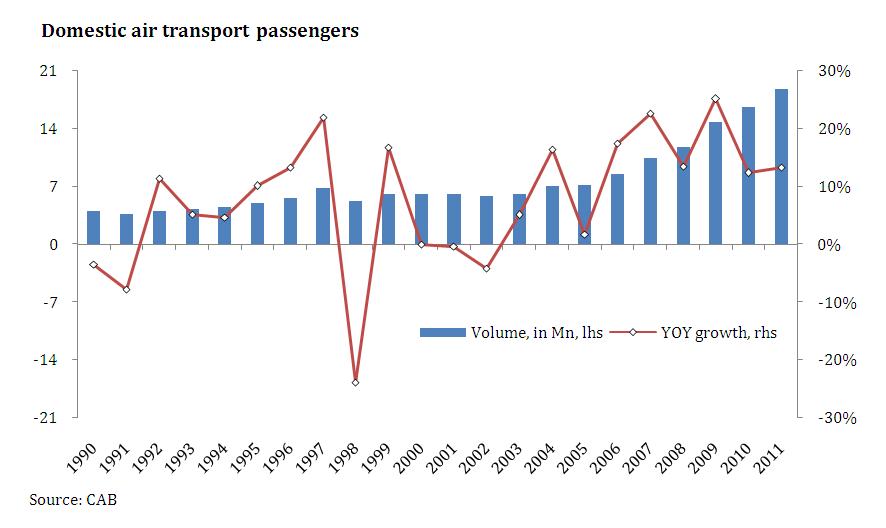

Domestic travel is the strong backbone of Philippine tourism, making it resilient during times of external vulnerabilities to health scares, terrorism, and global financial crisis, among others. In 2009 a group of 12 tourism destinations in the Philippines recorded a volume of 7.2 million arrivals with domestic travellers accounting for 79% of the total.159 Another indicator of the robust domestic travel market is the volume of domestic air passenger traffic, increasing by 25.1% in 2009 (see Figure 131 and Table 52).160

View original figure here

View original figure hereOf the 68 million international tourists recorded in Southeast Asia in 2008, only 4.8% visited the Philippines (see Figure 132). While the Philippines offers tourists many attractions, other Southeast Asian destinations are more favored by visitors: Thailand (14 million in 2008), Malaysia (21 million), Singapore (6 million), Indonesia (6 million), and Vietnam (5 million). Cambodia with 2 million and even Sabah (both destinations with open skies airports) could eventually move ahead of the Philippines. The speedy implementation of the new National Tourism Act should improve prospects for this high-potential sector with its high job creation coefficient.

View original figure here

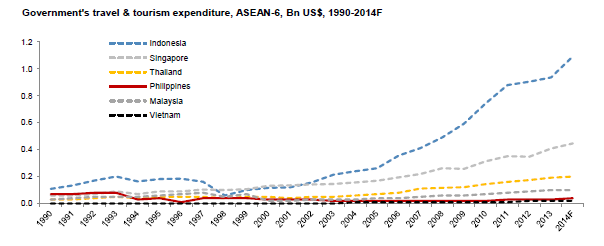

View original figure hereFigure 133 shows data for government consumption and investment spending on travel and tourism. The Philippines is spending more than Vietnam, the same as Malaysia, but less than Indonesia, Singapore, and Thailand. Government spending on travel and tourism includes estimates of government purchases, current and capital expenditures to provide travel and tourism services to the public on a collective basis (i.e. expenditures on highways and roads) and on an individual basis (i.e. budget for museums). These expenditures also comprise travel and tourism-related spending on equipment, land, buildings, and infrastructure. Travel and tourism public investment corresponds to the investment made on Travel and Tourism government programs.

View original figure here

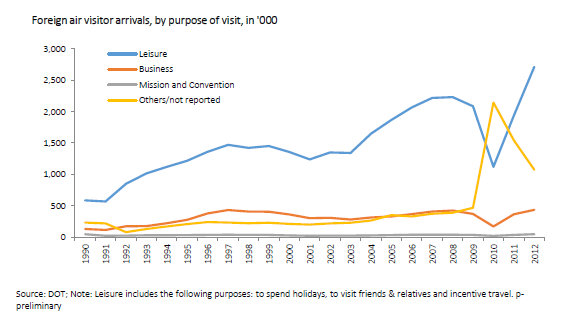

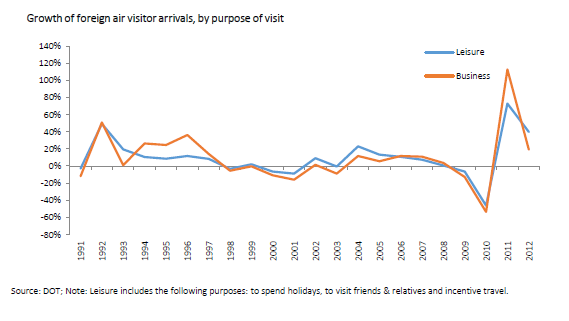

View original figure hereFigures 134 and 135 shows data on air visitor arrivals in the Philippines by purpose of visit. Tourists top the list of followed by those who come in for business reasons.

View original figure here

View original figure here View original figure here

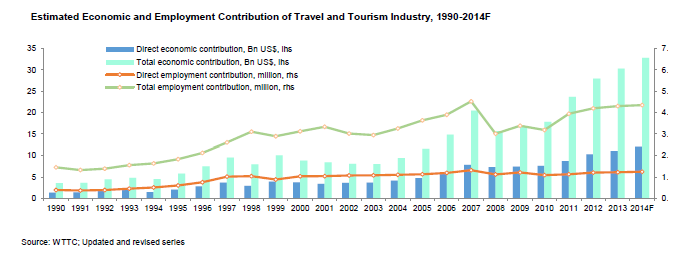

View original figure hereFigure 136 provides data on the direct and indirect economic and employment contribution of the travel and tourism industry to the Philippine economy based on estimates by the World Travel and Tourism Council (WTTC). In 2008 the WTTC estimated that tourism in the Philippines (both domestic and international) contributed 8.8% of GDP and 10.3% to national employment (3.3 million persons). The estimates by WTTC for 2009 reveal lower contributions of 6.9% to GDP and 8.5% to national employment due to the impact of the global financial crisis. The NSCB and the DOT jointly produced a Tourism Satellite Accounting System for the Philippines; the results showed an impact of 6.2% to GDP and 9.3% (3.2 million persons) national employment. Both studies by the WTTC and the NSCB confirm the important role of tourism in economic growth and development. Being labor intensive and drawing many of its inputs from the local economy makes tourism an excellent industry for meeting the imperative for employment creation in the country.

View original figure here

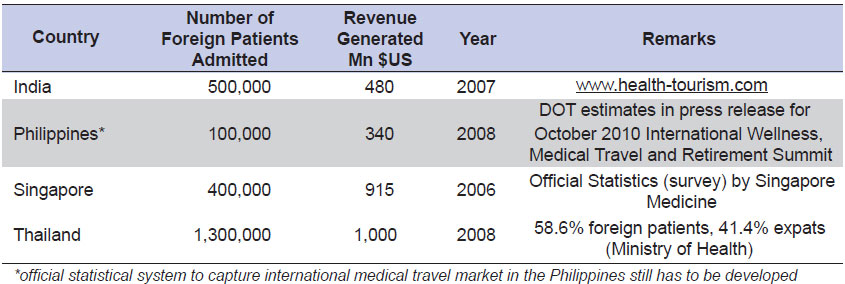

View original figure hereIn addition to standard tourism, medical travel and retirement by foreign nationals are two areas where the Philippines has high potential for competitive success. These are high yield markets since these visitors stay longer and spend more during their visits. Patients, for example, are accompanied by their families or friends who consume local goods, pay for non-invasive treatments (i.e. eye and dental check ups), visit spas and wellness centers, and tour various destinations in the country.

The growth of the medical travel market is driven by external developments in the global health care industry. Foreign patients travel overseas for a number of reasons. One, the treatments and facilities are not available at home or close to home, as in the case of developing countries. Second, they seek less expensive treatments and services, especially when they have to pay out-of-pocket for significant portions of their treatments. The US population, for example, includes an estimated 43 million medically uninsured and 120 million dental uninsured, and both numbers are likely to grow. Third, there are longer waiting times for treatment in the developed economies due to the relative lack of healthcare professionals and facilities. The Philippines offers a growing number of world class medical care facilities – although only in the national capital area – that currently serve foreign patients (see Table 53). Medical travel creates new opportunities for health care professionals and tourism suppliers through bundling of leisure, rejuvenation, and medical services.

Higher healthcare costs, declining fertility rates, and increasing longevity have exerted pressures on pension systems of a number of developed economies. Governments are seeking ways to take care of their growing elderly segment of the population. Incentives have been given to the younger population to build families and have more children. Immigration policies are being relaxed. Alternative solutions such as long stay programs and retirement communities overseas are also being explored. Foreign nationals are now moving to these countries with relatively lower costs of living and where they are socially acceptable.

The Philippines is one of those destinations seeking to attract foreign nationals to live in the country on a long stay or permanent basis. The government has offered a foreign retiree program for several decades, and in recent years the number of new participants has increased to 2,000- 3,000 a year, based on data from the Philippine Retirement Authority (PRA). The low cost of living, excellent weather, world-class medical care, recreational options, and the care and warmth of the Filipino people are pluses that support the high potential of the retirement subsector.

Context of Recommendations

Tourism’s contributions to the economy can be magnified considerably if the country can increase the volume of international visitors, which is still extremely low in comparison with top Asian country destinations, and domestic travelers, make them stay longer in a destination, and spend more. The key to unlocking the job creation potential of tourism is investment mobilization, by both the public and private sectors, individually or through public-private partnerships. From 2000 to 2009, cumulative tourism investments registered with the BOI reached PhP 38 billion, 81 percent (PhP 31 billion) of which was generated during the period 2005 to 2008. Tourism economic zone approved investments by the PEZA reached about PhP 25 billion with an employment impact of 13,576 for the period 2005 to 2007. Foreign direct equity investments in hotels and restaurants and real estate likewise jumped significantly from US$ 91.6 million in 2000-2004 to US$ 640.6 million in 2005-2009. These developments definitely contribute to sector capacity building in time for global recovery

Note however that the country has to catch up with the capacity of its regional neighbors (in terms of airport, seaport, and road infrastructure, tourism accommodation facilities, and services) in order to realize the vision of the Tourism Act of 2009 to transform the Philippines into a premier tourism destination in Asia, particularly for high yield markets such as international conferences, meetings, and exhibitions. Some popular tourist destinations are unable to meet demand for rooms.

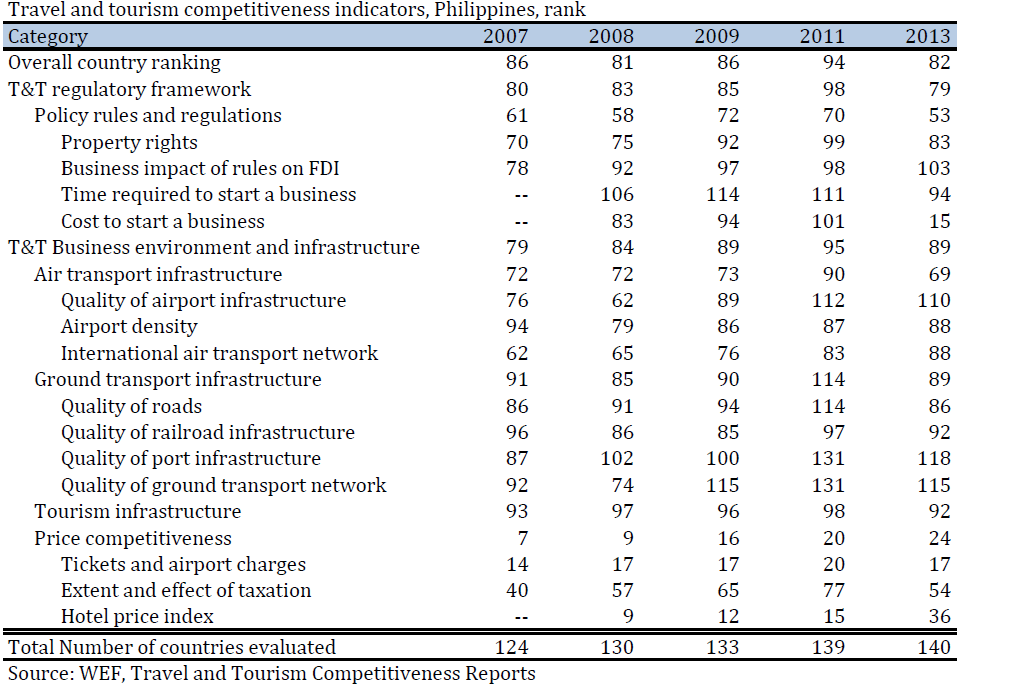

How can more investment be generated? The 2009 World Economic Forum Travel and Tourism Competitiveness Report enumerates issues that have also been raised by industry stakeholders in past years (see Table 54). The 2009 report shows that the Philippines has become less competitive (from 81st in 2008 to 86th out of 133 countries in 2009). The biggest decline is in the area of policy rules and regulations (from 58 to 72) and infrastructure, both critical for investment mobilization and sustainability.

A logical strategy to improve the tourism investment climate would be to focus on improving the areas of competitiveness ranked the lowest in order to improve future rankings.

International Connectivity

The most basic and crucial infrastructure for international tourism is air access. A high level of international airline connectivity is important to increasing the inflow of foreign visitors, whether they are tourists, patients, or retirees. An increasing number of direct flights by foreign airlines from major foreign airports to Manila, Cebu, Clark, and other international airports convenient to the most popular tourist destinations, medical facilities, and retirement communities are essential for foreign visitors to come and go from the Philippines as easily and inexpensively as possible. Open. air access will enable airlines to develop more efficient route networks and to quickly respond to market demand growth, offer more competitive fares, and offer services that will expand consumer choices. Promotional resources should also be largely concentrated in gateways and destinations that have the available infrastructure to accommodate more visitors and brands of tourism products to sell.

However, the Philippines has yet to catch up with its Asian neighbors in terms of the quality of its air transport network. According to the WEF Travel and Tourism Competitiveness Report, the country’s international air transport network rank declined from 62 in 2007 to 76 in 2009 (see Part 3 Infrastructure: Airports). This situation is not likely to improve as long as the US Federal Aviation Administration (FAA) downgrade and the EU blacklisting of RP carriers that have constrained the development of the North American and European tourism markets are in place. Furthermore, while liberal traffic rights have been negotiated in the past three years, foreign airlines, especially the long haul carriers, are not likely to significantly increase capacity to the Philippines given the current costs of doing business and investment climate.161

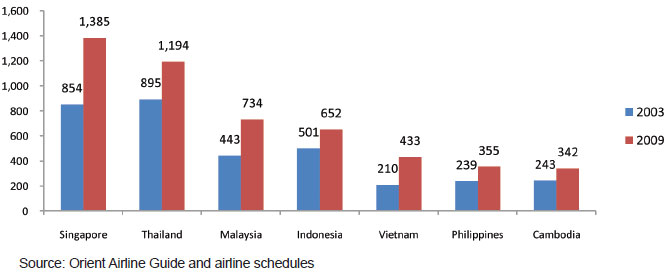

In fact, the Philippines is increasingly isolated from key tourism markets such as North America and Europe. Delta Airlines has reduced capacity from 24 (including 3 freighters) in 2001 to 12 in 2009. In 2001, there were 22 incoming flights per week by European carriers such as British Airways, Lufthansa, and Air France. Today, only KLM is left with daily services from Amsterdam. Vietnam has overtaken the Philippines in terms of attracting foreign carriers. It experienced the highest growth (106%) in flights by foreign air carriers from 2003 to 2009 (see Figure 137). Foreign carriers have significantly improved capacity in support of inbound tourism to Singapore, Indonesia, Vietnam, Malaysia, Indonesia, Thailand, and Cambodia but not to the Philippines (where increases in flights by foreign carriers in recent years primarily served the Overseas Filipino Worker traffic).

Costs of doing business and of travel

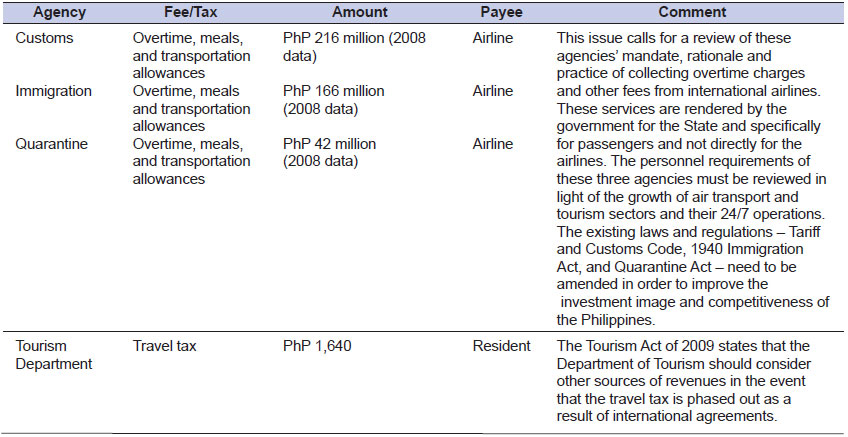

The relatively poor connectivity provided by foreign airlines operating in the Philippines can be partly attributed to the investment climate in the country. The Philippine government charges a number of taxes and fees that should be reviewed, reduced, simplified, or eliminated. IATA and the Board of Airline Representatives (BAR) have communicated strong opposition against the Common Carriers Tax (CCT) and the Gross Philippine Billings (GPB) imposed on foreign airlines operating in the Philippines. These taxes are not imposed by other countries and raise costs for foreign visitors vis-à-vis competitive destinations such as Malaysia, Thailand, and Vietnam. A tax regime comparable to international standards and practices will make the Philippines more attractive for foreign airlines as an investment destination, increase foreign tourism to the country, benefit the airline business (plus auxiliary services such as catering, maintenance and repair, food manufacturing) of PAL, Cebu Pacific, Zest Air, and SEAir, and expand the income streams of local tourism destinations.

Furthermore, the Philippines imposes overtime and special CIQ charges on airlines rather than providing these services at no cost or at low cost built into the ticket price. Airport landing fees charged foreign airlines are also much higher than the fees charged domestic flights (see Infrastructure: Airports). Travel tax-related procedures require some airlines to spend on additional manpower to handle about 34,000 travel tax documents per month.

Foreign airlines are already operating in Philippines at low profit margins, and these fees and taxes raise the risk that their services to the Philippines will be reduced, suspended, or terminated (see Table 55).162

Travelers also waste time and money due to airport and tax-related procedures. For foreign residents of the Philippines departing an international airport is an inhospitable hassle. For example, at Clark there are three lines (DOT, CIAC, and Immigration), credit cards are not valid, and only Philippine currency is accepted. Philippine residents exempted from the travel tax or entitled to reduced taxes need to spend extra time and money in order to secure certificates of exemption from the DOT.

For the Philippines to become an attractive foreign investment destination, especially for services such as tourism, logistics, IT-enabled, tele-health, backroom operations of companies, and the like, the government must facilitate the seamless placement and mobility of regional staff, support teams, and their families. This service economy stimulates the growth of international tourism – especially high yield business tourism. Foreign executives and staff based in the Philippines are required to pay fees for Special Return Certificate (SRC), Emigration Clearance Certificate (ECC), and Certificate of Exemption (CE) before each departure, head tax, legal research fee, fast lane fees, etc. The same fees are charged to family members. These procedures increase transaction costs (opportunity cost of time and funds) for investors in the Philippines. The Philippines has complex immigration processes relative to premier investment destinations in Asia. The strength of the Philippines in terms of quality of human resources is reduced and even nullified by the costs of doing business and burdensome government administrative procedures.

For day and destination wellness centers such as spas, especially those located in the countryside, enterprise owners have to send all their massage therapists to the DOH regional centers for their monthly venereal disease check up as required in the Sanitation Code of 1976 (Presidential Decree 856). Under the code, the term wellness center or spa is not used and defined. The facilities are classified as massage parlors and sauna baths. This code requires the owners of spas to allocate PhP 1,000 per message therapist to cover for transportation expenses and costs of the medical tests.

Many challenges must be overcome to make both medical travel and retirement grow robustly. For many foreign patients, their health insurance is not portable outside their home country. Fees charged by Philippine hospitals and doctors can often be non-transparent and confusing.

Current immigration policy allows visas of arriving foreigners a 59-day stay. The Bureau of Immigration (BI) is considering a proposal to allow longer stays, for example for medical visitors who require longer periods for doctors consultations, tests, operations, recuperation, and check-ups and also for potential participants in the retiree program who may wish to experience the Philippines and different provinces for one or more periods lasting several months before deciding to take up retirement residence in the Philippines.

Thailand offers such a long-term stay visa of unlimited one year multiple entry for the member and his/her partner. In Thailand, ease of entry and exit by the retirees is facilitated by the Longstay Management Company, a public-private partnership between the Tourism Authority of Thailand (30 percent ownership) and private stakeholders, set up to support the Longstay Tourism Development and Promotion project by the government. The Malaysian government introduced Malaysia My Second Home (MM2H) program in early 2000 as an international residency plan to allow foreigners to reside in the country on a long-stay visa of up to 10 years, and renewable.

Investment rules and regulations

Under the Tourism Act of 2009 (RA 9593), tourism economic zones can be designated by the newly created Tourism Infrastructure and Enterprise Zone Authority (TIEZA), upon the recommendation of any local government unit (LGU) or private entity, or through joint ventures between the public and the private sectors. Lands identified as part of a Tourism Economic Zone (TEZ) shall be exempt from the Urban Development and Housing Act (1992) and the Comprehensive Agrarian Reform Law but subject to rules and regulations to be crafted by TIEZA.

This provision means that the lands will be exempt from the coverage of Section 4 of Article II of Republic Act 7279 (which states that the LGUs may identify all lands in urban and urbanizable areas, including existing areas for priority development, zonal improvement sites, slum improvement, and resettlement sites, and in other areas as suitable for socialized housing). However, most lands with high potential are not prezoned and titled, thus increasing the lengthy land acquisition and conversion process.

Foreigners are not allowed to own 100% of Philippine lands and certain businesses. In the case of tourism, they can lease land for 50 years, renewable for another 25 years (as stated in RA 9593). Under the Retail Trade Liberalization Act of 2000, up to 100% foreign equity participation in restaurants is allowed for enterprises with a paid-up capital of US$ 2.5 million or more. Foreign equity participation of up to 40% is allowed in the operation and management of utilities (i.e. land, air, and water transport) including tourist transport operations. Executive Order No. 63 grants incentives to foreigners investing at least US$ 50,000 in a tourist-related project or in any tourist establishment.

There are two perspectives on this issue of allowing 100% foreign ownership of land and other businesses currently limited to Filipino nationals. There are stakeholders who expressed the view that foreign land ownership may be allowed but the size of land relative to the total land area of the country should be at the same level as other countries. It will be easier for the Philippines to attract foreign investment in tourism if 100% foreign ownership of land and certain businesses is allowed. On the other hand, 100% foreign ownership may not be a critical requirement for foreign investors, especially in LGU-based projects. The key is to pursue joint ventures and find a highly reputable partner who can expedite/facilitate investments (as in the case of Microtel and the Ayala projects). Joint venture (JVs) rules and regulations for government projects need to be reviewed in order to attract competitive players to tourism projects.

In the creation and operation of tourism economic zones under the Tourism Act of 2009, the rules and regulations for investors/locators must be simple, transparent, and consistent. They must be shielded from unnecessary interventions by LGUs. These rules must reflect the common or shared vision to promote tourism development as a vehicle for poverty reduction and sustainable development between the national and local governments and across all agencies. The investment climate will not improve if the vision is not supported by all agencies such as the DENR, DILG, DA, DAR, and the Land Registration Authority (LRA) that are critical in ensuring property rights protection for investors and local communities.

There are reforms that can be made that will increase the number of participants in the Philippine retirement program. These include clarifying land ownership, working privileges, visa categories, and building a network of retirement facilities and communities where foreigners of various cultural backgrounds are comfortable and cared for properly. Several foreign chambers of commerce have organized the International Chambers of Commerce Retirement & Healthcare Coalition (ICCRHC) to assist in the promotion or retirement and healthcare in the Philippines.163 This group also focuses on standards, international accreditation and cooperation, human capacity building, and provides a seal of good housekeeping to protect the interests of foreign retirees and patients.

“The current crisis has further highlighted that the Philippines is still a very small player(in tourism)…(and)… will continue to be the same small player even after the crisis in the absence of timely… and strategic responses to address the areas that have persistently contributed to low competitiveness in tourism… Now is the time to remove the obstacles to mobility and to competitiveness.”

—CRC paper, August 2009

Footnotes

- The top three are electronics, remittances, and IT-BPO.[Top]

- In computing the shares to total service exports and total Philippine exports, the adjusted values of tourism receipts (from the DOT visitor expenditure data) for the years 2006 to 2008 were used.[Top]

- www.wto.org[Top]

- Baguio City, Bohol, Boracay, Cagayan de Oro, Cagayan Valley, Camarines Sur, Camiguin, Cebu, Ilocos Norte, Davao City, Negros Oriental, and Palawan[Top]

- Given the varied means of transportation and many purposes of domestic travel, precise data for domestic tourists does not exist.[Top]

- From 2000 to 2009, the number of incoming seats per year increased from approximately 10 million to 30 million, largely due to the liberal bilateral air agreements signed in the past three years. The throughput number was 20 million in 2000 to 60 million in 2009.[Top]

- A number of foreign airlines have ended service to Manila in the last 15 years, including Air France, British Airways, United, and more recently Lufthansa[Top]

- Founding members are the American, European, Japanese, and Korean chambers[Top]