Investing Across Borders 2010

Prepared by the World Bank Group, Investing Across Borders 2010 measures how 87 economies facilitate market access and operations of foreign companies. The report presents cross-country indicators analyzing laws, regulations, and practices affecting FDI in 4 policy areas: investing across sectors, starting a foreign business, accessing industrial land, and arbitrating commercial disputes.

View original table here

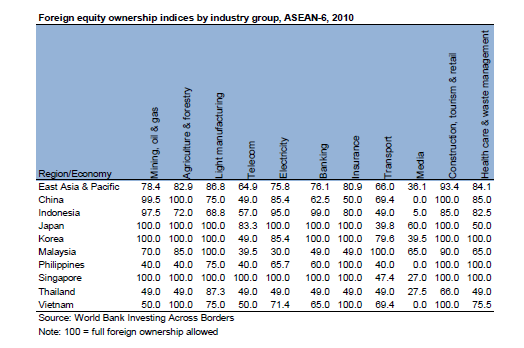

Under Investing Across Sectors, the report aggregated sectors into 11 industry groups and measured the degree to which domestic laws allow foreign companies to establish or acquire local firms. An index value of 100 indicates that full foreign ownership is allowed (see Table 17). Although the Philippines had an index of 100 in Construction, Tourism, and Retail; Insurance; and Healthcare and Waste Management, along with Singapore and Vietnam (except for the last industry group where Vietnam scored 75), it scored last in Mining, Oil, and Gas (40); Agriculture and Forestry (40); Transport (40); and Media (along with Vietnam which scored 0). In Light Manufacturing, the Philippines and Vietnam (tied at 75) are slightly more open than Indonesia (68.8) which was the most restrictive among the ASEAN-6. Similarly, the telecommunications sector in the Philippines (40) is as protected as in Malaysia (39.5), which was the least-open among the ASEAN-6.

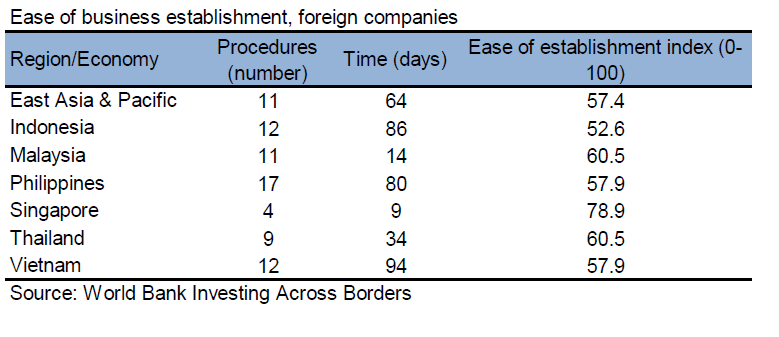

Starting a Foreign Business has three indicators: the number of days to comply with procedures in establishing a foreign-owned subsidiary, the number of procedural steps involved, and the “Ease of Establishment Index,” which measures the regulatory regimes for foreign business start-up. Countries that score well in this area have simple and efficient processes for foreign companies.

View original table here

Among the ASEAN-6, Singapore, Malaysia, and Thailand have the most efficient processes and regulations. It takes only 9 days to set up a foreign subsidiary in Singapore, 14 days in Malaysia, and 34 days in Thailand (see Table 18). While the Philippines has only 10 procedural steps – close to Thailand which has 9 steps and slightly higher than Malaysia which has 11 – it takes 108 days to establish a foreign subsidiary in the Philippines, the longest among the ASEAN-6 and 12 times longer than Singapore, 8 times longer than Malaysia, and 3 times longer than Thailand.

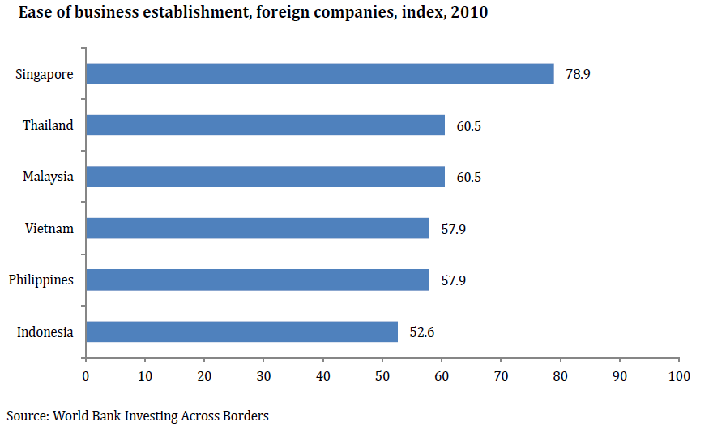

In the ease of establishment index the Philippines was ranked 4th (tied with Vietnam) among the ASEAN-6, following Singapore, Thailand, and Malaysia (see Figure 43). However, four economies (Malaysia, Philippines, Thailand, and Vietnam) are ranked very closely and more aggressive reforms by the Philippines could move the Philippines closer to Singapore in future surveys.

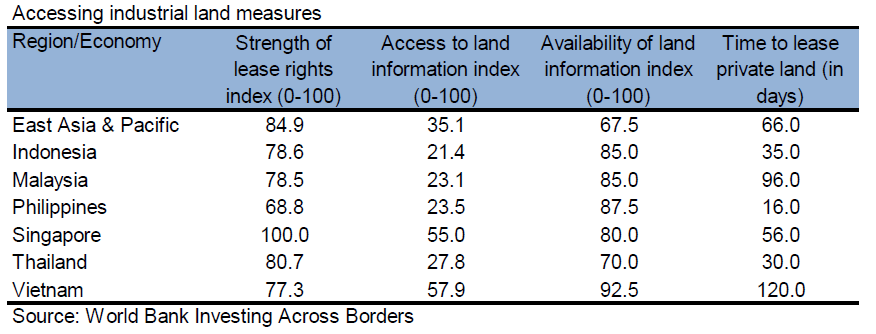

Accessing Industrial Land quantifies aspects of land administration regimes important for foreign companies seeking to lease land. The “strength of lease rights index” measures the ability of foreign companies to lease land without entering into a partnership with a domestic company or individual. Singapore led the ASEAN-6 in this category with a score of 100, while Thailand and Malaysia (which tied with Indonesia) followed with 80.7 and 78.5, respectively (see Table 19). The Philippines was last among the six countries with a score of 69. However, for “time to lease private land,” the Philippines led the ASEAN-6, taking only 16 days to lease private land. Thailand and Indonesia were second and third at 30 and 35 days, respectively, and Vietnam was last at 120 days.

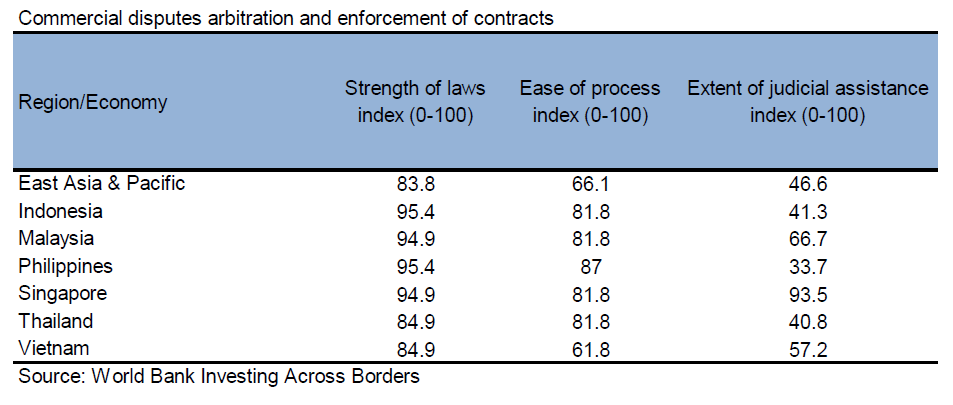

The fourth policy area, Arbitrating Commercial Disputes measures legal, institutional, and administrative regimes for commercial arbitration. The “strength of laws index” analyzes the strength of legal frameworks for alternative dispute resolution. Four of the ASEAN-6 (Indonesia, Malaysia, Philippines, and Singapore) were each rated at 95, while Thailand and Vietnam were at 85.

The “ease of arbitration index” assesses the ease of the arbitration process and whether there are restrictions that disputing parties face in seeking a resolution for their dispute. The Philippines ranked highest among the ASEAN-6 with an index of 87 (see Table 20). Indonesia, Malaysia, Singapore, and Thailand were tied at 82 and Vietnam at 62 was last.

The “extent of judicial assistance index” measures interaction between domestic courts and arbitral tribunals including the willingness of courts to assist during arbitration and their effectiveness in enforcing arbitration awards. In contrast with the two previous indices, the Philippines ranked last in this index with a rating of 34, while Singapore, at 93 led the ASEAN-6. This low-ranking in an otherwise high-ranked series suggests that Philippine courts can improve their processing of arbitration awards.