HANOI – I arrived in this city past midnight last Thursday curious to see what makes this once war-torn country so attractive to foreign investors. I am here more as a tourist out to enjoy the capital of the Socialist Republic of Vietnam which is actually over 1000 years old.

I was just reading on the history of Vietnam before I boarded the CebuPacific flight and couldn’t help but marvel at how the Vietnamese people handled the Chinese, its neighbors, the French and the Americans. It seems they played them off through the thousand years and ended up the strong nation that it is today.

Hanoi is a fascinating city, rich in history with the fine mingling of the various influences it had through the years. The French influence is strong, and so is the Chinese. A proud people, it has fought and won wars against China, and later on with the French and the Americans.

Today, it has emerged as one of the most competitive nations in ASEAN, overtaking the Philippines in terms of ability to attract direct foreign investments. Though it had problems with corruption in recent years, the communist government has been able to fight back and, unlike us, they have executed and jailed some senior officials accused of corrupt practices.

Even Filipino capitalists have been attracted to invest in Vietnam. Aboitiz is the most recent investor here, buying 70 percent of Vietnam-based Eurofeed for $3.7 million. Already operating in Vietnam for decades is Filipino snack food maker Oishi, Jollibee, San Miguel and Universal Robina.

Low key Vietnamese communist leaders have been providing the necessary leadership that has been powering Vietnam, helping it emerge as an economic powerhouse in Asean. As one Vietnamese commented to me, their communist leaders were pragmatic enough to adopt free market policies that made their economy grow.

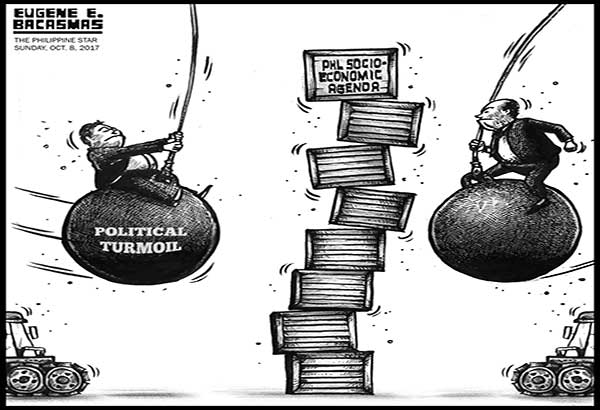

We can learn from their experience to improve our investment climate. We need a leadership who believes strongly in our country’s economic potentials that he will do everything he must to get us back in fighting form. For the country, that someone can only be the President. His economic managers alone will not be able to do it.

As we drove on Vietnam’s superb highway on our way to Halong Bay, our guide talked of how the Build Operate Transfer scheme was well utilized by their government to quickly expand infrastructure. Indeed it is easy to see why Vietnam is overtaking us from the extent and quality of their infrastructure.

Of course their airport is a lot better than our NAIA. When we left Manila, the air conditioning of Terminal 3 was not working well. It is as if P-Noy’s old airport manager is still running NAIA. Ano ba yan?

A recent Arangkada business forum highlighted things we should do by way of reforms and practices to make us more competitive. The daylong forum had an audience of stakeholders providing insights on how government can address the same old investor concerns.

Indeed, the concerns are well founded and haven’t changed much. The most recent Global Competitiveness Report 2017-2018, didn’t have good news. While it showed the Philippines going up in global competitiveness rankings by one notch, from 57th in 2016 to 56th in 2017, it showed us sliding down the ASEAN rankings. We are now standing at 8th in the region from 6th in 2016.

This two-point drop in regional standing means we are now below Vietnam and Brunei Darussalam, which both scored large improvement in competitiveness. We are the only country with a considerable decline in regional ranking.

The ratings are calculated by drawing together country-level data covering 12 categories – the pillars of competitiveness – that collectively make up a comprehensive picture of a country’s competitiveness. The 12 pillars are: Institutions, infrastructure, macroeconomic environment, health and primary education, higher education and training, goods market efficiency, labor market efficiency, financial market development, technological readiness, market size, business sophistication, and innovation.

The Executive Opinion Survey, a major component of the report, showed the most problematic factors for doing business in the Philippines also remain the same: Inefficient government bureaucracy (same rank in 2016), inadequate supply of infrastructure (same rank in 2016), corruption (same rank in 2016). Tax regulations are now in 4th, a spot higher than last year, while tax rates slip fee one spot, now at 5th.

The indicators that showed our bad side include: the number of procedures to start a business (ranked last out of 137), tuberculosis incidence (126th; not in the top five disadvantages of the previous year), burden of customs procedures (ranked 125th, down four spots from 2016), business cost of terrorism (ranked 125th, down five spots from 2016), and quality of air transport infrastructure (ranked 124th, down eight spots from 2016).

We made gains in terms of market size, but that’s a function of increasing population. Labor market efficiency is up four notches and higher education and training is up three notches.

Macroeconomic Environment remains as the country’s highest-ranking pillar; however, now at 22nd, it has slid down two spots from its 2016 ranking at 20th. Financial Market has also slid down, four notches from 48 in 2016, to 52 in 2017, but remains the third-highest pillar of the country.

We ranked first out of 137 countries in inflation, HIV prevalence (ranked 1st), government budget balance (ranked 24th), business impact of malaria (26th), domestic market size index (27th), and available airline seat kilometers (27th).

Out of the five top-ranked competitive advantages, government budget balance slid down seven spots from 2016, while domestic market size gained three notches up from the previous year.

In the region, Indonesia, Vietnam, and Brunei Darussalam made the largest strides in terms of rankings, with Indonesia going up five notches, Vietnam with a five-notch gain, and Brunei with the most significant improvement in the region, jumping 12 spots from its rank the previous year.

The report also highlights why Build Build Build must happen and faster than our bureaucracy seems capable of implementing. We trail behind our ASEAN neighbors in almost all measures of infrastructure. We ranked lowest in ASEAN in terms of “quality of overall infrastructure”, in “quality of roads”and in “quality of air transport infrastructure.”

The quality of air transport infrastructure was identified as one of the country’s greatest disadvantages, ranking 124th out of 137 countries. This is why I nag DOTr.

DPWH must also move faster. The quality of other infrastructure such as roads and ports are also seen as big disadvantages.

Analysts say the Philippines should equal or exceed Indonesia and Vietnam in the next few years, and Thailand in the medium term in terms of rankings in major global competitiveness indices… or be truly left behind. According to the report, Vietnam, Cambodia, the Philippines, Lao PDR, and Mongolia could all make large gains in competitiveness at a relatively lower cost by improving their performance on infrastructure, health, and education.

Commenting on my Facebook post on how Vietnam overtook the Philippines in competitiveness, business professor Rogelio Viray Paglomutan, who used to teach in Vietnam, said this should be expected. Vietnam and Indonesia, he said, have the lowest costs of electricity in the region, coupled with excellent peace and order in Vietnam (as a gunless society) and much less bureaucratic red tape in government permits/approvals.

But ironically, he said, many of the supervisors/managers of companies there are Filipinos. He has personally interacted with Filipino supervisors/engineers in Vietnam.

Prof. Paglomutan is correct. We have what it takes to be competitive and beat Vietnam in the rankings. But we need to have the heart and the imagination to make ourselves economically competitive with our neighbors. We just need our leadership to make that happen.

Source: https://www.philstar.com:8080/business/2017/10/09/1746790/competitiveness

In building a competitive business environment, judicial and anticorruption policies are very important to attract and to keep investors. Reforms in the administration of justice are ongoing, but their implementation should be continuously intensified.

In building a competitive business environment, judicial and anticorruption policies are very important to attract and to keep investors. Reforms in the administration of justice are ongoing, but their implementation should be continuously intensified.