Weak Export Volume Lacks Diversification

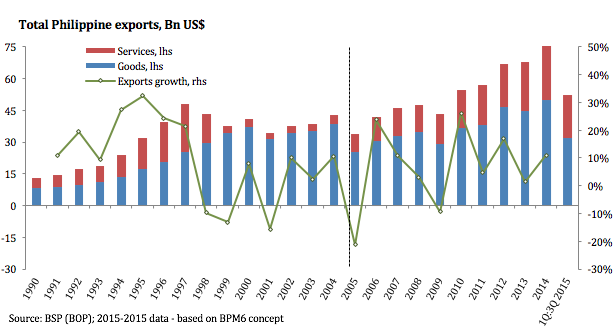

Philippines exports (Figure 25), which reached a record high of US$ 50.5 billion in 2007, fell sharply in 2008 and 2009 in reaction to sudden reduced demand from all top ten export markets led by the US, Japan, China, and Europe. The top exports – electronics, garments, auto parts, and furniture/home furnishings – are produced for these markets, and the majority of employee layoffs and workweek reductions in manufacturing occurred in these industries in the late 2008 and early 2009.

Figure 25.1: Total Philippine exports in US$ billions from 1990 to 2014

Source: BSP (BOP); 2015-2015 data – based on BPM6 concept

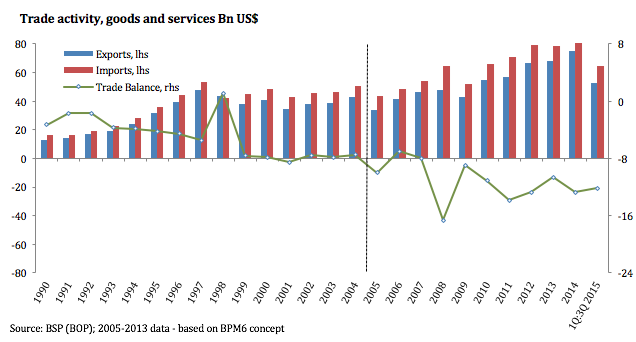

Figure.25.2: Trade activity for goods and services in US$ billions from 1990 to 2015

Fortunately, stronger-than-expected rebound in international trade this year provided a much needed breather to exporters. Official data for the first eight months show that value of trade flows (imports and exports) are on track to match revenues in 2007. Likewise, prospects for rapid growth of electronics exports to fill depleted inventories are excellent, and service exports from the fast-growing IT-BPO sector are projected to grow by some 25% annually (approximately US$ 2 billion) in 2010 and 2011.<sup “>23

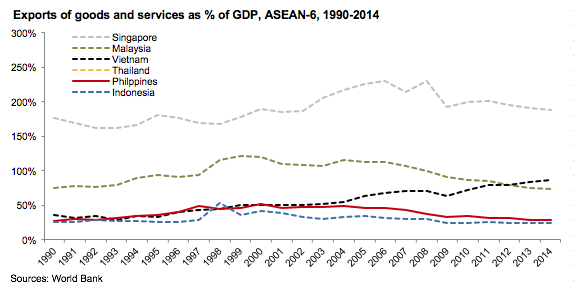

Figure 26: Exports of goods and services as percent of GDP among the ASEAN-6 from 1990 to 2014

Sources: World Bank

Because the Philippines is less dependent on exports than more developed Asian economies, the impact of the drop was less severe than in Asia’s powerhouse export economies such as Singapore, where exports are more than 200% of GDP and Malaysia at around 100% (see Figure 26). However, by mid-2010 Singapore had largely recovered as had Malaysia, where the drop in palm oil prices was short-lived. Philippine exports net of imported raw materials have consistently contributed 10-14% of GNP over the last decade.24 BSP data shows the value-added of exports was US$ 18 billion in 2008. Their reduced levels brought about by the crisis cost the economy perhaps US$ 5-10 billion dollars and reduced GDP growth by several percentage points from its high of 7% in 2007.

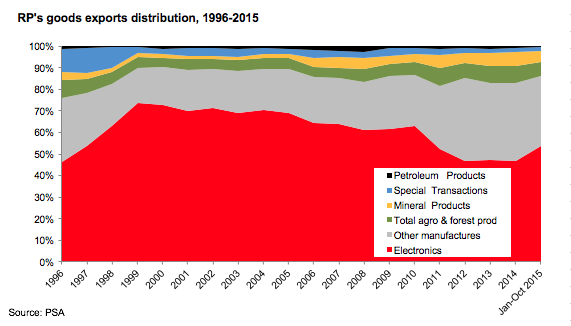

Figure 27 shows Philippine exports of goods in 2009 by product segment. Electronics have grown to over 60% of total exports, twice the value of other manufactured goods exports (24.5%) and far greater than agro-based products (5.5%) and mineral products (3.8%). If included, IT-BPO service exports valued at US$ 6.7 billion in 2009 would be about 15% of the total, with very high local content and value-added. Agro-based and mineral products also have high local content.

Figure 27: Philippine goods exports distribution from 1996 to 2015

Source: PSA

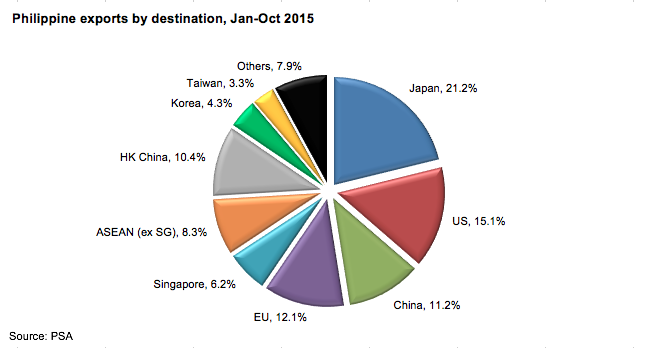

Figure 28 clearly shows the high potential for export diversification if exports of the agribusiness and mining sectors can be vigorously developed. Similarly, the potential for increased revenue is high for services for medical visitors, retired foreigners, and international tourist visitors.

“…ultimately accountability for a country’s failure to attract investment must lie with its leadership and government institutions.”

—Oscar M. Lopez, Chairman, Lopez Group of Companies, FOCAP speech, January 15, 2008

Gita Wirjawan (head of Indonesian Investment Coordinating Board) said that Indonesia should be able to achieve a “sweet spot” of total investment of US$-35 billion year.

Vice President Boediono… emphasized the need for more private sector investment. “To accelerate growth from 6 to 7%, we need improved infrastructure, roads and railways without delay,” Beodiono said. “This investment will not be possible without investment from the private sector as the government does not have anywhere near enough money.” “We have worked hard to reduce the hurdles to investment in infrastructure,” Boediono added. “…we have… a rather ambitious infrastructure development plan for the next 5 years.

—Reuters, Indonesia News, March 22, 2010

“The present dispensation’s horrible image is the biggest deterrent. Benigno Aquino III cited basics we must provide in order to increase FDI and local investments. Level playing field. Rule of law and predictable policies. Provide infrastructure, upgrade communications, secure reliable and reasonably priced power”

—Boo Chanco, The Philippine Star, February 24, 2010

“The primary incentive for investors will be the assurance of peace and order, especially in areas like Mindanao, and the setting up of systems that will guarantee less graft and corruption… such as increased private sector participation in government procurement by creating an Economic Coordinating Council that will review all bids for projects.”

—2010 Platform of Joseph Estrada, erap.ph, accessed May 12, 2010

“If we allow foreigners to own the land they can compete with our local realtors and once(they own land) they will develop that. Once they develop that, it will generate jobs.”

—Joseph Estrada, Philippine Daily Inquirer, May 2, 2010

“When we started experiencing corruption in Subic… smuggling prospered, investments went down. All we attracted as investors were the minnows. The moment we removed corruption, we attracted Hanjin, and much more foreign investment.”

—Dick Gordon, The Manila Times, April 25, 2010

“One cannot resolve poverty. One can only set the stage for people to get out of it… My goal is to make the Philippines a favorable platform for investments both domestic and foreign, with some conditions, for example protection of workers’ rights, of the environment, of our farmers. The goal is to provide proper government investments, such as infrastructure, and policies such as transparency, to afford confidence in our economy and in our people—basic education reform”

—Gilbert Teodoro, The Philippine Star, January 10, 2010

“In his first 100 days, Manny Villar plans to set up a one-stop shop for foreign and local investors to encourage a healthy investment climate and eliminate red tape.”

—Manila Bulletin, May 4, 2010

“Rationalizing investment incentives both local and foreign to favor labor-intensive industries can be done. There is a mismatch in the availability of skills and the actual manpower requirements of employers.. Entrepreneurship is a long-term solution to joblessness… We will focus on labor intensive industries like tourism, BPOs and the hospitality industries… key engines of economic growth.”

Manuel Villar, Jr., Philippine Daily Inquirer, May 2, 2010

The Institute for International Finance (IIF) estimated in March 2010 that the Emerging Asia region will receive US$ 300 billion in total capital inflows in 2010 and 2011, almost twice as much as 2008 and more than other developing regions (Africa/Middle East, Emerging Europe, and Latin America) (see Table 14). Furthermore, one-third of this forecast capital inflow is expected to be in the form of direct investment and one-fifth in equity investment (see Figure 29). China received the majority of this FDI, over US$ 4,400 billion from 1997 to 2008.

Figure 29: Emerging Asia’s external financing by source, 2010

Sources: IIF and Macaranas, 2010

Footnotes

- Chinese firms have reportedly had difficulty completing stand-alone business deals in mining and telecommunications and are beginning to acquire significant minority equity ownership in several foreign ventures operating in the Philippines.

- Services exports projection is from Business Processing Association of the Philippines (BPAP). [Top]

- Dr. Emilio Antonio, President, CRC, April 23, 2009[Top]