Foreign Equity and Professionals

All countries allow, prohibit, or restrict foreign economic activity within their territory to varying degrees. Even extremely open economies such as Singapore and Hong Kong maintain some restrictions.205 In the 21st century, the movement of workers and professionals remains highly restricted throughout the world and is a sensitive political issue in many capitals. In contrast, equity capital and goods move across borders with fewer barriers than ever before. And ideas and information can move almost instantaneously with modern communications, albeit sometimes blocked by the few governments that attempt to control online access of their citizens.206

The Philippines is increasingly linked to these global flows – of goods, ideas, money, and people. The Filipino economy depends heavily on remittances from nationals whose labor other countries need. Some products made in the Philippines are in use throughout the world.207Filipino capital also crosses borders into a considerable variety of corporate investments and private bank accounts.208

With such strong and growing global ties, the people of the Philippines have moved ahead of their government and the mindset of some public and private sector leaders who support restrictions on the participation of foreigners in the Philippine economy. In an economy with high unemployment and underemployment, the paramount national interest should be creating jobs in the domestic economy. It follows that attracting more foreign capital, professionals, and technology to create jobs should be a high priority.

“In an age when grow is the result of free movement of investments across borders to areas of greatest efficiency, we have restricted investments. A native oligarchy has used economic nationalism to inhibit trade and prevent investors to come in and compete. The oligarchy, ironically, enjoys ideological support from the political left which is hopelessly trapped in 19th century view of economic processes”

—First Person, Alex Magno, Philippine Star, March 11, 2010

There has been considerable public discussion of constitutional restrictions on foreign equity, including by two commissions appointed by two presidents, but proposals to change other restrictive practices are rare.209The only change in the Foreign Investment Negative List (FINL) since limited foreign investment in retail trade was allowed in 2000 was the opening in 2010 of gambling casinos to majority foreign equity.210

Reforms that should result in more foreign participation in the economy have not been a priority for the government. Several JFC recommendations to the DTI, DOF, and NEDA to liberalize the FDI regime and professions have not gained traction for lack of senior policy direction. The JFC in December 2008 wrote former President Macapagal Arroyo to suggest a government study to recommend policies and actions to make the FINL less negative. Although DTI and NEDA subsequently met with the JFC, none of the suggested changes in the FINL have been made.

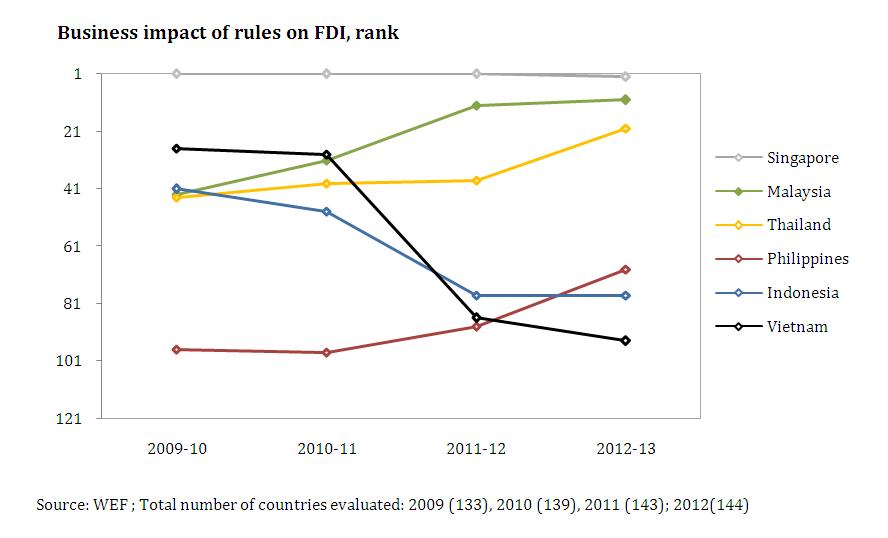

In addition to constitutional restrictions, there are dozens of other restrictions on foreign equity and foreign professionals as well as discriminatory taxes and fees, from which Filipinos but not foreigners are exempt, that should be reviewed to see if they meet the national interest of creating jobs. Figure 167 shows the Philippines significantly lagging behind the rest of ASEAN-6 and ranking in the bottom third of all countries surveyed (98 out of 139) in having a regulatory regime favorable to foreign investment.

Several ASEAN-6 countries are reforming their restrictions on foreign investment. Malaysia’s new prime minister Najib Tun Razak in March 2010 announced a “New Economic Model” that would reform the extensive system of investment and hiring restrictions discriminating in favor of the majority ethnic Malays but which were keeping away capital. For the past few years, foreign direct investment in Malaysia has slowed to a trickle in an economy that used to be one of Southeast Asia’s dynamos. Prime Minister Najib wants Malaysia to increase per capita income from the current US$ 7,000 to US$ 15,000 in 10 years.

Indonesia in June 2010 issued Presidential Regulation No. 36 regarding the List of Businesses Closed or Conditionally Open for Capital Investment which made important changes to its negative investment list, which limits foreign ownership in companies. Health care and education are among the sectors in which increased foreign investment is permitted. The new decree opened to varying degrees some 40 sectors to increased foreign investment.

Constitutional restrictions

Constitutional restrictions on land ownership and public utilities in place since 1935 are the most formal barriers to foreign participation in the Philippine economy. Relaxing them would ease the entry of foreign capital needed for further modernization and growth and could increase competition in these sectors, benefiting the entire economy. Other constitutional restrictions limit foreign investment in advertising, education, media, and natural resources.

While there appears to be a consensus to remove these and other constitutional restrictions on foreign equity and to replace them with legislation, these reforms have become enmeshed with controversial political proposals to shift from the presidential system (in place since 1935) to a unicameral parliamentary system and to reduce central government authority under a new federal system. The timing and method of amending the foreign equity restrictions of the constitution will remain controversial as long as there is a perceived probability that any single political group will employ the so-called “cha-cha” to increase its political power.211

• Education

Education is increasingly globalizing, with American and other foreign universities opening campuses and establishing educational alliances with schools in other countries. China is reported to have more than 700 such arrangements. Singapore is attracting Asian students to programs at their campuses partnered with top American universities. Major US universities are opening campuses in Abu Dhabi and Doha.

Foreign equity, foreign management, and foreign national teachers are restricted in the education sector in the Philippines. However, a large opportunity exists for the Philippines to provide educational services to many more foreigners than currently studying in the Philippines. The country can be cost-competitive for students in the region who cannot afford the high tuition and living expenses to study in developed countries.

Liberalizing restrictions could involve allowing foreign investment in educational institutions, permitting foreign management to accompany such investment, and inviting foreign teaching staff to complement teaching and research capacities of Philippine universities.

English proficiency in the Philippines gives the country a special advantage in offering educational programs for students from the fast growing middle classes of the Asian region to study English as a second language. Educational tourism, where studying English and local tourism are combined, is already popular among Korean visitors. The Philippines can also write and publish English teaching materials for export as well as on-line use.

While a key to creating an important hub for English and other programs is to liberalize restrictions, this should be accompanied by a regulatory program to assure high standards and quality of foreign education providers, while also respecting Philippine cultural and social values.

• Land

The ban on foreign ownership of land, in Article XII of the 1987 Philippine Constitution, is total. However, foreigners may lease land for up to 50 years, renewable for another 25 years.212 Still, leasing land involves legal expenses and complications, and as a result some foreign companies have either left the Philippines or not made investments. Allowing foreigners to own land for industrial and commercial purposes and limited ownership for residential purposes would simplify current arrangements and benefit the economy by increasing investment in businesses using land, such as manufacturing, property development, and tourism. Within ASEAN, Philippine land ownership policy is viewed as more restrictive. The Filipino business community generally supports some foreign ownership of residential, commercial, and industrial lands. Foreign ownership of agricultural land is more sensitive.

• Public utilities

The 1987 Philippine Constitution states that only firms owned at least 60% by Philippine nationals or corporations may be approved to operate a public utility.213 The pre-war Public Utility Act was originally intended to reserve 60% majority ownership in public utilities to American and Filipino investors. After 1946, American owners had to sell down to 40% equity.

There is variance, through legal solutions to the restrictions in ownership of public utility sectors, with foreign equity sometimes exceeding the 40% ceiling in the law and the constitution. Foreign equity capital has invested in some public utility sectors, particularly telecommunications. The 60-40 ownership rule is nominally observed, so long as Philippine citizens and firms exercise 60% of voting rights. Under the Control Test, more than 40% equity in a firm may be foreign owned, a practical solution when local capital is insufficient to finance large infrastructure projects.214 However, the legal fees required to set up these arrangements and erratic judicial and administrative application of laws and rules often discourage foreign investors who prefer a legal regime with more predictability.

While the eventual removal of the current 60-40 ownership rule from the constitution is highly desirable, policy planners should not wait for “cha-cha” to improve the environment for domestic and foreign investors in large infrastructure projects. Extensive studies by AusAID, the ADB, and the WB provide recommendations for an improved institutional, legal, and regulatory framework for increased infrastructure investment. As a prerequisite, large infrastructure firms must be offered sufficient incentives including confidence in the fairness of the investment climate.

The limit on foreign owners in the management of public utilities is also found in Section 11 of the Philippine Constitution and its removal also requires a constitutional amendment. The 1999 and 2005 constitutional commissions recommend removal of both the equity and management restrictions from the constitution.

• Professions

The constitution creates a policy bias in favor of Philippine citizens, but not a strict legal barrier to the participation of foreign professionals. Most of the laws regulating professions contain reciprocity provisions. However, the provisions are administratively difficult to satisfy, and very few foreign professionals apply to the Professional Regulatory Commission (PRC) other than for temporary permits. With Filipino professionals leaving the country in great numbers for higher-paying jobs abroad, few foreign professionals are likely to work in low-paying professions in the Philippines, even if the current restrictive practices are relaxed.

Although the constitutional language states that “the practice of all professions in the Philippines shall be limited to Filipino citizens,” this statement is immediately followed by “save in cases prescribed by law.” There are 45 laws governing the practice of specific professions, and 40 contain “reciprocity” provisions allowing foreigners to practice their profession in the Philippines, provided their countries of origin also allow Filipinos to practice these (see Annex 3). In addition, a Supreme Court rule limits the practice of law to Philippine nationals. Five laws regulating criminologists, environmental planners, foresters, pharmacists, and radio and x-ray technologists state the profession is restricted to Philippine nationals and contain no reciprocity provision.

Because millions of Filipinos work abroad and support the Philippine economy with their remittances, it should be in the national interest to seek the reduction of restrictions on professionals in other countries, for example, in the negotiations on the General Agreement on Trade in Services (GATS) under the WTO and the ASEAN Framework Agreement on Services (AFAS).215 At the same time, having more foreign professionals practicing in the Philippines can bring new skills, ideas, connections and integration into global networks of service providers, and support sunrise sectors like R&D, medical travel and retirement.

All of the Seven Big Winner sectors will benefit from having foreign professionals working with Filipino professionals to develop the high growth potential of the sectors. In short, more foreign professionals practicing in the Philippines will mean more jobs for Filipinos at home.

Restrictions in legislation

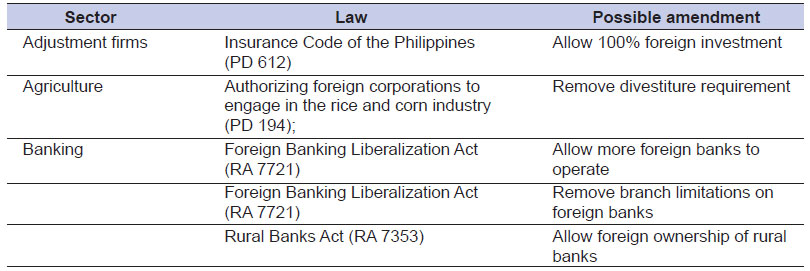

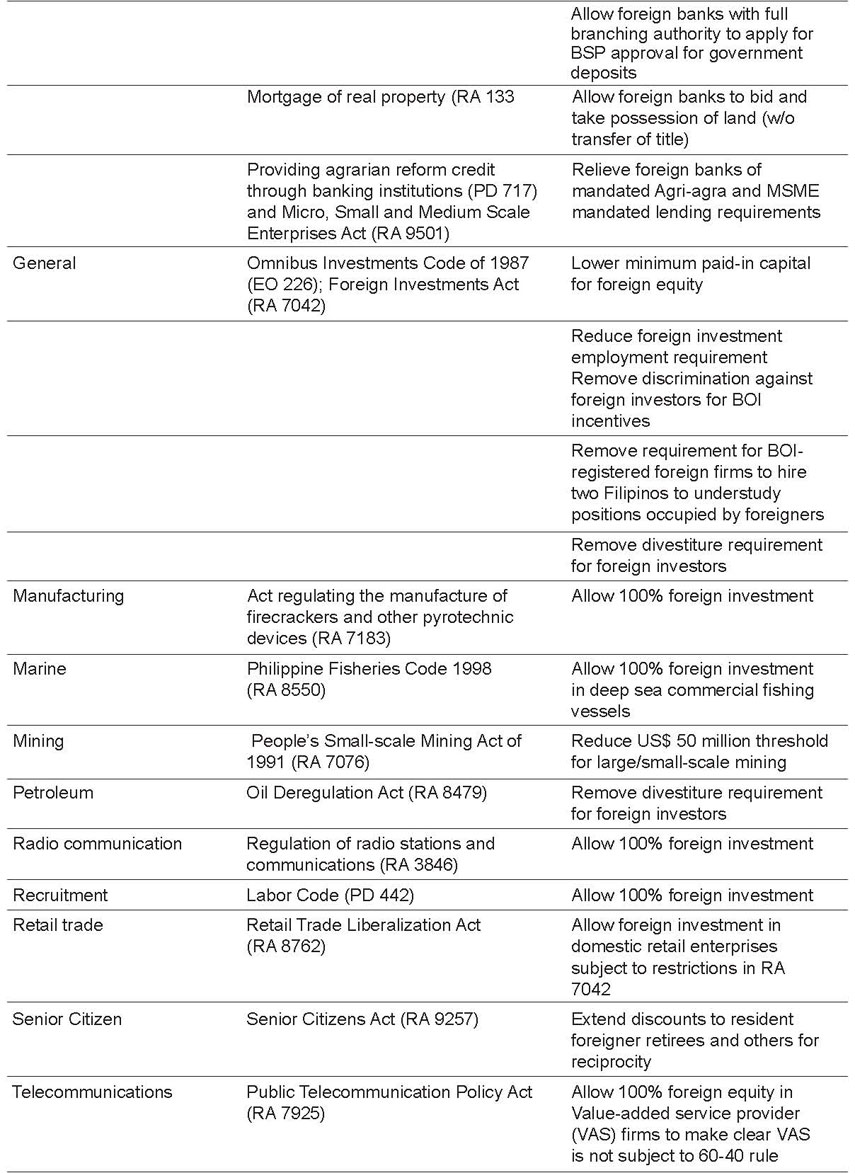

While constitutional restrictions on foreign capital and foreign professionals are hard to change, restrictions in legislation should be easier to liberalize through amendments to the restrictive provisions. Many such restrictions are scattered through various laws, some quite old. Most have rarely if ever been reviewed to determine whether they are still in the national interest, especially whether they do or do not meet the goal of creating jobs.

The introduction of the FINL was a major reform in 1991, improving transparency for foreign investors with a negative list of business activities foreign investors could not engage in or would be allowed to invest in for less than 100% equity. While the list is reissued every two years, it has become static. Only two substantive changes (retail trade and gambling) have been made in the last decade. Separate legislation governs the banking sector; restrictions on foreign banks are not listed in the FINL.

Despite a requirement in the Foreign Investment Act that the minimum equity for a foreign investment project should be US$ 200,000 (only US$ 100,000 if employing at least 50 persons or using new technology), EO 758 created a Special Visa for Employment Generation (SVEG) which allows foreigners who invest in businesses employing ten Filipinos and their spouse and children to receive a SVEG.

There has been no reform program in government to review the FINL to determine whether existing restrictions continue to be necessary. While two commissions have reviewed the constitution’s foreign equity restrictions and recommended they be removed and instead be addressed in legislation – or not at all – no such review has taken place for other legal restrictions. Year after year, government departments apply the same laws without taking any initiative to change them. Such a review is overdue.

Headline Recommendations

- A high-level commission should review current restrictions in the FINL and elsewhere and propose remedial measures, considering which will most increase investment and create jobs.

- Pending constitutional revision, creative but legal solutions, including the control test, should be applied to 60-40 ownership provisions, in order to increase investment and create jobs.

- Because foreign professionals can enhance national competitiveness and create jobs, the PRC should liberalize its procedures to accredit foreign professionals. The FINL should not include professionals. Philippine diplomacy should pursue global openness for Filipino professionals. Distinguish ownership of companies that provide professional services and execution of medical services.

Recommendations (12):

A. Create a commission, with NEDA as its secretariat, to review various restrictions on the participation in the Philippine economy of foreign equity and professionals, taking into consideration whether the restrictions impede job creation and competitiveness. The commission should consider the recommendations of the 1999 and 2005 constitutional review commissions, study the current FINL and banking laws, consult with stakeholders, and make recommendations to the president for reforms within six months. (See Table 66) (Immediate action OP, DOJ, PRC, and NEDA)

B. At the appropriate time, support practicable efforts to remove all economic restrictions from the 1987 Philippine Constitution. To achieve a level playing field, consider zero or minimal successor restrictions, after their removal from the constitution. (Private sector)

C. In order to develop the country as an education hub, especially for English, encourage foreign investment in education and more foreign teachers and researchers to practice in the Philippines. Find a way to do this in a legal and practicable manner. Grant longer single-entry visas for tourists and students coming to the Philippines for short-term study purposes. (Immediate action BOI, DOT, and CHED)

D. Anticipating that foreign ownership of land will be allowed when the constitutional restriction is removed, prepare a list of principles governing future foreign ownership of agricultural, commercial, and residential land to be followed in enabling legislation. (Medium-term action by DOJ and private sector)

E. Adjust the FINL to make explicit that foreign ownership of land in horizontal condominiums, industrial estates, tourism estates, retirement villages, and similar real estate arrangements is allowed. (Immediate action NEDA)

F. The commission should also conduct a review of laws and IRRs for all regulatory agencies to determine the extent to which each can authorize exceptions to 60-40 public utility equity rules (as in the MARINA special permit authority). (Immediate action OP, DOJ, NEDA, and regulatory agencies)

G. Maintain the “control test” not “grandfather rule” in respect to the 60-40 rule for equity in public utilities. Consider language for regulated public utility sectors similar to Section 6 of the EPIRA (RA 9136), which clearly states that power generation shall be competitive, not be considered a public utility, and not require a franchise. (Action DOJ)

H. Remove the practice of professions from the FINL, where it is not a germane provision in a document created by the Foreign Investment Act and intended to catalogue limitations on foreign equity in non-banking business sectors. Clarity is also needed to distinguish ownership of companies that provide professional services and the execution of medical services. (Immediate action NEDA)

I. Encourage the PRC to relax its interpretation of reciprocity provisions and announce a new policy to invite foreign nationals in professions that are needed to support the Seven Big Winner sectors to apply to work in the Philippines. (Immediate action PRC with support of appropriate departments, including DA, CICT, DENR, DOH, DOLE, DOT, and DTI)

J. File bills to open the practice of professions now closed by law to foreign nationals (criminology, environmental planning, foresters, pharmacists, radio, and x-ray technology). (Long-term action PRC, Congress, and private sector)

K. Encourage Philippine legal associations and the Supreme Court to support changing the rule of the court limiting the practice of law to Philippine nationals to allow foreign lawyers to practice. (Immediate action SC and private sector)

L. Consistent with the current role of Philippine professionals in the global workplace, Philippine diplomacy should seek increased opportunities for Philippine professionals to work abroad, pursuing these in negotiations on the GATS and AFAS. (Immediate action DOF, PRC, DOLE, and DTI)

Footnotes

- E. g. Hong Kong does not allow gambling casinos. Nor did Singapore until recently.[Top]

- Facebook cannot be accessed in China and Vietnam.[Top]

- E.g. Watches and automotive wire harnesses made in Cebu, semiconductors made in Baguio and Clark, aviation parts for Airbus and Boeing made in Baguio, transmissions and cars made in Laguna, and garments made on Luzon.[Top]

- ICTSI operates ports in many countries. Ayala owns call centers in the US and Central America. Jollibee and other Filipino retailers have foreign outlets.[Top]

- Investors Lease Act (RA 7652) allows foreign investors to lease land for a maximum of 50 years, renewable once for up to 25 years, for the “establishment of industrial estates, factories, assembly or processing plants, agro-industrial enterprises, land development for industrial, or commercial use, tourism, and other similar priority productive endeavors.”[Top]

- “Article XII, Section 11. No franchise, certificate, or any other form of authorization for the operation of a public utility shall be granted except to citizens of the Philippines or to corporations or associations organized under the laws of the Philippines, at least sixty per centum of whose capital is owned by such citizens; …The participation of foreign investors in the governing body of any public utility enterprise shall be limited to their proportionate share in its capital, and all the executive and managing officers of such corporation or association must be citizens of the Philippines[Top]

- The 60-40 limitation originates in several colonial era laws. A 60-40 limitation in the old foreign investment law for firms that were not exporting was removed in 1991 when the FINL was introduced in RA 7042, amended in 1996 by RA 8179.[Top]

- AFAS opens ASEAN economies for seven professions on a reciprocal basis but only for nationals of the participating ASEAN members.[Top]