Annexes

ANNEX 1: SIGNIFICANT REFORMS THAT HAVE INCREASED

OPPORTUNITIES FOR FOREIGN INVESTMENT AND ENHANCED

THE INVESTMENT CLIMATE

Successive Philippine Government administrations have introduced significant reforms to improve the overall investment climate. Those which specifically increased opportunities for foreign investment, trade, and professional participation have been fewer, but among them are:

1966 – The Condominium Act (RA 4726) allows foreigners ownership of up to 40% of the total capital stock of condominium units and shares in condominium corporations. Recommendations made more recently to amend the law to apply it to industrial estates have not been adopted.

1969 – Bataan Trade Zone Authority (RA 5490) created the first free trade zone in the Philippines located in Mariveles, Bataan, allowing entry of foreign merchandise without being subject to Philippine taxes and duties. The law was intended to accelerate economic development by promoting of foreign commerce.

1972 – Export Processing Zone Authority (EPZA) (PD 66) created the EPZA to manage the export processing zone in Bataan and other such zones that will be established. Several fiscal incentives were provided for locators to encourage foreign export manufacturing in these zones, wherein three additional zones were established in Baguio, Cavite and Mactan (Cebu).

1980 to 2001 – Tariff Reform. Beginning with President Marcos through the next three presidents, the Philippines moved from quotas to tariffs (Import Liberalization Program) and reduced tariffs (Tariff Reform Program). President Macapagal Arroyo agreed to local industry pressures to raise tariffs somewhat. Average MFN tariffs declined from 9.7% in 1999 to 5.8% in 2003 then increased to 7.4 % a year later. Agricultural goods are more protected than manufactured products. Tariff quotas applied to 14 product categories as of 2005.

1986 – Privatization of Government-Owned and Controlled Corporations (GOCCs) (Presidential Proclamation 50) established a policy of privatization and prompt disposition of a large number of non-performing assets of government financial institutions or government owned or controlled corporations. This resulted in the sale of large (i.e., Petron, Philippine Airlines, Philippine National Bank) and many small government corporations and properties over the last two decades. Foreign interest in many of these assets was not high, especially when only minority equity ownership was possible. In two high profile transactions where the assets were awarded to foreign investors (Subic Shipyard and Manila Hotel), discrimination against foreign participation was imposed by the Supreme Court, which interpreted 1936 laws on public utilities and bidding on government procurement in favor of rival Philippine bidders who brought suit against the foreign investor.

1987 – Value Added Tax (EO 273) rationalized the then current system of taxing goods and services by imposing a multi-stage value-added tax to replace the tax on original and subsequent sales tax and percentage tax or certain services.

1987 – Restoring Private Sector Generation of Electricity (EO 215) restored the right of private corporations, including foreign-owned corporations, to construct and operate electric power generation plants. Billions of dollars have since been invested by independent power producers (IPPs) in new power plants. Since the first contract in 1988, more than 40 IPP contracts have been signed.

1987 – Omnibus Investments Code (EO 226 amended by RA 7918) created the Board of Investments and the annual Investments Priorities Plan (IPP). Up to 100% foreign equity in export enterprises is permitted. More generous fiscal incentives, including an Income Tax Holiday (ITH) of up to six years, are provided. Foreign

investment in domestic market activities is limited to 40% foreign equity in order to qualify for incentives unless consider a pioneer project or willing to commit to divest to 40% within 30 years.

1987 – Special Investor’s Resident Visa for Tourism-Related Projects (EO 63) grants incentives to foreigners investing at least US$50,000 in a tourist-related project or in any designated tourist establishments.

1990 – Philippine Build-Operate-Transfer Act (RA 6957, amended in 1993 by RA 7718), provides the legal framework which allows the private sector to build, finance, lease, maintain, operate, and own a variety of infrastructure projects such as power plants, highways, ports, airports and telecommunications regulated by government that support economic development. The law allows investors in BOT projects and similar arrangements to engage the services of Philippine and/or foreign firms for the construction of BOT infrastructure projects.

1991 – Foreign Investments Act (RA 7042 amended in 1996 by RA 8179) liberalizes the entry of foreign investments into the country by opening the domestic market more to 100% foreign investment project except in areas/sectors identified in the Foreign Investment Negative List (FINL). Allows 100% foreign ownership in domestic market activities above a minimum investment of $100,000 (with advanced technology or employing 50 direct employees), otherwise $200,000.

1992 – Bases Conversion Development Act (RA 7227) created the Bases Conversion Development Authority (BCDA), the Subic Bay Metropolitan Authority (SBMA) and the Subic Special Economic and Freeport Zone (SSEFZ), formerly known as the Subic Special Economic Zone and the Clark Special Economic Zone. The BCDA supports the commercial conversion of the former American military bases at Subic and Clark and their extensions (i.e., John Hay, Wallace, O’Donnell and Poro Point) to contribute to the economic and social development of central Luzon and the rest of the country. Fiscal incentives for registered enterprises include a tax of 5% of gross income earned.

1992 – Lifting of exchange controls on most current-account transactions.

1992 – Privatization of government ownership of Philippine Airlines.

1993 – Electric Power Crisis Act (RA 7648) gave the president “emergency” powers to increase electric power generation to solve the power supply shortage and brownouts that began in 1992.

1993 – Investors Lease Act (RA 7652) allows foreign investors to lease private land for up to 50 years, renewable once for an additional 25 years, for the establishment of factories, processing plants or the development of land for industrial or commercial use. Leases must conform with the Agrarian Reform law.

1993 – Telecommunication Competition (EO 109) increases competition in providing telecommunications services in order to expand coverage to underserved and unserved areas. EO 109 created an opportunity for new firms to enter the industry. Foreign investment up to 40% is allowed. After 15 years, one large firm and two smaller firms are competing vigorously against the previously single dominant service provider for the nation’s growing telecommunications market. Service has greatly improved while prices have fallen dramatically.

1994 – Insurance Sector Liberalization increased the number of foreign firms licensed to operate in the Philippines. Department of Finance (DOF) Order No 100-94 allows wholly-owned foreign insurance and re-insurance companies to operate in the country either as branches, newly incorporated subsidiaries or through the acquisition of existing domestic firms. Minimum capital requirements increase with the degree of foreign ownership.

1994 – Export Development Act (RA 7844) develops the export sector by granting incentives such as tax credits and exemption from duties for imported inputs and raw materials used in production.

1994 – Foreign Banking Liberalization Act (RA 7721) allows ten new foreign banks (in addition to the four existing foreign banks) to open full-service branches in the Philippines with a maximum of six branch offices. However, the law limits foreign ownership in locally incorporated banks to 60%. It allows new entrants to set up subsidiaries or buy into existing banks.

1994 – Ratification of the GATT and Accession to WTO wherein the government committed to remove import restrictions on sensitive agricultural products except rice, replacing them with high tariffs. The Philippines committed to bind tariffs in 2,800 industrial tariff lines, which represents 50% of total tariff lines. It also committed to reduce 66 tariff lines (42 agricultural and 24 in textiles and clothing) by the year 2004.

1994 – Domestic Shipping Deregulation (EO 185 and 213) which allows new operators to enter existing routes already served by franchised operators (EO 185) and; deregulates shipping passenger and freight rates (i.e., (EO 213).

1994 – Privatization of 60% equity in state-owned oil refinery.

1995 – Extension of land-lease period for foreigners from 50 to 75 years.

1995 – Special Economic Zone Act of 1995 (RA 7916, amended by RA 8748) created the Philippine Economic Zone Authority (PEZA) which establishes and regulates public and private sector economic zones for exports of goods and services. Locators may import free of duty and taxes; their income is subject to a 5% gross receipts tax, shared between national and local government.

1995 – National Water Crisis Act (RA 8041) gave the president “emergency” powers that assisted his reform policy to privatize the MWSS.

1995 – Domestic and International Civil Aviation Liberalization (EO 219) promoted greater competition within the Philippines and from the Philippines to other countries by Philippine carriers (at least 60% Philippine-owned). The monopoly long enjoyed by state-favored Philippine Airlines (PAL) was broken with the entry of Cebu Pacific, which today equals PAL in the domestic market and increasingly operates regional flights. There are three other domestic passenger carriers operate in the market. However, since airlines remain public utilities, foreign-owned carriers cannot enter the domestic market.

1995 – Mining Act (RA 7942) allows foreign investment by instituting a new system of mineral resources exploration, development and utilization through agreements known as Financial and/or Technical Assistance (FTAA). Fiscal benefits under the Omnibus Investments Code are specified

1997 – Manila water system privatized through two 25–year franchises

1997 – Investment Houses Law (RA 8366) increased foreign equity participation in investment houses from 40% to 60% and allows foreign citizens to sit on board of directors corresponding to the extent of foreign equity participation in the enterprise.

1998 – Oil Industry Liberalization Act (RA 8479) increased competition in the petroleum products market by allowing new entrants, including foreign oil retail firms, in the downstream oil industry (i.e., importing , refining, storing and distribution of petroleum products).

2004 – Alternative Dispute Resolution Act (RA 9285) promotes the freedom of the party to make their own arrangements to resolve their disputes. This law encourages and actively promotes the use of Alternative Dispute Resolution (ADR) as an important means to achieve speedy and impartial justice and declog court dockets.

2004 – Optical Media Act (RA 9239) ensures the protection and promotion of intellectual property rights through the regulation of the optical media as well as providing penalties for violating such act.

2004 – Domestic Shipping Development Act (RA 9295) supports the country’s shipping industry including ship-building and repair which provides much needed infrastructure for economic activity, and development by encouraging a modernized and safe domestic merchant marine fleet through fiscal incentives.

2004 – Securitization Act (RA 9267) promotes the development of the capital market by supporting securitizaiton, by providing a legal and regulatory framework for securitization and by creating a favorable market environment for a range of asset-backed securities. It rationalizes the rules, regulations, and laws that impact upon the securitization process, particularly on matters of taxation and sale of real estate on installment and pursues the development of a secondary market, particularly for residential mortgage-backed securities and other housing-related financial instruments, as essential to its goal of generating investment and accelerating the growth of the housing finance sector, especially for socialized and low-income housing.

2004 – Philippine Clean Water Act (RA 9275) mandates the protection, preservation and revival of the quality of our fresh, brackish and marine waters

2004 – Documentary Stamp Tax Elimination on Secondary Trading of Financial Instruments (RA 9243) exempts long-term insurance policies and pre-need plans from DST and imposes a DST on other evidences of indebtedness such as special savings accounts.

2005 – Lateral Attrition Act (RA 9335) provides for a system of rewards/incentives which shall cover all officials and employees of the BIR and the BOC whenever they surpass their collection targets.

2005 – Special Purpose Vehicle Act extension (RA 9343) extends RA 9182 (see above).

2006 – Expanded Value-Added Tax Law (RA 9337) replaces the more burdensome and cascading sales tax to increase effectivity of tax collection. EVAT is a tax on consumption levied on the sale of goods and services and on the imports of goods into the Philippines

2007 – Anti-Red Tape Act (RA 9485) promotes integrity, accountability, proper management of public affairs and public property as well as establishing effective practices aimed at the prevention of graft and corruption in government. This law promotes transparency in each agency with regard to public transactions adopting simplified procedures to reduce red tape and expedite transactions in government

2007 – Amnesty for Businesses in the Special Economic Zones and Freeports (RA 9399) declaring a one-time amnesty on certain tax and duty liabilities incurred by certain business enterprises operating within the special economic zones and freeports created under proclamation no. 163, series of 1993; proclamation no. 216, series of 1993; proclamation no. 120, series of 1994; and proclamation no, 984, series of 1997, pursuant to section 15 of Republic Act no. 7227.

2007 – Bases Conversion and Development Act amendments (RA 9400) converts Subic into a Special Economic Zone, same with Clark Military base, Poro Point Freeport Zone, Morong Special Economic Zone and John Hay Special Economic Zone. These aforementioned zones are to be managed by a separate customs territory ensuring free flow or movement of goods and capital within, into and exported out of the two economic zones

2007 – Biofuels Act (RA 9367) mandates the development and utilization of indigenous renewable and sustainable-sources clean energy sources to reduce dependence on imported oil and to mitigate toxic and greenhouse gas (GSG) emissions

2008 – Civil Aviation Authority (RA 9497) provides safe and efficient air transport and regulatory services in the Philippines by providing for the creation of a civil aviation authority with jurisdiction over the restructuring of the civil aviation system, the promotion, development and regulation of the technical, operational, safety, and aviation security functions under the civil aviation authority

2008 – Foreclosure Period Extended for Foreign Banks (RA 9501) is provided for in the Amended Magna Carta for Micro, Small and Medium Enterprises Act (RA 9501) which allows foreign banks the same period (5 years) to obtain optimum value as domestic banks in foreclosure proceedings involving real estate. Foreign banks will be allowed to bid for real estate in foreclosure proceedings, thereby avoiding undercutting of prices and failed auctions and encouraging foreign banks to lend, while respecting the constitutional provision on land ownership.

2008 – Individual Income Taxes Rate Exemption (RA 9504) exempts minimum wage earners from paying income tax, increases the exemption for all earners and allows additional exemptions for individuals with dependents and children.

2008 – JPEPA Ratification. The JPEPA seeks to promote a freer trans-border flow of goods, persons, services, and capital between the Philippines and Japan reinforcing existing bilateral economic relations.

2008 – National Grid Corporation Franchise (RA 9511) grants the National Grid Corporation of the Philippines a franchise to engage in transmitting electricity through high voltage interconnected transmission lines, substations, and relate facilities.

2008 – Credit Information System (RA 9510) creates a centralized credit information system which is expected to lower the risk of defaults and at the same time, improve the availability of credit, especially for small- and medium-sized enterprises. The implementation of this new law, creates a stronger and more transparent financial system.

2008 – Personal Equity Retirement Act (PERA) (RA 9505) encourages millions of Filipinos, at home and abroad, to save for retirement and will make more financial resources available to build the domestic capital market.

2009 – Special Visa for Employment Generation (SVEG) (EO 758) allows foreigners who invest in businesses which employ ten Filipinos and their spouse and children to receive a SVEG.

2009 –Renewable Energy Act ( RA 9513) accelerates the development and utilization of renewable energy such as biomass, solar, wind and ocean energy thereby minimizing dependence on fossil fuels. 2009 – Philippine Deposit Insurance Corporation reform (RA 9576) increases the guarantee for each depositor from Php 250,000 to Php 500,000.

2009 – National Tourism Policy Act of 2009 (RA 9593) declares a national policy for tourism as an engine of investment, employment, growth and national development.

2009 – Documentary Stamp Tax Exemption of Stock Transactions (RA 9648) seeks to permanently exempt from DST any sale, barter or exchange of shares of stock listed and traded through the stock exchange. This makes the Philippine Stock Exchange more competitive and increase transactions.

2009 – Bureau of Food and Drugs Act Amendments (RA 9711) strengthens the regulatory capacity of the Bureau of Food and Drugs (BFAD) by establishing adequate testing laboratories and field offices, upgrading its equipment, augmenting its human resource complement, giving authority to retain its income, converting it into the Food, Drugs, Cosmetics and Devices Administration (FDCDA) and amends certain sections of Republic Act 3720

2009 – Cooperatives Code (RA 9520) encourages the creation and growth of cooperatives as a practical vehicle for promoting self-reliance and harnessing citizens towards the attainment of economic development and social justice.

2010 – Customs Brokers Act Amendment (RA 9853) Amends RA 9280 which removed the prohibition on corporate practice of customs brokerage as long as the company hires licensed customs brokers.

2010 – Residential Free Patent (RA 10023) provides residential owners efficient, effective and affordable methods to title their lands by means of securing property rights, facilitating land transactions and to use their land titles as a guarantee for loans.

2010 – Real Estate Investment Trust (RA 9856) encourages the development of the capital market and expanding the participation of Filipinos in the ownership of real estate in the Philippines. Also, the Act enables Filipinos to use the capital market for infrastructure development by facilitating a regulatory framework.

2010 – Pre-Need Code (RA RA 9829) establishes a new regulatory framework for the operation of pre-need companies and to protect plan holders. This measure seeks to address the growing problems of the pre-need industry such as the trust fund deficiencies.

2010 – Tax Information Exchange (RA 10021) amends sections 6(F), 71 and 270 of the National Internal Revenue Code of 1997 which allows the exchange of information between the Bureau of Internal Revenue and foreign governments regarding tax matters following internationally-agreed tax standards and imposing penalties for violators.

2010 – Revised Kyoto Convention (RKC) is the accession of the Philippines to the harmonization of the international customs measures and procedures embodied in the Revised Kyoto Convention.

2010 – Anti-Camcording Act (RA 10088) prohibits and penalizes the unauthorized use, possession and/or control of audiovisual recording devices for the unauthorized recording of cinematographic films and other audiovisual works and/or their soundtracks in an exhibition facility.

2010 – Corporate Recovery Act (RA 10142) provides regulations for the rehabilitation or liquidation of financially distressed enterprises.

ANNEX 2: PAID HOLIDAYS IN SELECTED ASIAN ECONOMIES

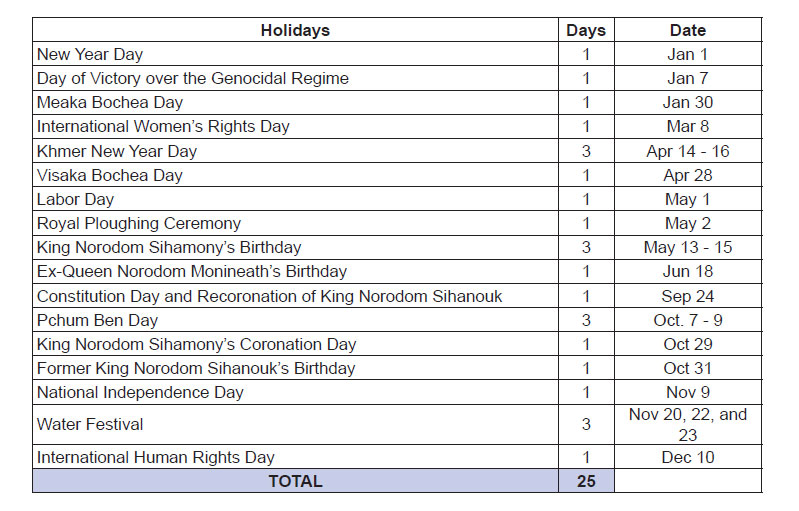

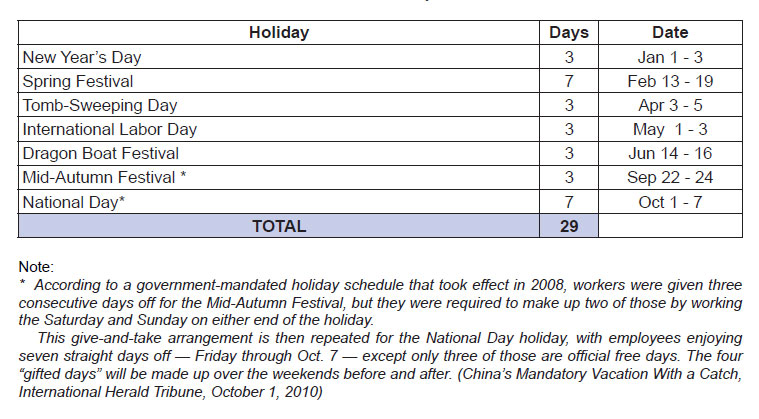

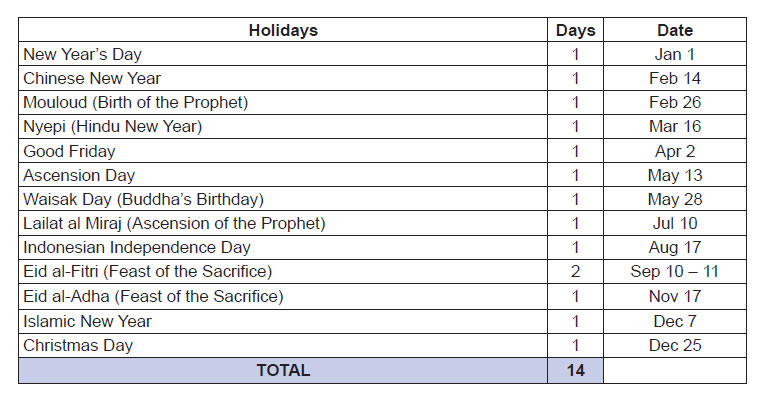

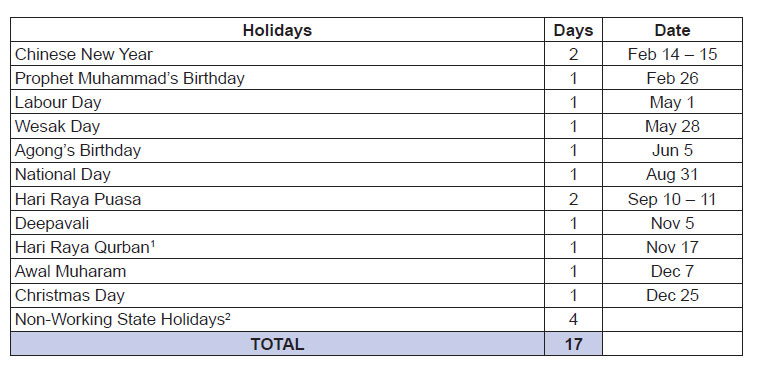

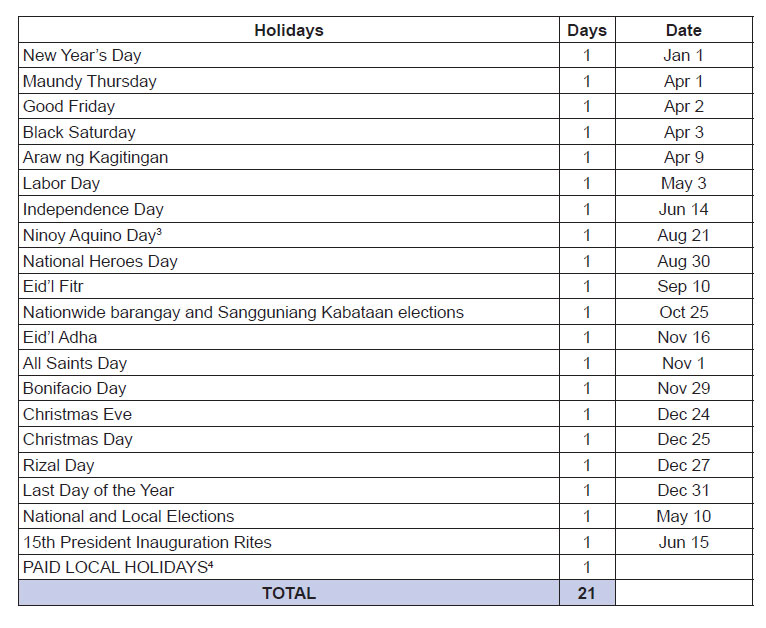

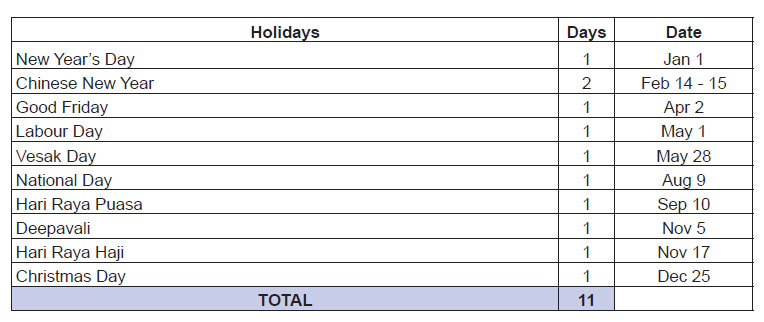

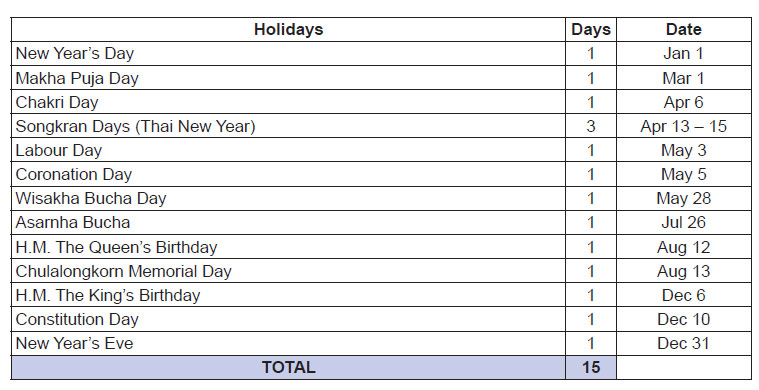

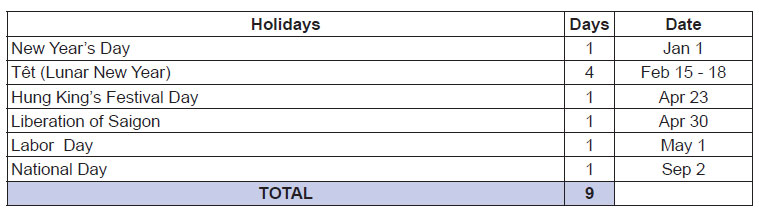

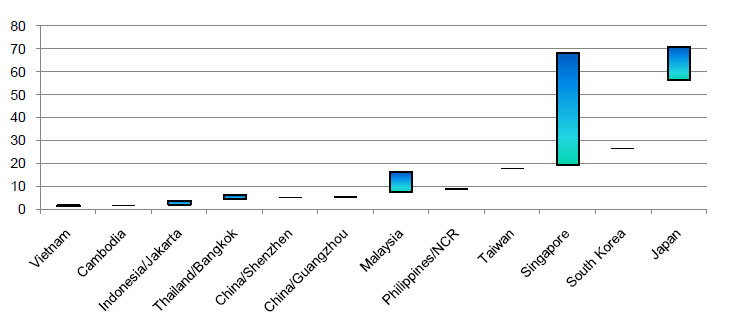

In mid-2010, the American Chamber of Commerce of the Philippines conducted a study on paid holidays and minimum wages of the ASEAN-6 (Indonesia, Malaysia, Philippines, Singapore, Thailand, and Vietnam) and other Asian economies (Cambodia, China, Japan, Korea, and Taiwan). Results of the study show that China, Cambodia, and the Philippines have the highest number of paid holidays. Those with the least number of paid holidays were Taiwan, Singapore and Vietnam. The average number of paid holidays of the ASEAN-6 is 14. The Philippines is above the average with 20 paid holidays in 2010 (See Figure 1).

Tables 1 to 11 present the lists of paid holidays for each of the 11 economies covered in the study.

To supplement this study, the minimum wages of the selected economies were also examined. Among the ASEAN-6, the Philippines has one of the highest minimum wages. China, Thailand, and Indonesia have lower minimum wages. Vietnam and Cambodia have the lowest minimum wages. Taiwan, Singapore, Korea, and Japan have the highest (See Table 12).

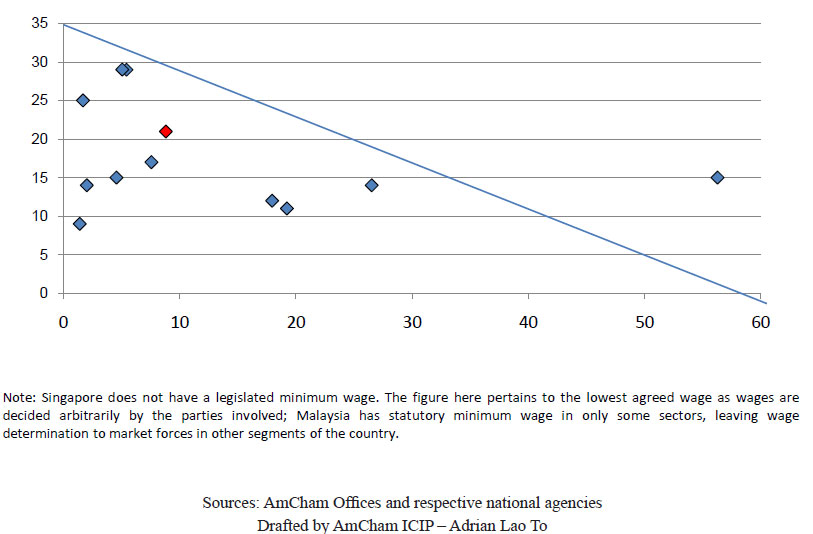

Figure 3 combines these two factors of labor costs into a scatter chart. The closer an economy is to the lower left corner of the chart, the more competitive it is with respect to minimum wages and paid holidays. Vietnam, Indonesia, Thailand, and Malaysia are the most competitive among the 11 economies studied.

Table 2: Paid Holidays, China

Table 3: Paid Holidays, Indonesia

Table 4: Paid Holidays, Japan

1 Only two States (Kelantan & Terengganu) celebrate this holiday as a two-day event.

2 This is the average number of paid state holidays for the sixteen states of Malaysia.

3 Ninoy Aquino Day was enacted by virtue of RA 9256 of 2004 signed by President Gloria Macapagal Arroyo and was set at August 21. In 2007, RA 9492 (Holiday Economics Law) was enacted and the holiday was moved to the Monday nearest August 21. Ninoy Aquino Day was moved back to August 21 by order of President Benigno Aquino III by the virtue of Proclamation 13 enacted on August 11, 2010.

4 Further research is needed to determine how universal local non-working days were rationalized in 1987. We do know that in recent years they have become common in most parts of the Philippines. Accordingly, this table counts one such holiday per year.

Figure 2: Daily minimum wage range, selected Asian countries, 2010, US$

Table 12: Comparative wages, selected countries, $US per day

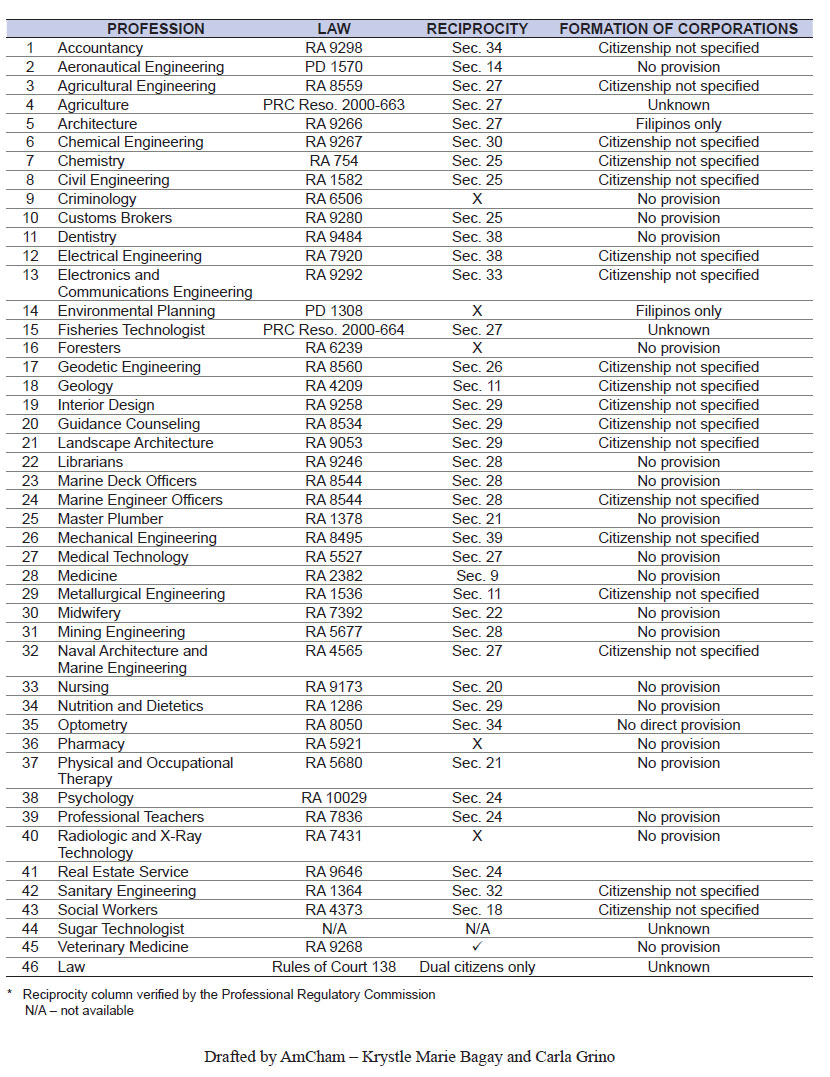

ANNEX 3: LEGISLATION ON PROFESSIONS

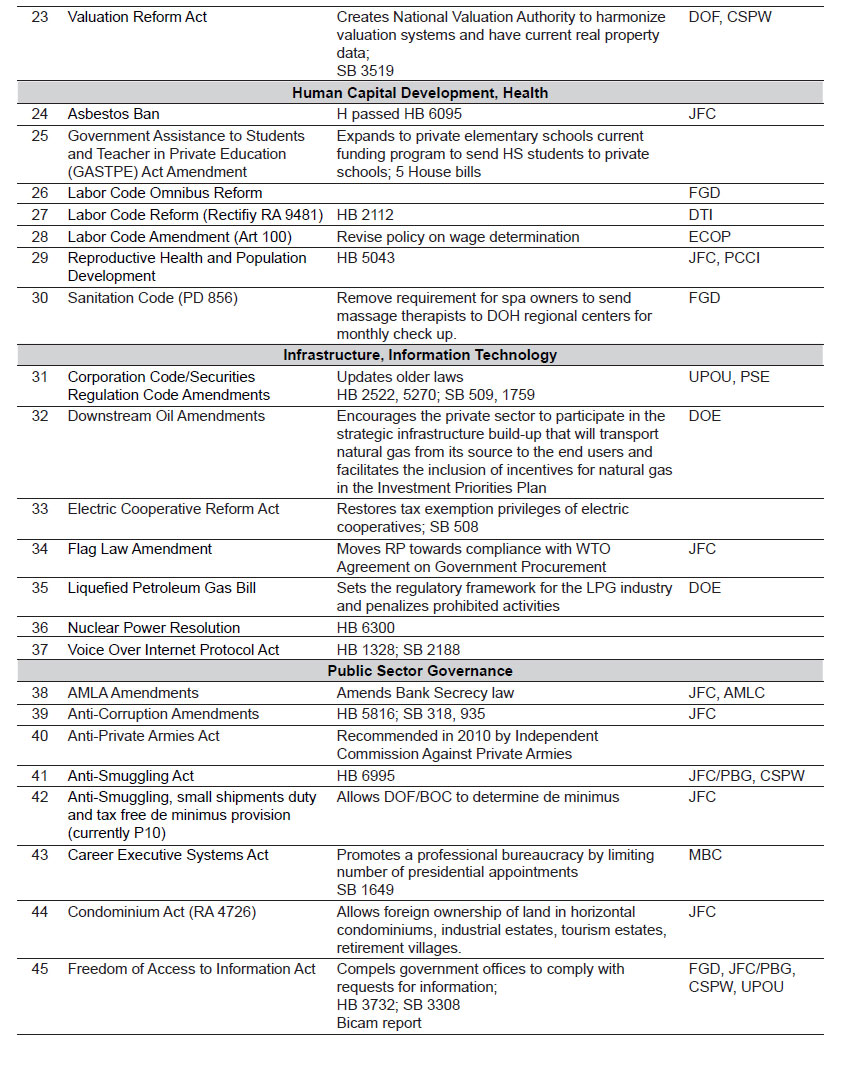

ANNEX 4: OTHER LEGISLATIVE PRIORITIES

5 Relevant bills introduced in 14th Congress are cited. When no bills are cited, Roadmap authors are unaware of any draft legislation.

6 December 1999, “Report of the Preparatory Commission on Constitutional Reforms” and December 2005, “The Proposed Revision of the 1987 Constitution by the Consultative Commission, with Highlights and Primers on the Major Proposals and Background Information on the Consultative Commission.”